Covia Investor Presentation

Appendix: Non-GAAP Reconciliation

Contribution Margin

Covia

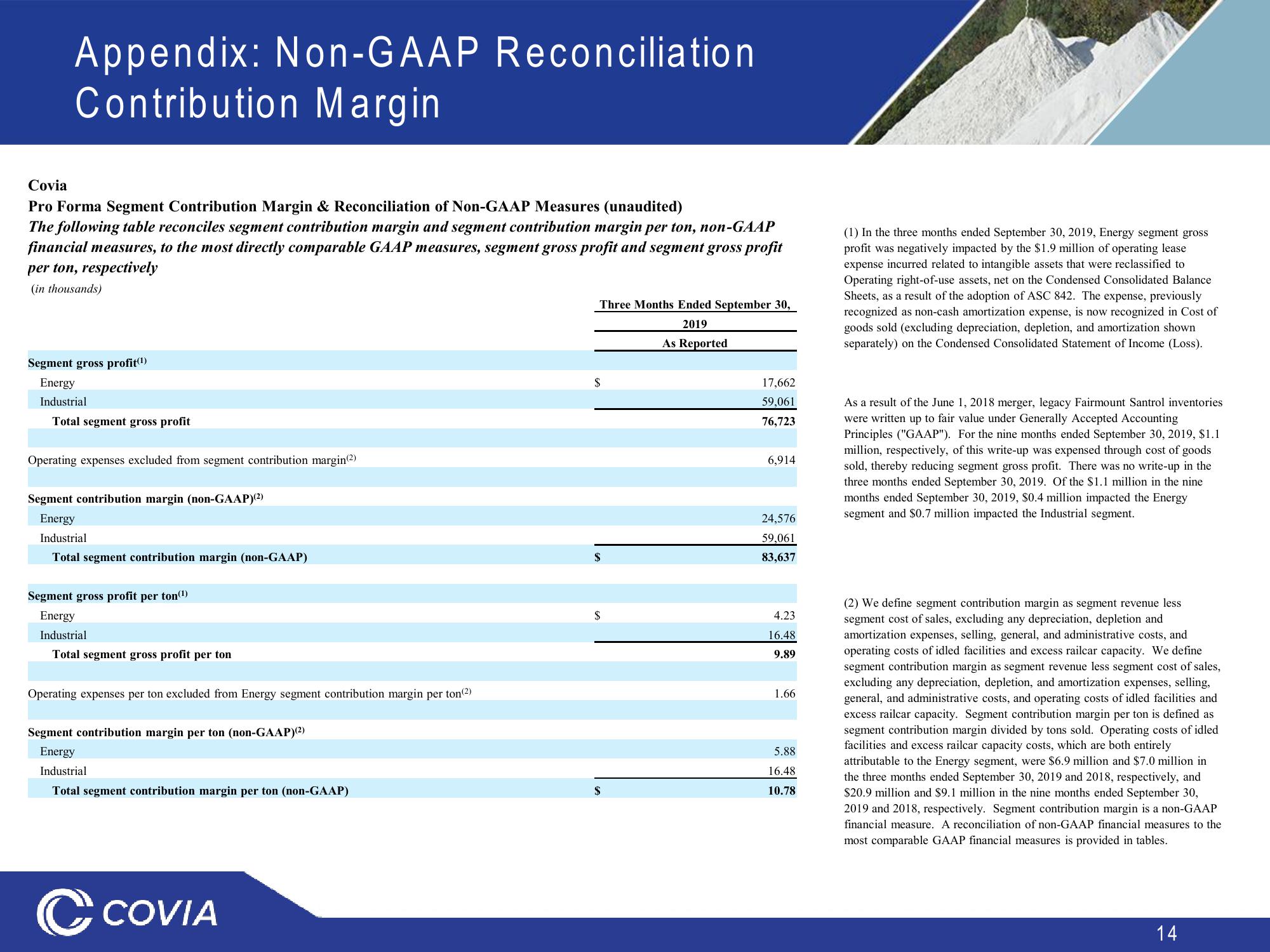

Pro Forma Segment Contribution Margin & Reconciliation of Non-GAAP Measures (unaudited)

The following table reconciles segment contribution margin and segment contribution margin per ton, non-GAAP

financial measures, to the most directly comparable GAAP measures, segment gross profit and segment gross profit

per ton, respectively

(in thousands)

Segment gross profit(¹)

Energy

Industrial

Total segment gross profit

Operating expenses excluded from segment contribution margin(2)

Segment contribution margin (non-GAAP) (2)

Energy

Industrial

Total segment contribution margin (non-GAAP)

Segment gross profit per ton(¹)

Energy

Industrial

Total segment gross profit per ton

Operating expenses per ton excluded from Energy segment contribution margin per ton(2)

Segment contribution margin per ton (non-GAAP)(²)

Energy

Industrial

Total segment contribution margin per ton (non-GAAP)

C COVIA

Three Months Ended September 30,

2019

As Reported

$

S

$

S

17,662

59,061

76,723

6,914

24,576

59,061

83,637

4.23

16.48

9.89

1.66

5.88

16.48

10.78

(1) In the three months ended September 30, 2019, Energy segment gross

profit was negatively impacted by the $1.9 million of operating lease

expense incurred related to intangible assets that were reclassified to

Operating right-of-use assets, net on the Condensed Consolidated Balance

Sheets, as a result of the adoption of ASC 842. The expense, previously

recognized as non-cash amortization expense, is now recognized in Cost of

goods sold (excluding depreciation, depletion, and amortization shown

separately) on the Condensed Consolidated Statement of Income (Loss).

As a result of the June 1, 2018 merger, legacy Fairmount Santrol inventories

were written up to fair value under Generally Accepted Accounting

Principles ("GAAP"). For the nine months ended September 30, 2019, $1.1

million, respectively, of this write-up was expensed through cost of goods

sold, thereby reducing segment gross profit. There was no write-up in the

three months ended September 30, 2019. Of the $1.1 million in the nine

months ended September 30, 2019, $0.4 million impacted the Energy

segment and $0.7 million impacted the Industrial segment.

(2) We define segment contribution margin as segment revenue less

segment cost of sales, excluding any depreciation, depletion and

amortization expenses, selling, general, and administrative costs, and

operating costs of idled facilities and excess railcar capacity. We define

segment contribution margin as segment revenue less segment cost of sales,

excluding any depreciation, depletion, and amortization expenses, selling,

general, and administrative costs, and operating costs of idled facilities and

excess railcar capacity. Segment contribution margin per ton is defined as

segment contribution margin divided by tons sold. Operating costs of idled

facilities and excess railcar capacity costs, which are both entirely

attributable to the Energy segment, were $6.9 million and $7.0 million in

the three months ended September 30, 2019 and 2018, respectively, and

$20.9 million and $9.1 million in the nine months ended September 30,

2019 and 2018, respectively. Segment contribution margin is a non-GAAP

financial measure. A reconciliation of non-GAAP financial measures to the

most comparable GAAP financial measures is provided in tables.

14View entire presentation