XP Inc Results Presentation Deck

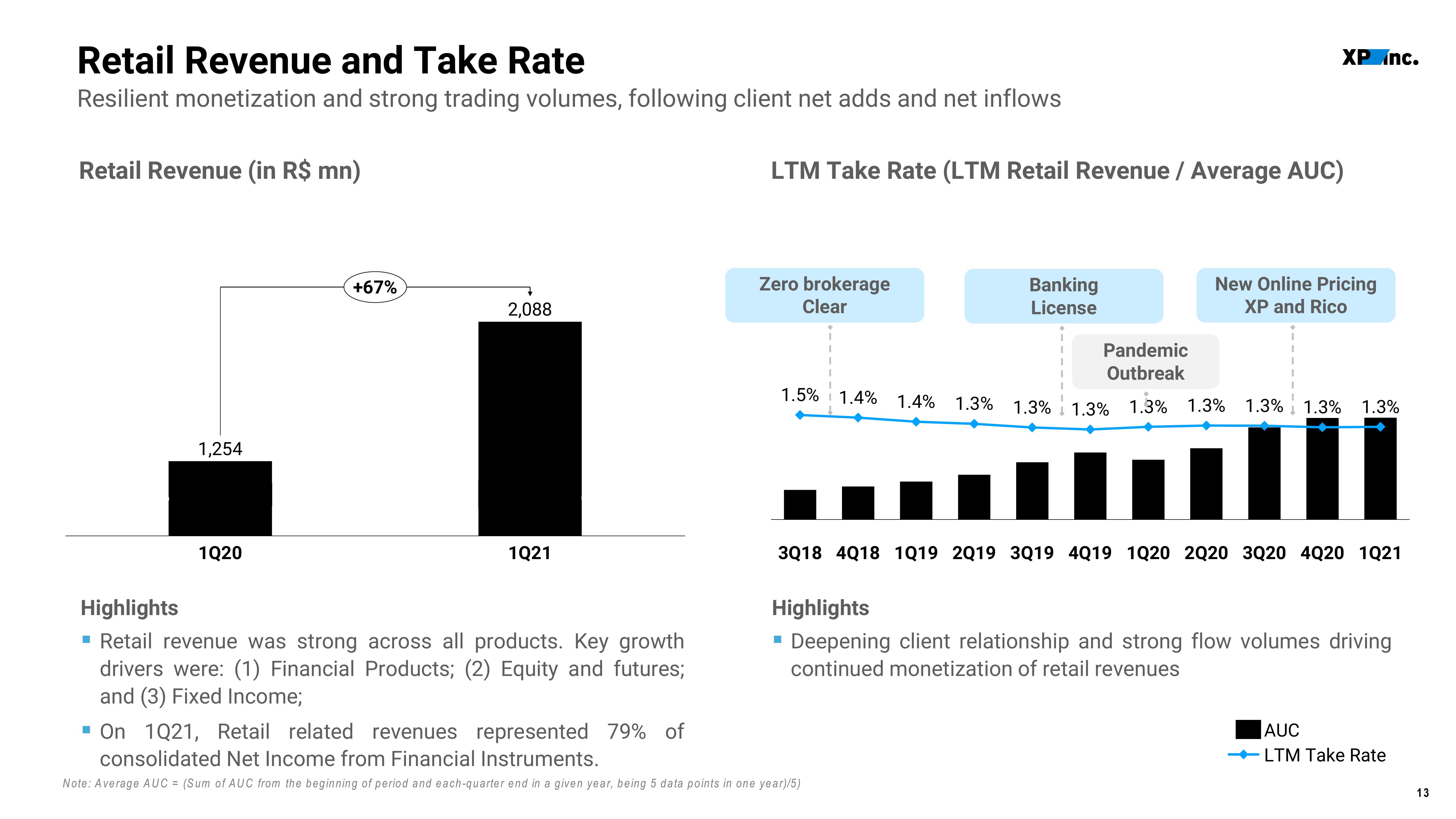

Retail Revenue and Take Rate

Resilient monetization and strong trading volumes, following client net adds and net inflows

Retail Revenue (in R$ mn)

1,254

1Q20

+67%

2,088

1Q21

Highlights

▪ Retail revenue was strong across all products. Key growth

drivers were: (1) Financial Products; (2) Equity and futures;

and (3) Fixed Income;

LTM Take Rate (LTM Retail Revenue / Average AUC)

Zero brokerage

Clear

XP Inc.

Banking

License

New Online Pricing

XP and Rico

Pandemic

Outbreak

1.5% 1.4% 1.4% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3%

▪ On 1Q21, Retail related revenues represented 79% of

consolidated Net Income from Financial Instruments.

Note: Average AUC = (Sum of AUC from the beginning of period and each-quarter end in a given year, being 5 data points in one year)/5)

3Q18 4Q18 1019 2019 3Q19 4Q19 1020 2020 3Q20 4Q20 1021

Highlights

Deepening client relationship and strong flow volumes driving

continued monetization of retail revenues

AUC

-LTM Take Rate

13View entire presentation