Maersk Investor Presentation Deck

Key statements

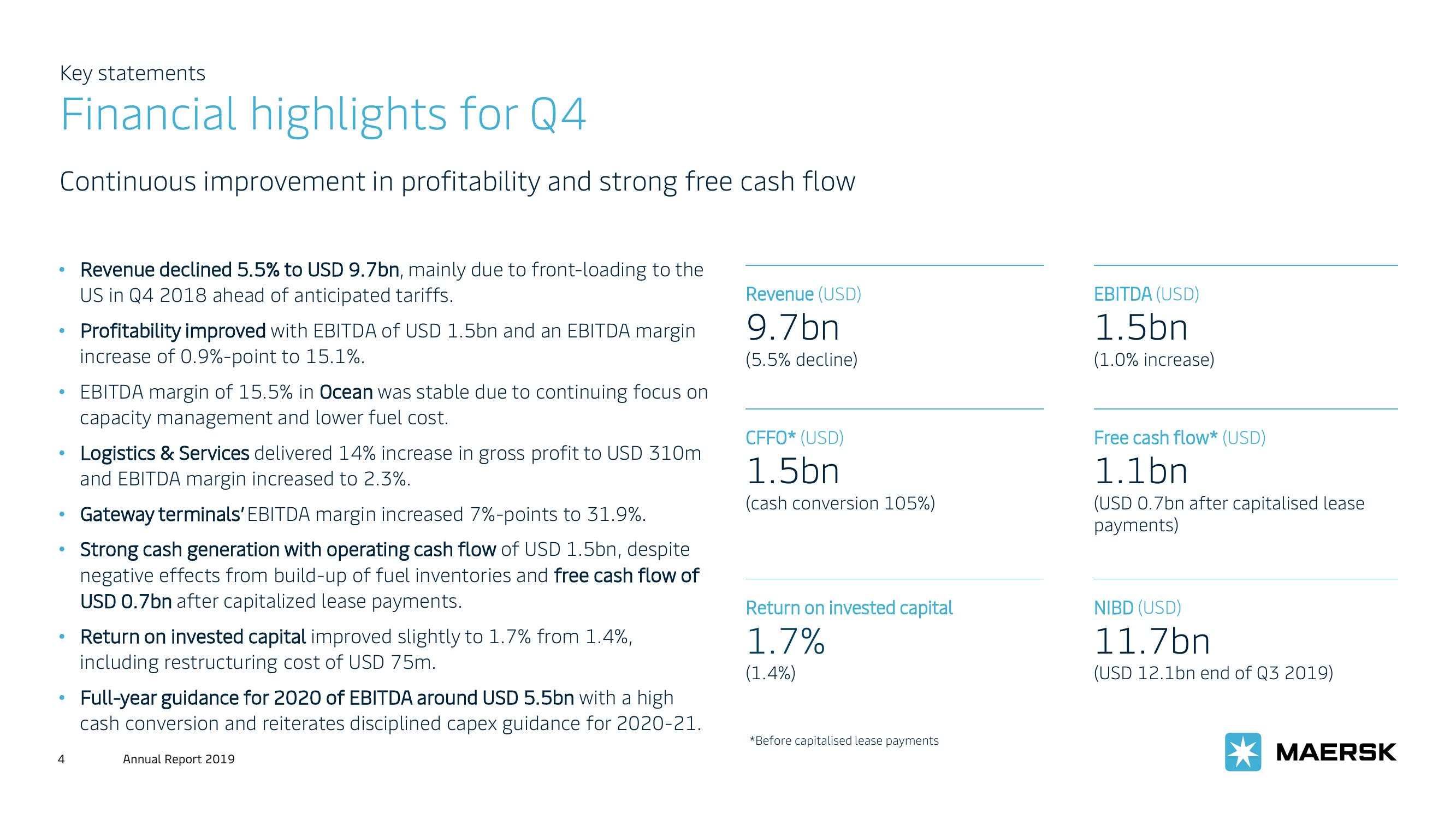

Financial highlights for Q4

Continuous improvement in profitability and strong free cash flow

4

Revenue declined 5.5% to USD 9.7bn, mainly due to front-loading to the

US in Q4 2018 ahead of anticipated tariffs.

Profitability improved with EBITDA of USD 1.5bn and an EBITDA margin

increase of 0.9%-point to 15.1%.

EBITDA margin of 15.5% in Ocean was stable due to continuing focus on

capacity management and lower fuel cost.

Logistics & Services delivered 14% increase in gross profit to USD 310m

and EBITDA margin increased to 2.3%.

Gateway terminals' EBITDA margin increased 7%-points to 31.9%.

Strong cash generation with operating cash flow of USD 1.5bn, despite

negative effects from build-up of fuel inventories and free cash flow of

USD 0.7bn after capitalized lease payments.

Return on invested capital improved slightly to 1.7% from 1.4%,

including restructuring cost of USD 75m.

Full-year guidance for 2020 of EBITDA around USD 5.5bn with a high

cash conversion and reiterates disciplined capex guidance for 2020-21.

Annual Report 2019

Revenue (USD)

9.7bn

(5.5% decline)

CFFO* (USD)

1.5bn

(cash conversion 105%)

Return on invested capital

1.7%

(1.4%)

*Before capitalised lease payments

EBITDA (USD)

1.5bn

(1.0% increase)

Free cash flow* (USD)

1.1bn

(USD 0.7bn after capitalised lease

payments)

NIBD (USD)

11.7bn

(USD 12.1bn end of Q3 2019)

MAERSKView entire presentation