Baird Investment Banking Pitch Book

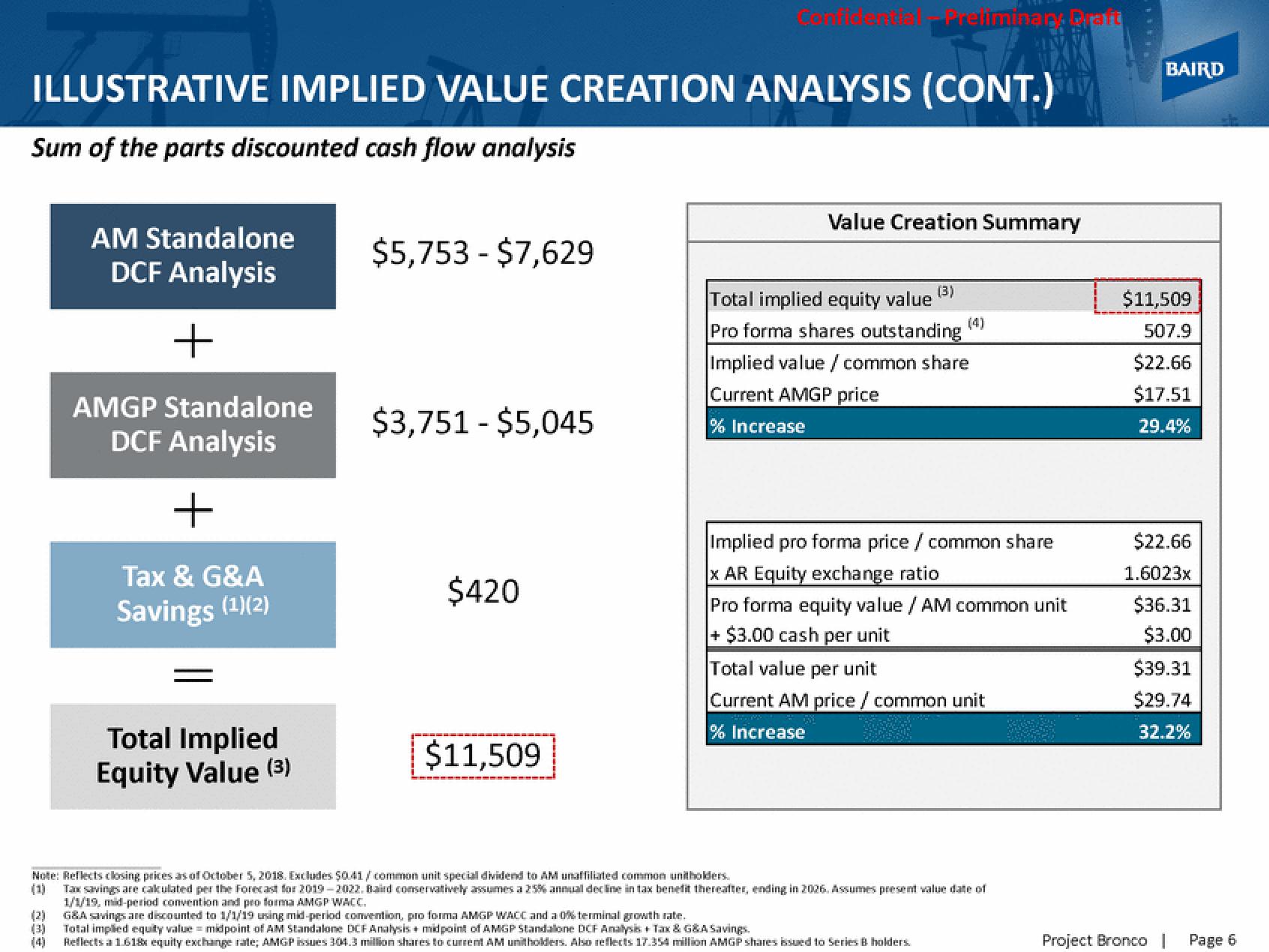

ILLUSTRATIVE IMPLIED VALUE CREATION ANALYSIS (CONT.)

Sum of the parts discounted cash flow analysis

AM Standalone

DCF Analysis

+

AMGP Standalone

DCF Analysis

+

Tax & G&A

Savings (¹)(2)

Total Implied

Equity Value (3)

$5,753 - $7,629

$3,751 - $5,045

$420

Contiteuster, Preliminary Draft

$11,509

Value Creation Summary

(3)

Total implied equity value

Pro forma shares outstanding (4)

Implied value / common share

Current AMGP price

% Increase

Implied pro forma price / common share

x AR Equity exchange ratio

Pro forma equity value /AM common unit

+ $3.00 cash per unit

Total value per unit

Current AM price / common unit

% Increase

Note: Reflects closing prices as of October 5, 2018. Excludes $0.41/common unit special dividend to AM unaffiliated common unitholders.

Tax savings are calculated per the Forecast for 2019-2022, Baird conservatively assumes a 25% annual decline in tax benefit thereafter, ending in 2026. Assumes present value date of

1/1/19, mid-period convention and pro forma AMGP WACC.

(2) G&A savings are discounted to 1/1/19 using mid-period convention, pro forma AMGP WACC and a 0% terminal growth rate.

(3) Total implied equity value midpoint of AM Standalone DCF Analysis + midpoint of AMGP Standalone DCF Analysis + Tax & G&A Savings.

Reflects a 1.618 equity exchange rate; AMGP issues 304.3 million shares to current AM unitholders. Also reflects 17.354 million AMGP shares issued to Series Bholders.

BAIRD

$11,509

507.9

$22.66

$17.51

29.4%

$22.66

1.6023x

$36.31

$3.00

$39.31

$29.74

32.2%

Project Bronco

Page 6View entire presentation