jetBlue Mergers and Acquisitions Presentation Deck

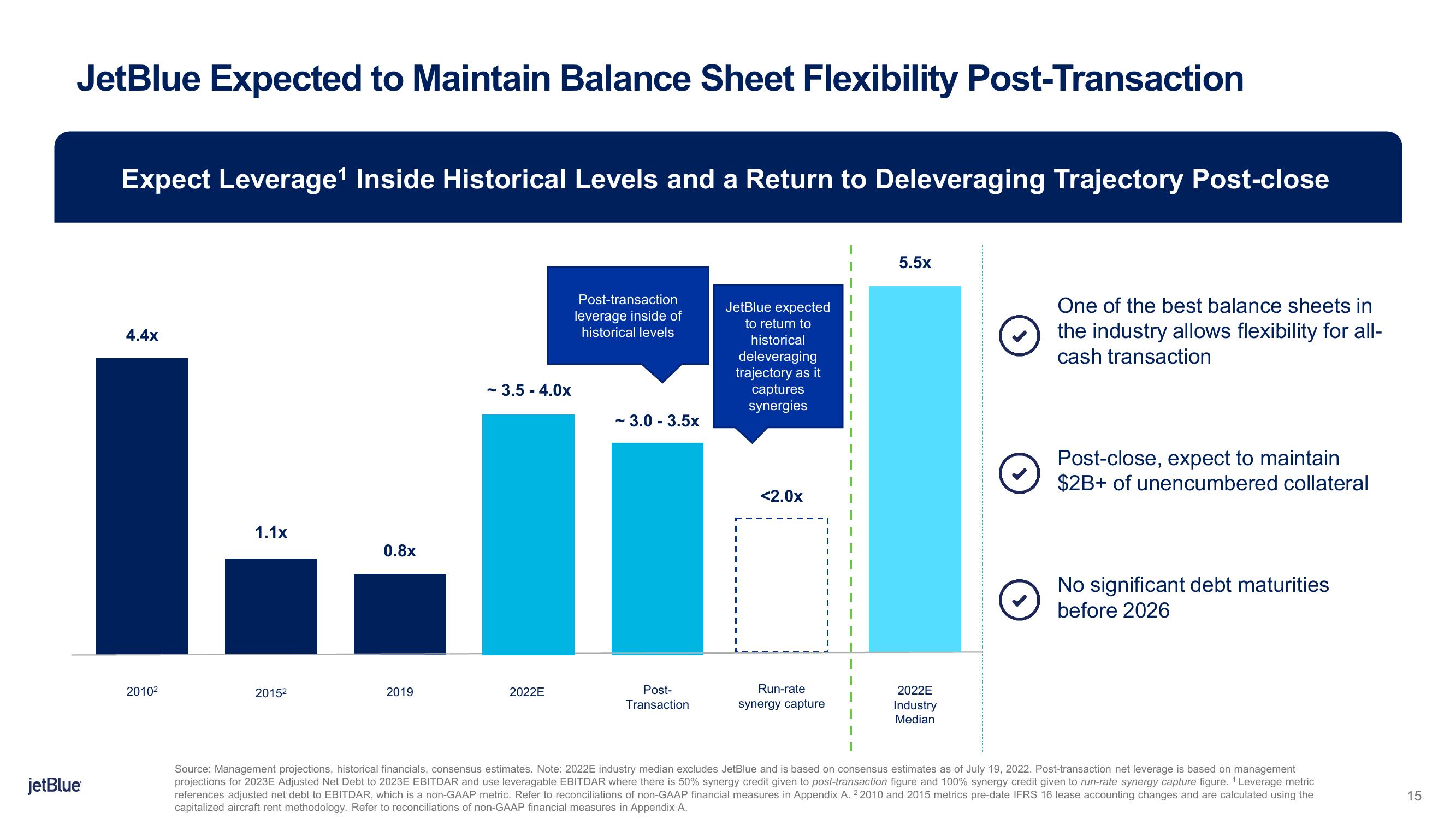

JetBlue Expected to Maintain Balance Sheet Flexibility Post-Transaction

jetBlue

Expect Leverage¹ Inside Historical Levels and a Return to Deleveraging Trajectory Post-close

4.4x

2010²

1.1x

2015²

0.8x

2019

- 3.5-4.0x

2022E

Post-transaction

leverage inside of

historical levels

~ 3.0 - 3.5x

Post-

Transaction

JetBlue expected

to return to

historical

deleveraging

trajectory as it

captures

synergies

1

<2.0x

Run-rate

synergy capture

5.5x

2022E

Industry

Median

One of the best balance sheets in

the industry allows flexibility for all-

cash transaction

Post-close, expect to maintain

$2B+ of unencumbered collateral

No significant debt maturities

before 2026

Source: Management projections, historical financials, consensus estimates. Note: 2022E industry median excludes JetBlue and is based on consensus estimates as of July 19, 2022. Post-transaction net leverage is based on management

projections for 2023E Adjusted Net Debt to 2023E EBITDAR and use leveragable EBITDAR where there is 50% synergy credit given to post-transaction figure and 100% synergy credit given to run-rate synergy capture figure. ¹ Leverage metric

references adjusted net debt to EBITDAR, which is a non-GAAP metric. Refer to reconciliations of non-GAAP financial measures in Appendix A. 22010 and 2015 metrics pre-date IFRS 16 lease accounting changes and are calculated using the

capitalized aircraft rent methodology. Refer to reconciliations of non-GAAP financial measures in Appendix A.

15View entire presentation