Vici Investor Presentation

RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES (CONT.)

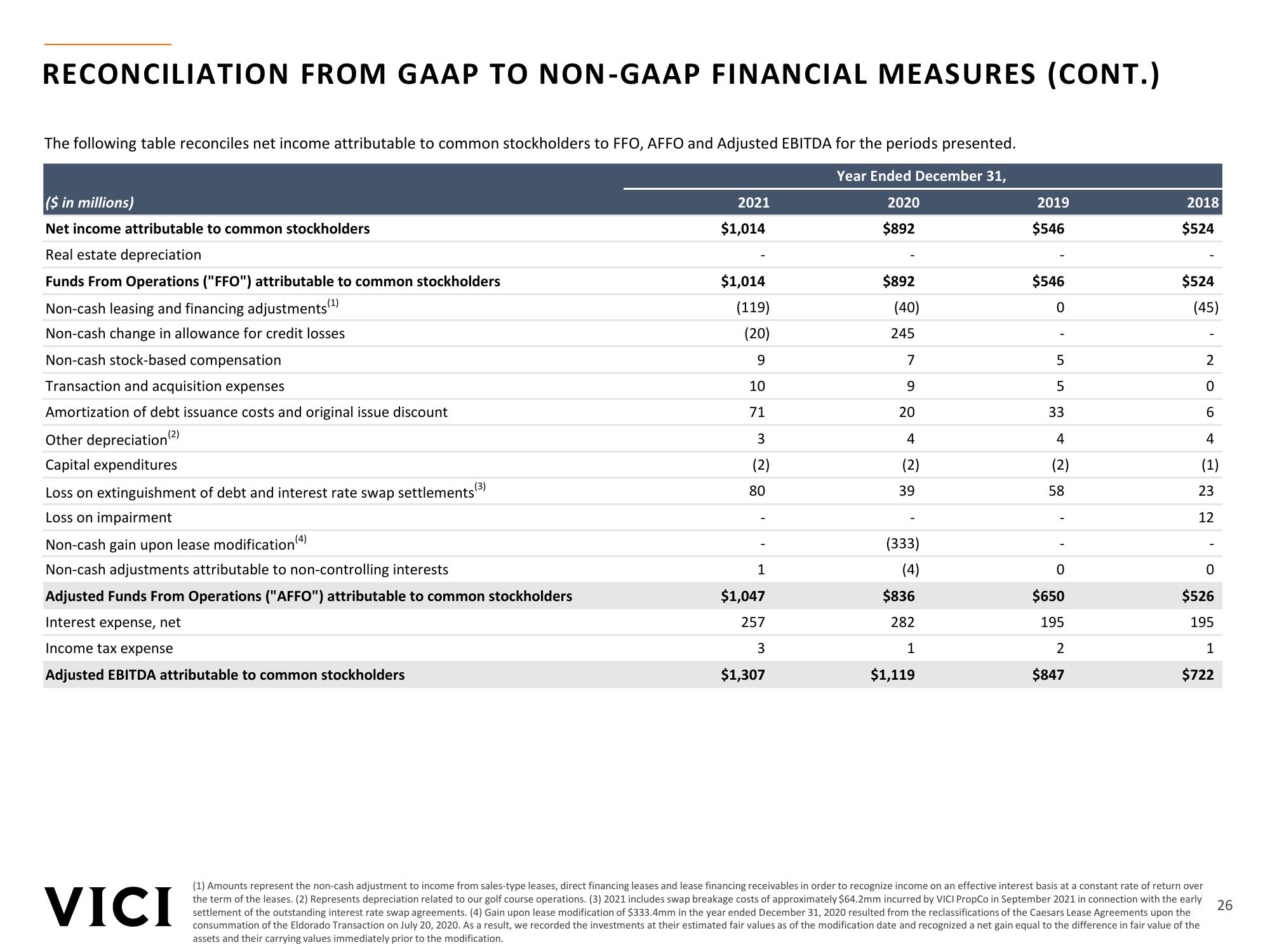

The following table reconciles net income attributable to common stockholders to FFO, AFFO and Adjusted EBITDA for the periods presented.

Year Ended December 31,

2020

$892

($ in millions)

Net income attributable to common stockholders

Real estate depreciation

Funds From Operations ("FFO") attributable to common stockholders

Non-cash leasing and financing adjustments (¹)

Non-cash change in allowance for credit losses

Non-cash stock-based compensation

Transaction and acquisition expenses

Amortization of debt issuance costs and original issue discount

Other depreciation (²)

Capital expenditures

(3)

Loss on extinguishment of debt and interest rate swap settlements

Loss on impairment

Non-cash gain upon lease modification (4)

Non-cash adjustments attributable to non-controlling interests

Adjusted Funds From Operations ("AFFO") attributable to common stockholders

Interest expense, net

Income tax expense

Adjusted EBITDA attributable to common stockholders

VICI

2021

$1,014

$1,014

(119)

(20)

9

10

71

3

(2)

80

1

$1,047

257

3

$1,307

$892

(40)

245

7

9

20

4

(2)

39

(333)

(4)

$836

282

1

$1,119

2019

$546

$546

0

5

5

33

4

(2)

58

0

$650

195

2

$847

2018

$524

$524

(45)

2

0

6

4

(1)

23

12

0

$526

195

1

$722

(1) Amounts represent the non-cash adjustment to income from sales-type leases, direct financing leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over

the term of the leases. (2) Represents depreciation related to our golf course operations. (3) 2021 includes swap breakage costs of approximately $64.2mm incurred by VICI PropCo in September 2021 in connection with the early

settlement of the outstanding interest rate swap agreements. (4) Gain upon lease modification of $333.4mm in the year ended December 31, 2020 resulted from the reclassifications of the Caesars Lease Agreements upon the

consummation of the Eldorado Transaction on July 20, 2020. As a result, we recorded the investments at their estimated fair values as of the modification date and recognized a net gain equal to the difference in fair value of the

assets and their carrying values immediately prior to the modification.

26View entire presentation