Netstreit IPO Presentation Deck

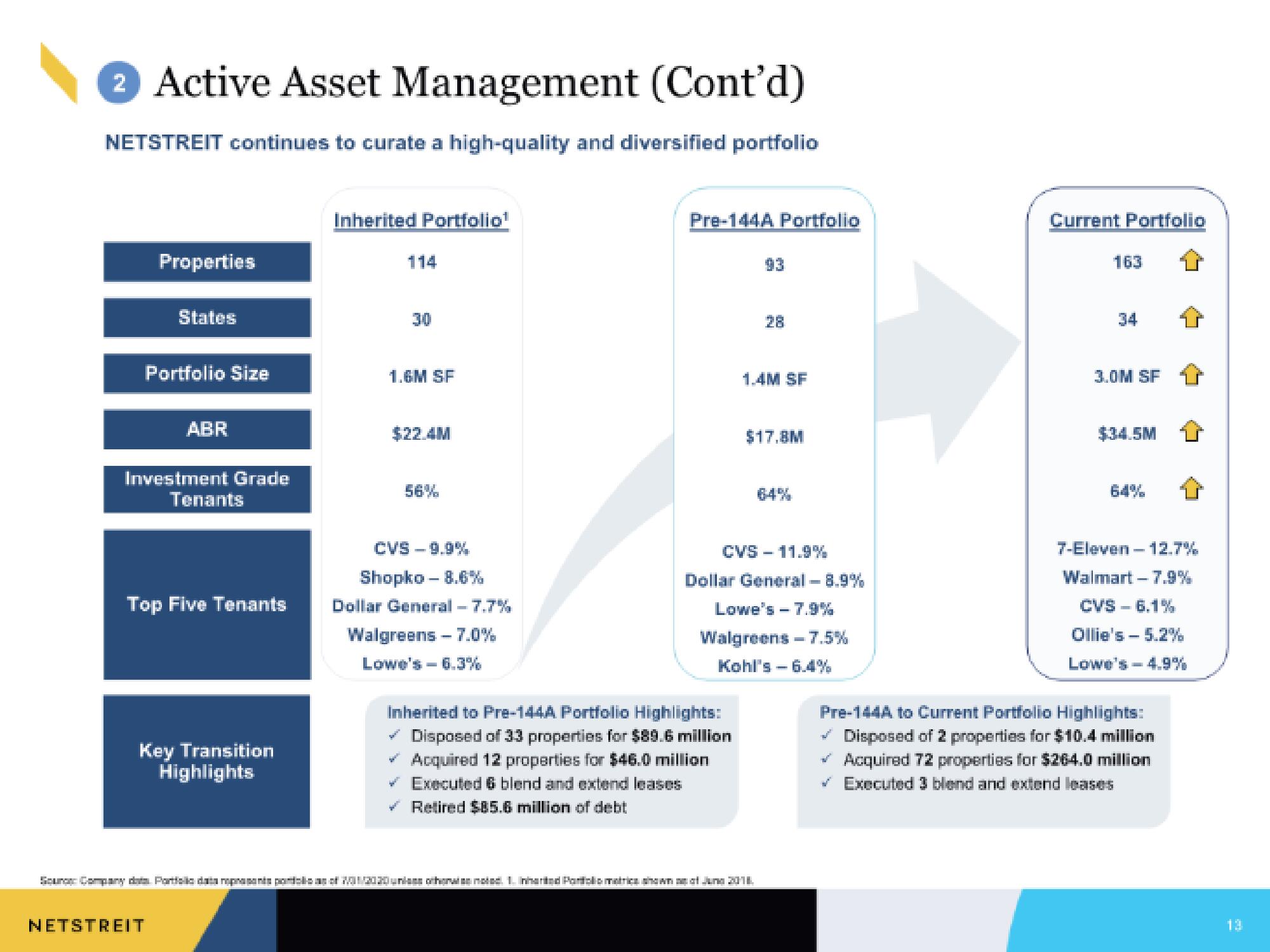

2 Active Asset Management (Cont'd)

NETSTREIT continues to curate a high-quality and diversified portfolio

Properties

States

Portfolio Size

ABR

Investment Grade

Tenants

NETSTREIT

Top Five Tenants

Key Transition

Highlights

Inherited Portfolio¹

114

30

1.6M SF

$22.4M

56%

CVS-9.9%

Shopko -8.6%

Dollar General - 7.7%

Walgreens - 7.0%

Lowe's-6.3%

Pre-144A Portfolio

Inherited to Pre-144A Portfolio Highlights:

✓ Disposed of 33 properties for $89.6 million

✓ Acquired 12 properties for $46.0 million

✓ Executed 6 blend and extend leases

Retired $85.6 million of debt

93

28

1.4M SF

Source Company data. Particia data represents portlas of 20/2020 unless otherwise noted. 1. Inherited Porfolio metrics shown of Juna 2018.

$17.8M

CVS - 11.9%

Dollar General - 8.9%

Lowe's - 7.9%

Walgreens - 7.5%

Kohl's - 6.4%

Current Portfolio

163

3.0M SF

$34.5M

↑

7-Eleven - 12.7%

Walmart-7.9%

CVS - 6.1%

Ollie's - 5.2%

Lowe's - 4.9 %

Pre-144A to Current Portfolio Highlights:

Disposed of 2 properties for $10.4 million

Acquired 72 properties for $264.0 million

✓ Executed 3 blend and extend leases

13View entire presentation