J.P.Morgan Software Investment Banking

Strategics buyer insights - Salesforce

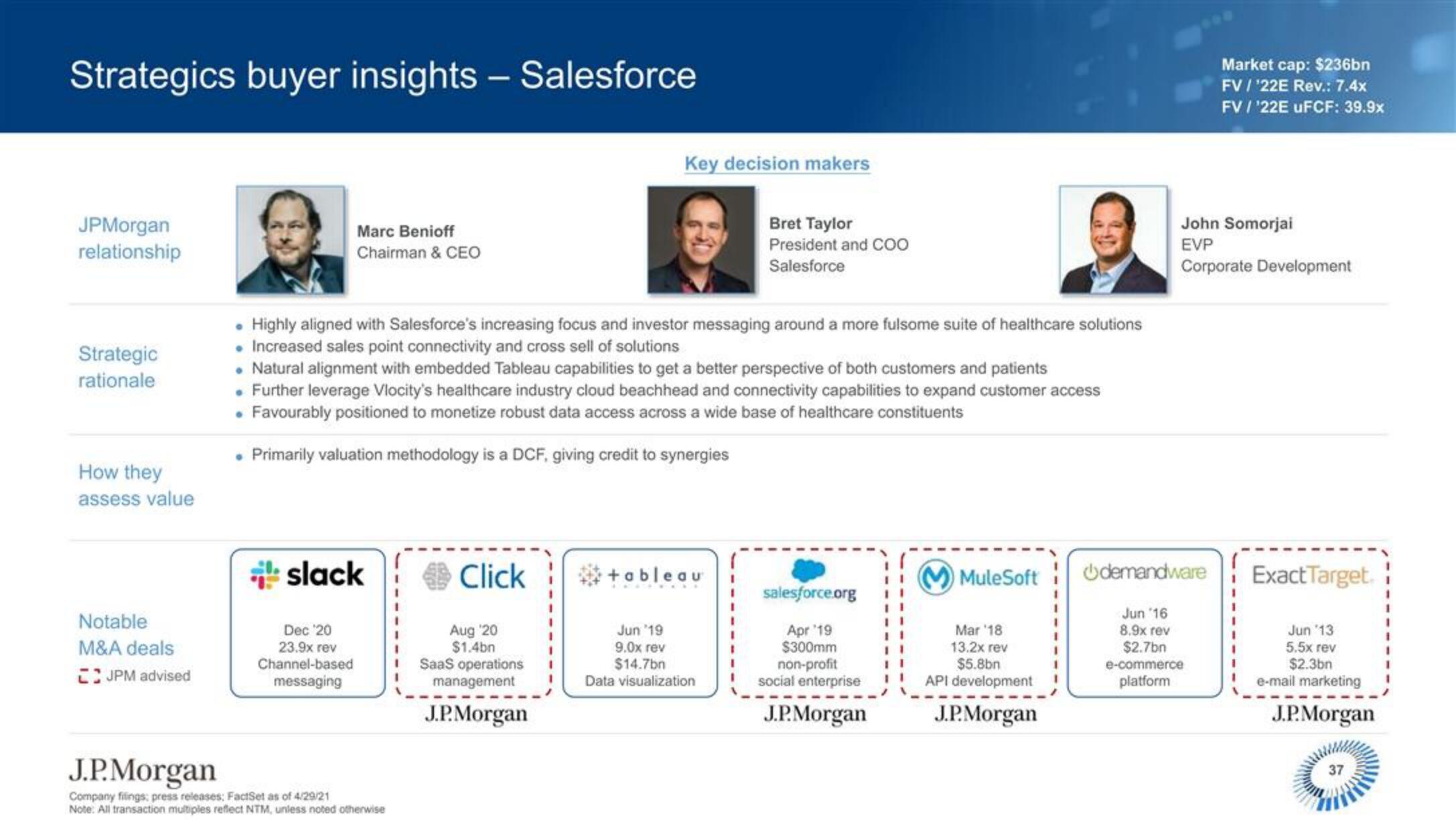

JPMorgan

relationship

Strategic

rationale

How they

assess value

Notable

M&A deals

JPM advised

Marc Benioff

Chairman & CEO

islack

Dec '20

23.9x rev

Channel-based

messaging

• Highly aligned with Salesforce's increasing focus and investor messaging around a more fulsome suite of healthcare solutions

• Increased sales point connectivity and cross sell of solutions

. Natural alignment with embedded Tableau capabilities to get a better perspective of both customers and patients

. Further leverage Vlocity's healthcare industry cloud beachhead and connectivity capabilities to expand customer access

• Favourably positioned to monetize robust data access across a wide base of healthcare constituents

• Primarily valuation methodology is a DCF, giving credit to synergies

J.P.Morgan

Company filings: press releases; FactSet as of 4/29/21

Note: All transaction multiples reflect NTM, unless noted otherwise

Key decision makers

Click

Aug '20

$1.4bn

SaaS operations

management

J.P. Morgan

+ableau

Bret Taylor

President and COO

Salesforce

Jun '19

9.0x rev

$14.7bn

Data visualization

salesforce.org

Apr '19

$300mm

non-profit

social enterprise

J.P.Morgan

MuleSoft

Mar '18

13.2x rev

$5.8bn

API development

J.P. Morgan

1

1

I

John Somorjai

EVP

Corporate Development

demandware

Market cap: $236bn

FV/'22E Rev.: 7.4x

FV / 22E UFCF: 39.9x

Jun '16

8.9x rev

$2.7bn

e-commerce

platform

I

Exact Target.

Jun '13

5.5x rev

$2.3bn

e-mail marketing

J.P.Morgan

37View entire presentation