Maersk Investor Presentation Deck

Financial highlights 2020

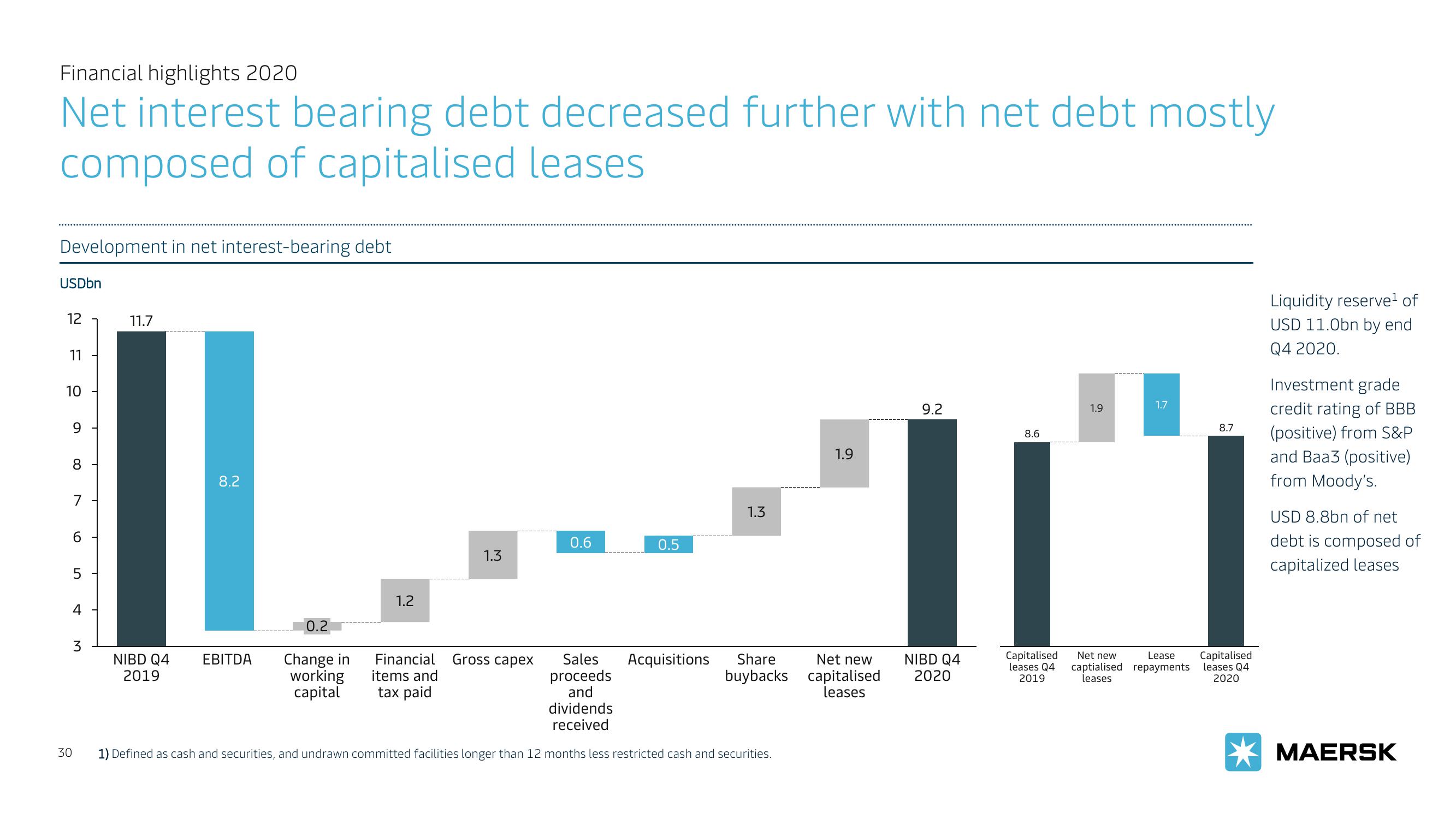

Net interest bearing debt decreased further with net debt mostly

composed of capitalised leases

Development in net interest-bearing debt

USDbn

12

11

10

9

8

7

6

LO

5

4

3

30

T

T

11.7

NIBD Q4

2019

8.2

EBITDA

0.2

Change in

working

capital

1.2

Financial

items and

tax paid

1.3

Gross capex

0.6

0.5

1.3

Sales Acquisitions

proceeds

and

dividends

received

1) Defined as cash and securities, and undrawn committed facilities longer than 12 months less restricted cash and securities.

Share

buybacks

1.9

Net new

capitalised

leases

9.2

NIBD Q4

2020

8.6

Capitalised

leases Q4

2019

1.9

1.7

Lease

Net new

captialised repayments

leases

8.7

Capitalised

leases Q4

2020

Liquidity reserve¹ of

USD 11.0bn by end

Q4 2020.

Investment grade

credit rating of BBB

(positive) from S&P

and Baa3 (positive)

from Moody's.

USD 8.8bn of net

debt is composed of

capitalized leases

MAERSKView entire presentation