Accel Entertaiment Results Presentation Deck

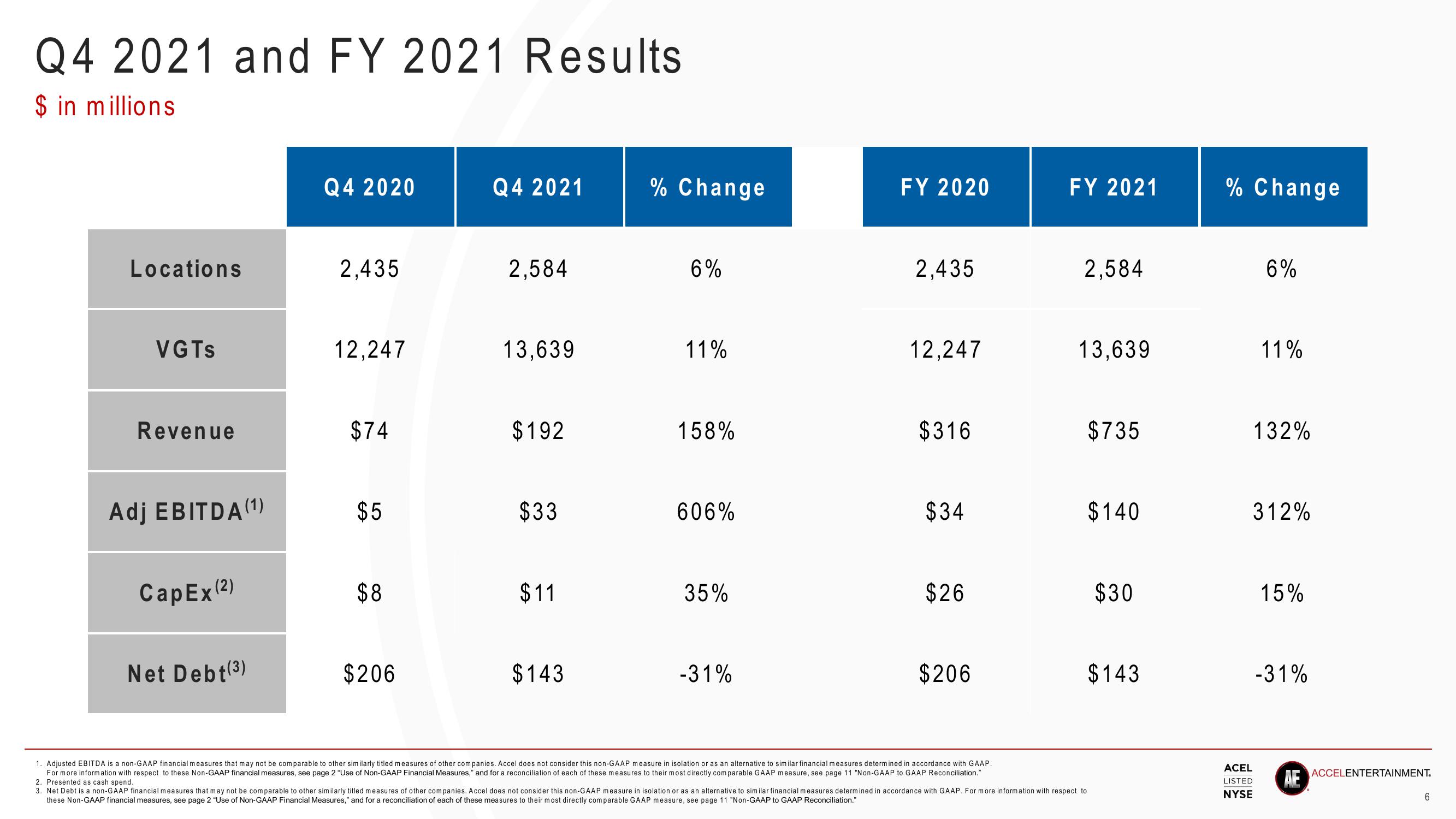

Q4 2021 and FY 2021 Results

$ in millions

Locations

VGTS

Revenue

Adj EBITDA (1)

CapEx (2)

Net Debt(3)

Q4 2020

2,435

12,247

$74

$5

$8

$206

Q4 2021

2,584

13,639

$192

$33

$11

$143

% Change

6%

11%

158%

606%

35%

-31%

FY 2020

2,435

12,247

$316

$34

$26

$206

FY 2021

2,584

13,639

$735

$140

$30

$143

1. Adjusted EBITDA is a non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined i accordance with GAAP.

For more information with respect to these Non-GAAP financial measures, see page 2 "Use of Non-GAAP Financial Measures," and for reconciliation of each of these measures to their most directly comparable GAAP measure, see page 11 "Non-GAAP to GAAP Reconciliation."

2. Presented as cash spend.

3. Net Debt is a non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to

these Non-GAAP financial measures, see page 2 "Use of Non-GAAP Financial Measures," and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 11 "Non-GAAP to GAAP Reconciliation."

% Change

6%

11%

132%

ACEL

LISTED

NYSE

312%

15%

-31%

AE

ACCELENTERTAINMENT.

6View entire presentation