J.P.Morgan Shareholder Engagement Presentation Deck

A Say-on-Pay Response

New disclosures were also added as a result of the Board's review of our

compensation program

A

EXPLAINING THAT THERE ARE NOT SEPARATE SHORT- AND LONG-

TERM INCENTIVE PLANS (SLIDE 6)

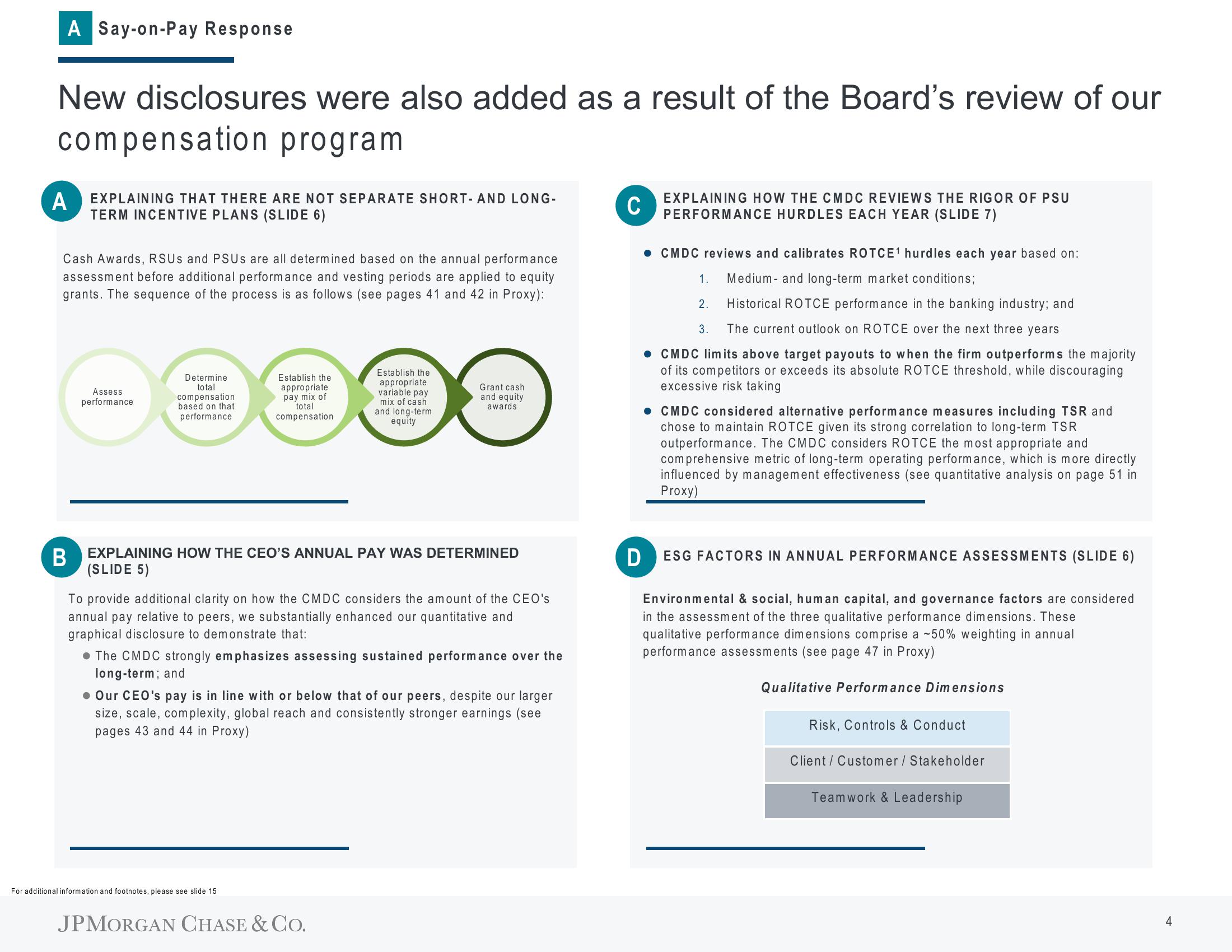

Cash Awards, RSUS and PSUs are all determined based on the annual performance

assessment before additional performance and vesting periods are applied to equity

grants. The sequence of the process is as follows (see pages 41 and 42 in Proxy):

Assess

performance

Determine

total

compensation

based on that

performance

Establish the

appropriate

pay mix of

total

compensation

Establish the

appropriate

variable pay

mix of cash

and long-term

equity

EXPLAINING HOW THE CEO'S ANNUAL PAY WAS DETERMINED

(SLIDE 5)

Grant cash

and equity

awards

B

To provide additional clarity on how the CMDC considers the amount of the CEO's

annual pay relative to peers, we substantially enhanced our quantitative and

graphical disclosure to demonstrate that:

For additional information and footnotes, please see slide 15

• The CMDC strongly emphasizes assessing sustained performance over the

long-term; and

• Our CEO's pay is in line with or below that of our peers, despite our larger

size, scale, complexity, global reach and consistently stronger earnings (see

pages 43 and 44 in Proxy)

JPMORGAN CHASE & CO.

EXPLAINING HOW THE CMDC REVIEWS THE RIGOR OF PSU

PERFORMANCE HURDLES EACH YEAR (SLIDE 7)

C

● CMDC reviews and calibrates ROTCE¹ hurdles each year based on:

Medium- and long-term market conditions;

Historical ROTCE performance in the banking industry; and

3. The current outlook on ROTCE over the next three years

● CMDC limits above target payouts to when the firm outperforms the majority

of its competitors or exceeds its absolute ROTCE threshold, while discouraging

excessive risk taking

D

1.

2.

● CMDC considered alternative performance measures including TSR and

chose to maintain ROTCE given its strong correlation to long-term TSR

outperformance. The CMDC considers ROTCE the most appropriate and

comprehensive metric of long-term operating performance, which is more directly

influenced by management effectiveness (see quantitative analysis on page 51 in

Proxy)

ESG FACTORS IN ANNUAL PERFORMANCE ASSESSMENTS (SLIDE 6)

Environmental & social, human capital, and governance factors are considered

in the assessment of the three qualitative performance dimensions. These

qualitative performance dimensions comprise a ~50% weighting in annual

performance assessments (see page 47 in Proxy)

Qualitative Performance Dimensions

Risk, Controls & Conduct

Client Customer / Stakeholder

Teamwork & Leadership

4View entire presentation