Silicon Valley Bank Results Presentation Deck

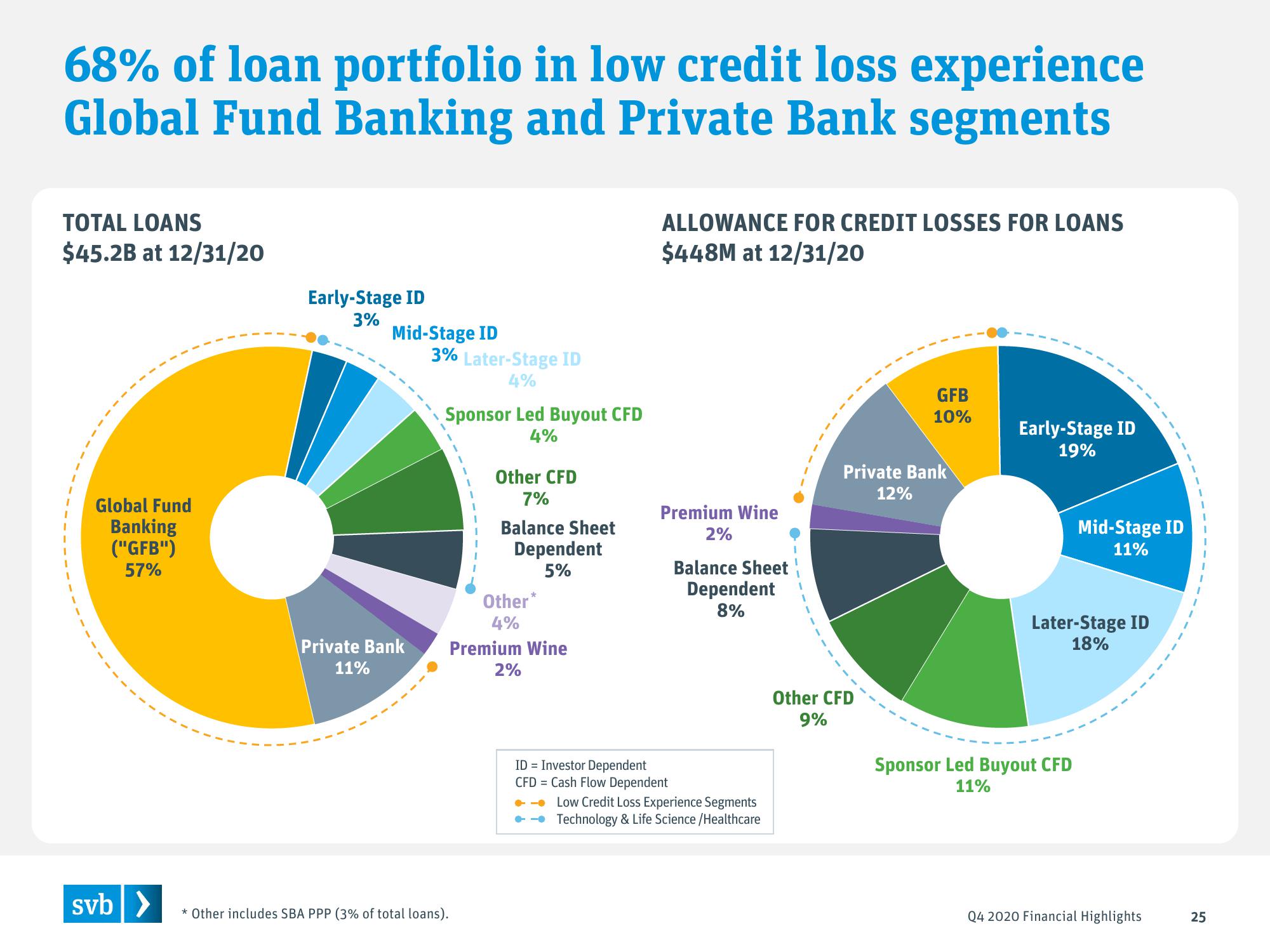

68% of loan portfolio in low credit loss experience

Global Fund Banking and Private Bank segments

TOTAL LOANS

$45.2B at 12/31/20

1

Global Fund

Banking

("GFB")

57%

svb >

Early-Stage ID

3%

Mid-Stage ID

Private Bank

11%

3% Later-Stage ID

4%

Sponsor Led Buyout CFD

4%

* Other includes SBA PPP (3% of total loans).

Other CFD

7%

Balance Sheet

Dependent

5%

Other*

4%

Premium Wine

2%

ALLOWANCE FOR CREDIT LOSSES FOR LOANS

$448M at 12/31/20

Premium Wine

2%

ID = Investor Dependent

CFD Cash Flow Dependent

Balance Sheet

Dependent

8%

Low Credit Loss Experience Segments

Technology & Life Science /Healthcare

GFB

10%

Private Bank

12%

Other CFD

9%

Early-Stage ID

19%

Mid-Stage ID

11%

Later-Stage ID

18%

Sponsor Led Buyout CFD

11%

Q4 2020 Financial Highlights

25View entire presentation