SoftBank Results Presentation Deck

1.

2.

3.

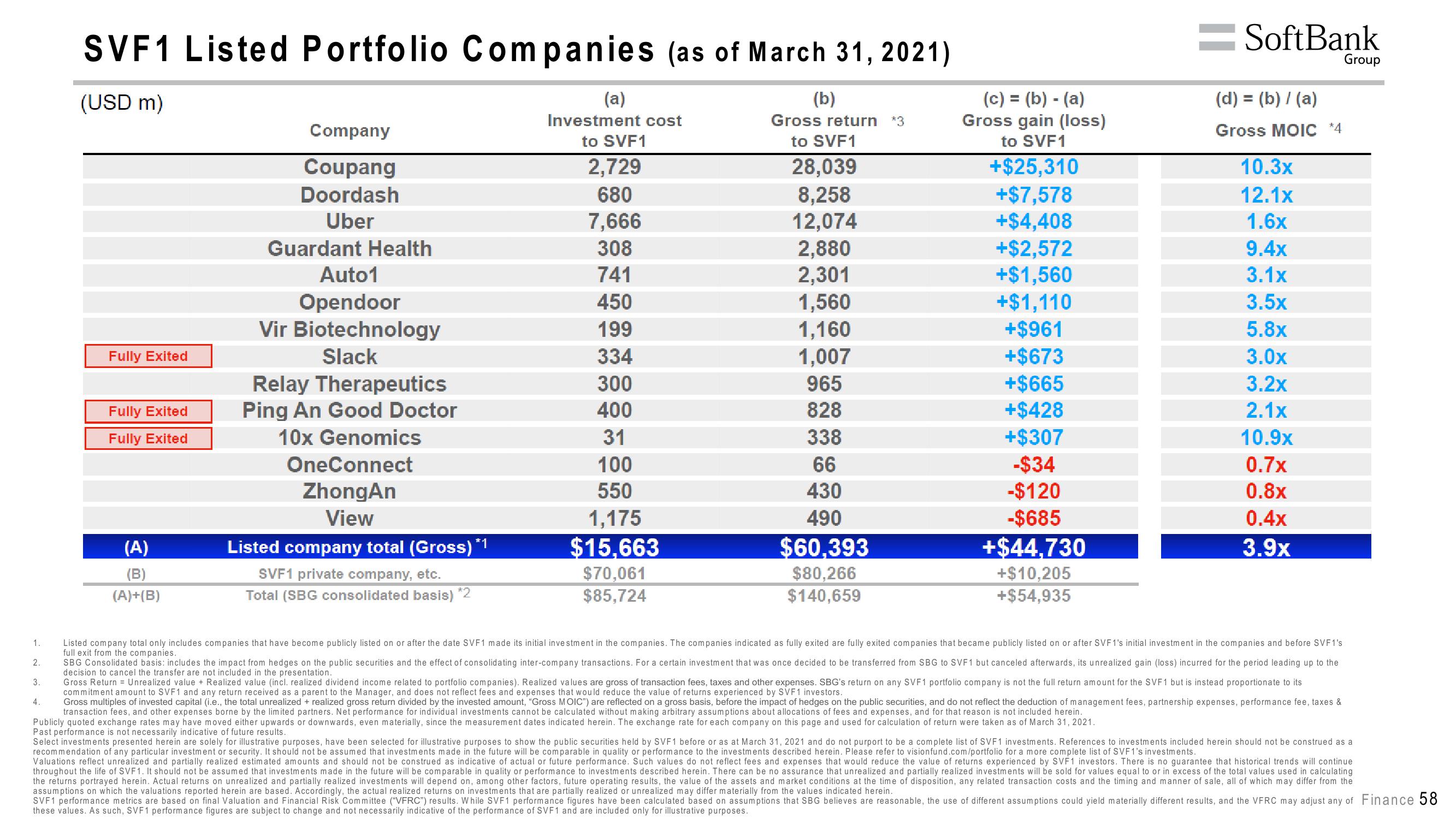

SVF1 Listed Portfolio Companies (as of March 31, 2021)

(USD m)

4.

Fully Exited

Fully Exited

Fully Exited

(A)

(B)

(A)+(B)

Company

Coupang

Doordash

Uber

Guardant Health

Auto1

Opendoor

Vir Biotechnology

Slack

Relay Therapeutics

Ping An Good Doctor

10x Genomics

OneConnect

ZhongAn

View

Listed company total (Gross)*

SVF1 private company, etc.

Total (SBG consolidated basis) *2

(a)

Investment cost

to SVF1

2,729

680

7,666

308

741

450

199

334

300

400

31

100

550

1,175

$15,663

$70,061

$85,724

(b)

Gross return *3

to SVF1

28,039

8,258

12,074

2,880

2,301

1,560

1,160

1,007

965

828

338

66

430

490

$60,393

$80,266

$140,659

(c) = (b) - (a)

Gross gain (loss)

to SVF1

+$25,310

+$7,578

+$4,408

+$2,572

+$1,560

+$1,110

+$961

+$673

+$665

+$428

+$307

-$34

-$120

-$685

+$44,730

+$10,205

+$54,935

SoftBank

(d) = (b) / (a)

Gross MOIC *4

10.3x

12.1x

1.6x

Listed company total only includes companies that have become publicly listed on or after the date SVF1 made its initial investment in the companies. The companies indicated as fully exited are fully exited companies that became publicly listed on or after SVF1's initial investment in the companies and before SVF1's

full exit from the companies.

SBG Consolidated basis: includes the impact from hedges on the public securities and the effect of consolidating inter-company transactions. For a certain investment that was once decided to be transferred from SBG to SVF1 but canceled afterwards, its unrealized gain (loss) incurred for the period leading up to the

decision to cancel the transfer are not included in the presentation.

Gross Return = Unrealized value + Realized value (incl. realized dividend income related to portfolio companies). Realized values are gross of transaction fees, taxes and other expenses. SBG's return on any SVF1 portfolio company is not the full return amount for the SVF1 but is instead proportionate to its

commitment amount to SVF1 and any return received as a parent to the Manager, and does not reflect fees and expenses that would reduce the value of returns experienced by SVF1 investors.

Gross multiples of invested capit (i.e., the total unrealized + realized gross return divided by the invested amount, "Gross MOIC") are reflected on a gross basis, before the impact of hedges on the public securities, and do not reflect the deduction of management fees, partnership expenses, performance fee, taxes &

transaction fees, and other expenses borne by the limited partners. Net performance for individual investments cannot be calculated without making arbitrary assumptions about allocations of fees and expenses, and for that reason is not included herein.

Publicly quoted exchange rates may have moved either upwards or downwards, even materially, since the measurement dates indicated herein. The exchange rate for each company on this page and used for calculation of return were taken as of March 31, 2021.

Past performance is not necessarily indicative of future results.

Select investments presented herein are solely for illustrative purposes, have been selected for illustrative purposes to show the public securities held by SVF1 before or as at March 31, 2021 and do not purport to be a complete list of SVF1 investments. References to investments included herein should not be construed as a

recommendation of any particular investment or security. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. Please refer to visionfund.com/portfolio for a more complete list of SVF1's investments.

Valuations reflect unrealized and partially realized estimated amounts and should not be construed as indicative of actual or future performance. Such values do not reflect fees and expenses that would reduce the value of returns experienced by SVF1 investors. There is no guarantee that historical trends will continue

throughout the life of SVF1. It should not be assumed that investments made in the future will be comparable in quality or performance to investments described herein. There can be no assurance that unrealized and partially realized investments will be sold for values equal to or in excess of the total values used in calculating

the returns portrayed herein. Actual returns on unrealized and partially realized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the

assumptions on which the valuations reported herein are based. Accordingly, the actual realized returns on investments that are partially realized or unrealized may differ materially from the values indicated herein.

SVF1 performance metrics are based on final Valuation and Financial Risk Committee ("VFRC") results. While SVF1 performance figures have been calculated based on assumptions that SBG believes are reasonable, the use of different assumptions could yield materially different results, and the VFRC may adjust any of Finance 58

these values. As such, SVF1 performance figures are subject to change and not necessarily indicative of the performance of SVF1 and are included only for illustrative purposes.

9.4x

3.1x

3.5x

5.8x

3.0x

3.2x

2.1x

10.9x

0.7x

0.8x

0.4x

3.9x

GroupView entire presentation