UBS Results Presentation Deck

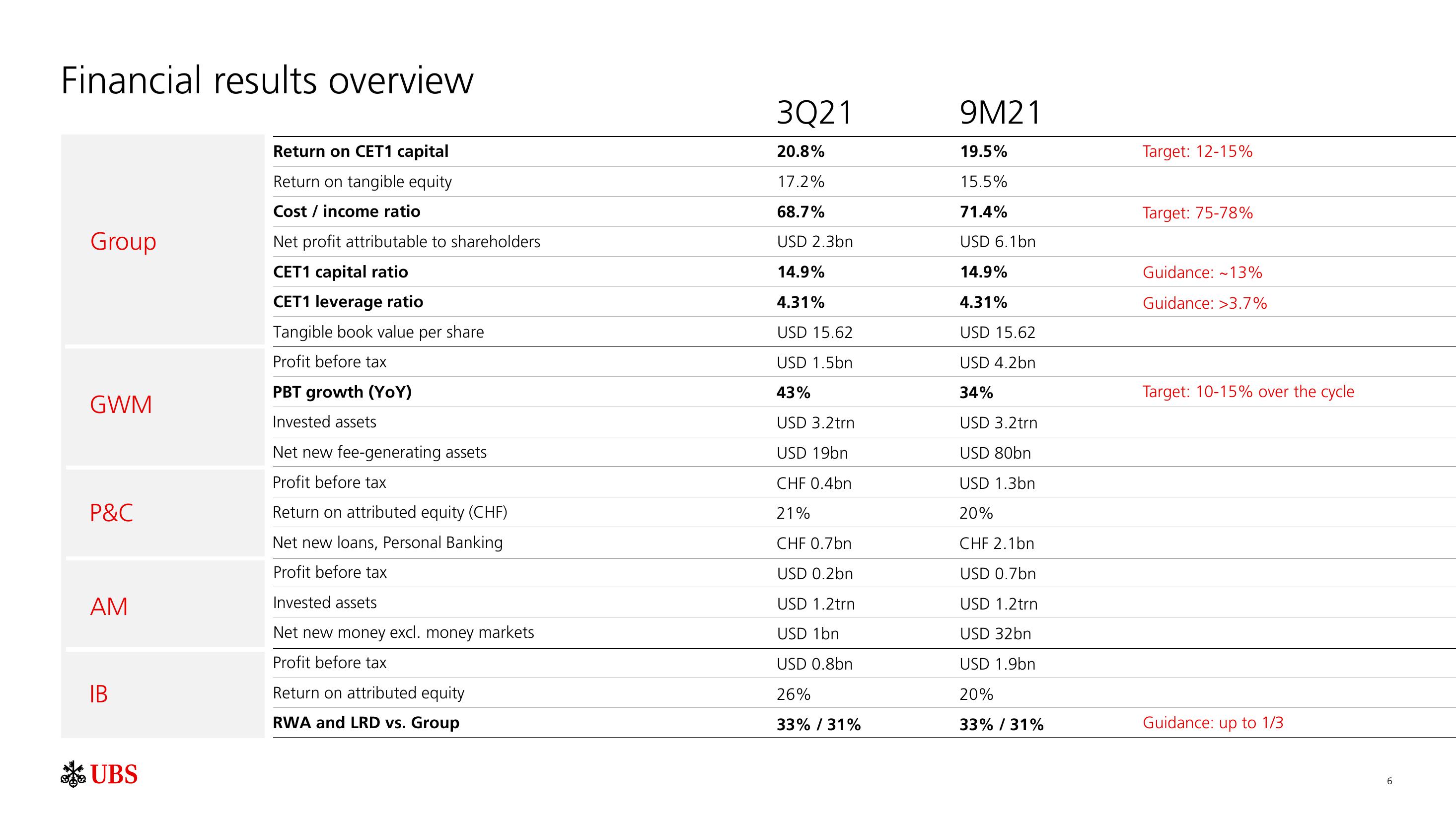

Financial results overview

Group

GWM

P&C

AM

IB

UBS

Return on CET1 capital

Return on tangible equity

Cost / income ratio

Net profit attributable to shareholders

CET1 capital ratio

CET1 leverage ratio

Tangible book value per share

Profit before tax

PBT growth (YoY)

Invested assets

Net new fee-generating assets

Profit before tax

Return on attributed equity (CHF)

Net new loans, Personal Banking

Profit before tax

Invested assets

Net new money excl. money markets

Profit before tax

Return on attributed equity

RWA and LRD vs. Group

3Q21

20.8%

17.2%

68.7%

USD 2.3bn

14.9%

4.31%

USD 15.62

USD 1.5bn

43%

USD 3.2trn

USD 19bn

CHF 0.4bn

21%

CHF 0.7bn

USD 0.2bn

USD 1.2trn

USD 1bn

USD 0.8bn

26%

33% / 31%

9M21

19.5%

15.5%

71.4%

USD 6.1bn

14.9%

4.31%

USD 15.62

USD 4.2bn

34%

USD 3.2trn

USD 80bn

USD 1.3bn

20%

CHF 2.1bn

USD 0.7bn

USD 1.2trn

USD 32bn

USD 1.9bn

20%

33% / 31%

Target: 12-15%

Target: 75-78%

Guidance: 13%

Guidance: >3.7%

Target: 10-15% over the cycle

Guidance: up to 1/3

6View entire presentation