Kin SPAC Presentation Deck

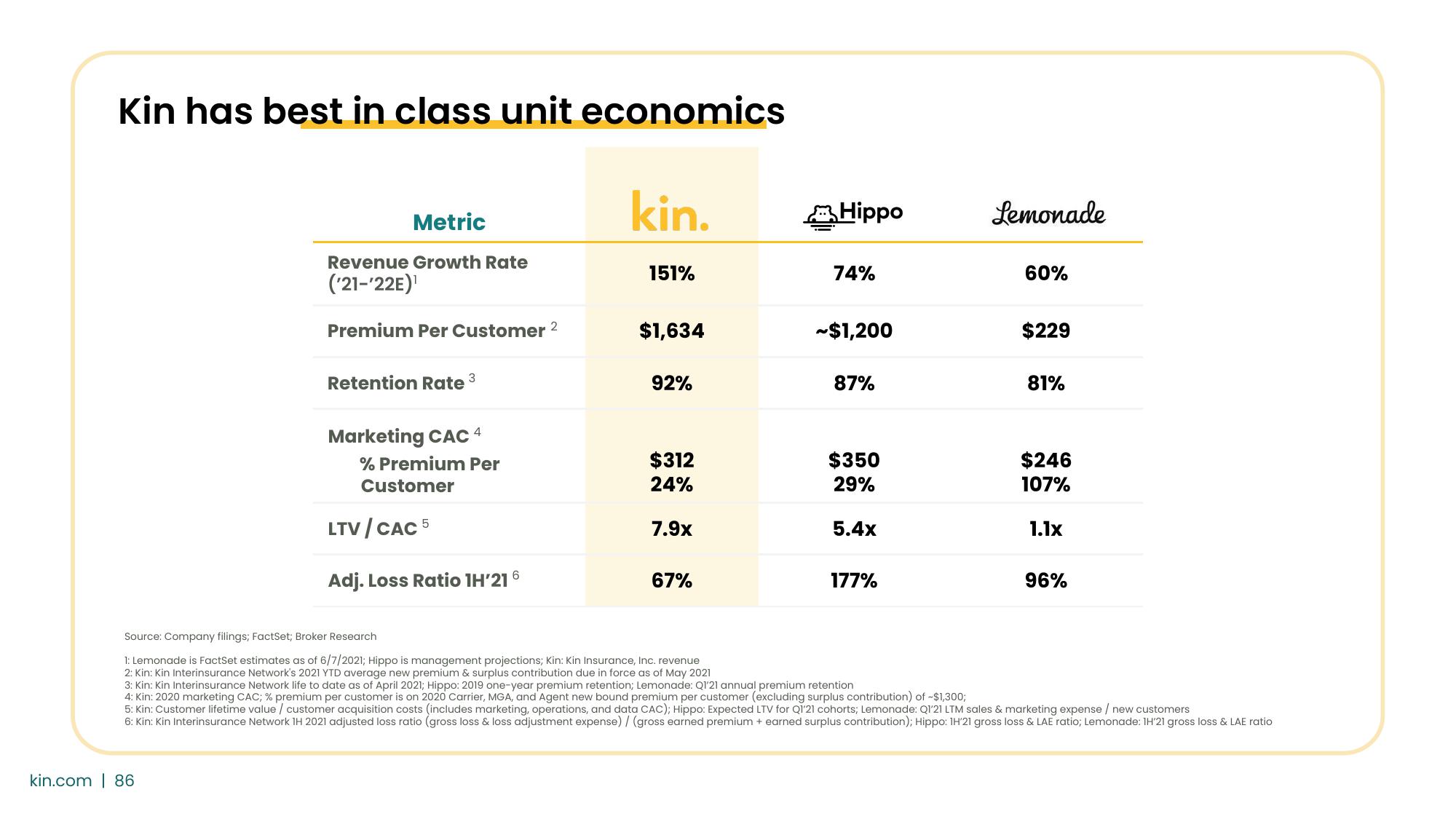

Kin has best in class unit economics

Metric

Revenue Growth Rate

('21-'22E)¹

Premium Per Customer ²

Retention Rate

3

kin.com 86

Marketing CAC 4

% Premium Per

Customer

LTV/CAC 5

Adj. Loss Ratio 1H'216

kin.

151%

$1,634

92%

$312

24%

7.9x

67%

Hippo

74%

~$1,200

87%

$350

29%

5.4x

177%

Source: Company filings; FactSet; Broker Resed

1: Lemonade is FactSet estimates as of 6/7/2021; Hippo is management projections; Kin: Kin Insurance, Inc. revenue

2: Kin: Kin Interinsurance Network's 2021 YTD average new premium & surplus contribution due in force as of May 2021

3: Kin: Kin Interinsurance Network life to date as of April 2021; Hippo: 2019 one-year premium retention; Lemonade: Q1'21 annual premium retention

4: Kin: 2020 marketing CAC; % premium per customer is on 2020 Carrier, MGA, and Agent new bound premium per customer (excluding surplus contribution) of -$1,300;

Lemonade

60%

$229

81%

$246

107%

1.1x

96%

5: Kin: Customer lifetime value / customer acquisition costs (includes marketing, operations, and data CAC); Hippo: Expected LTV for Q1'21 cohorts; Lemonade: Q1'21 LTM sales & marketing expense / new customers

6: Kin: Kin Interinsurance Network 1H 2021 adjusted loss ratio (gross loss & loss adjustment expense) / (gross earned premium + earned surplus contribution); Hippo: 1H'21 gross loss & LAE ratio; Lemonade: 1H'21 gross loss & LAE ratioView entire presentation