SoftBank Results Presentation Deck

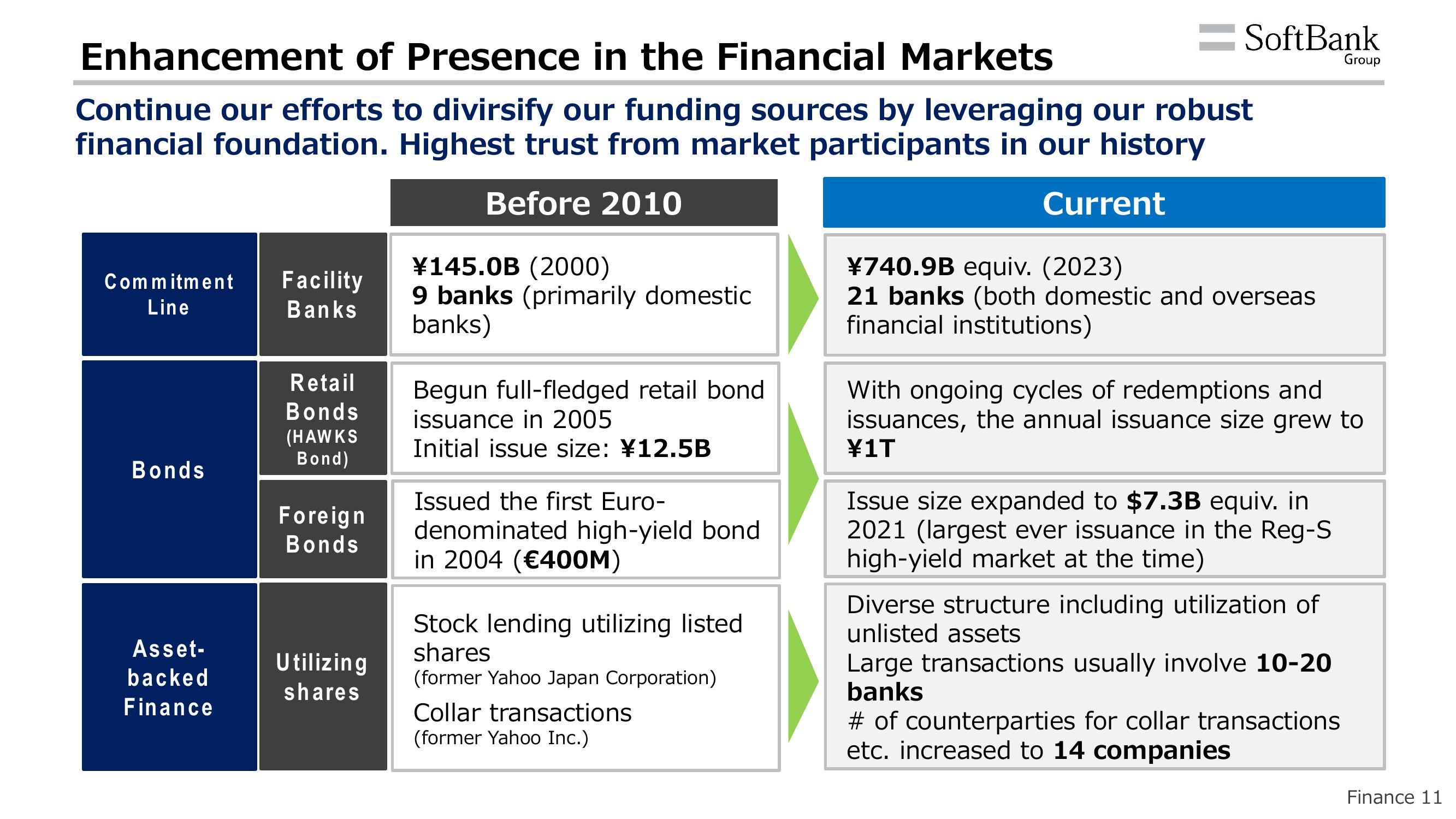

Enhancement of Presence in the Financial Markets

Continue our efforts to divirsify our funding sources by leveraging our robust

financial foundation. Highest trust from market participants in our history

Before 2010

Current

Commitment Facility

Line

Banks

Bonds

Asset-

backed

Finance

Retail

Bonds

(HAWKS

Bond)

Foreign

Bonds

Utilizing

shares

¥145.0B (2000)

9 banks (primarily domestic

banks)

Begun full-fledged retail bond

issuance in 2005

Initial issue size: ¥12.5B

Issued the first Euro-

denominated high-yield bond

in 2004 (€400M)

Stock lending utilizing listed

shares

(former Yahoo Japan Corporation)

= SoftBank

Collar transactions

(former Yahoo Inc.)

¥740.9B equiv. (2023)

21 banks (both domestic and overseas

financial institutions)

With ongoing cycles of redemptions and

issuances, the annual issuance size grew to

¥1T

Issue size expanded to $7.3B equiv. in

2021 (largest ever issuance in the Reg-S

high-yield market at the time)

Diverse structure including utilization of

unlisted assets

Large transactions usually involve 10-20

banks

Group

# of counterparties for collar transactions

etc. increased to 14 companies

Finance 11View entire presentation