Allwyn Investor Presentation Deck

Cohn Robbins' view on value

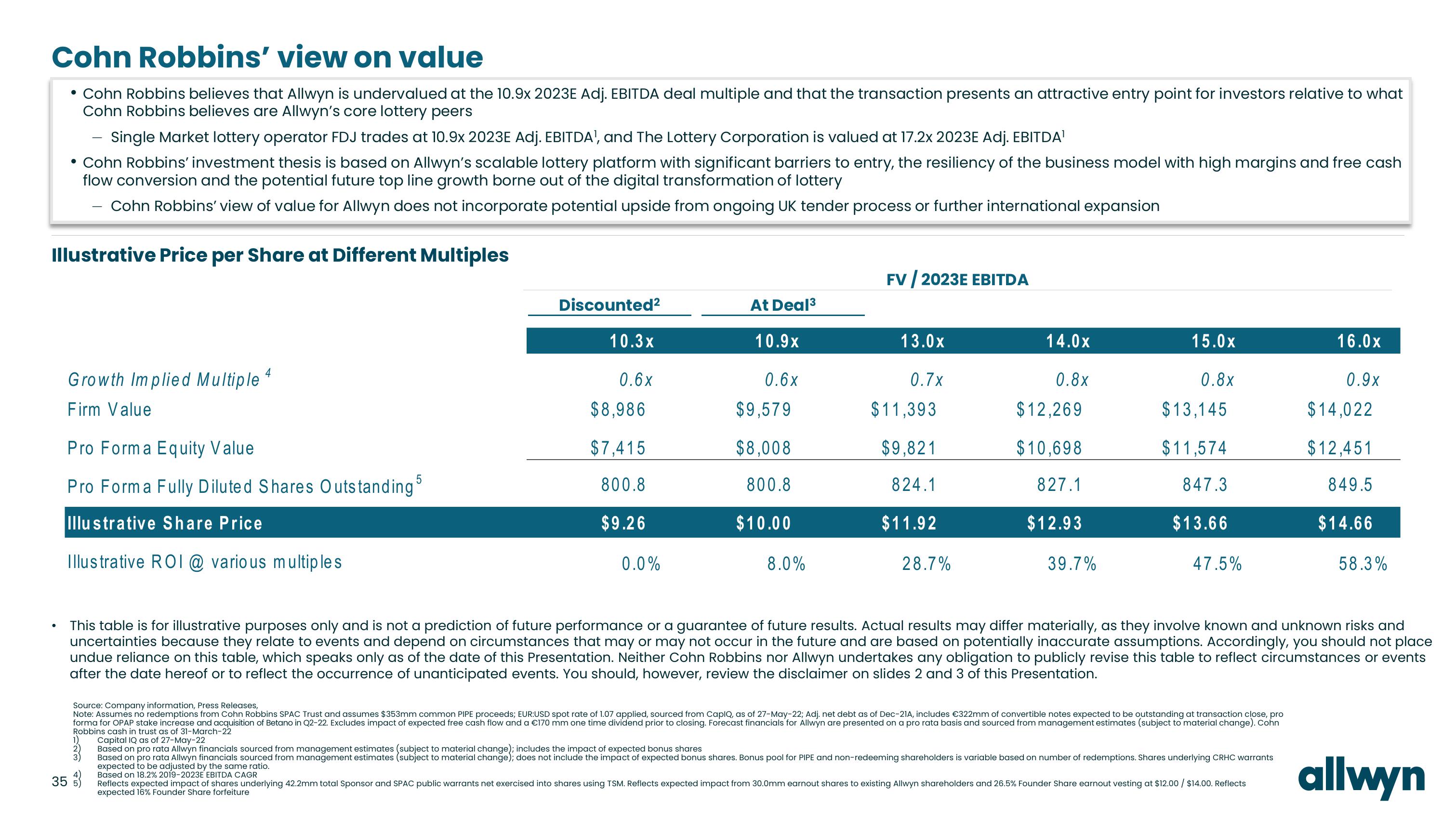

• Cohn Robbins believes that Allwyn is undervalued at the 10.9x 2023E Adj. EBITDA deal multiple and that the transaction presents an attractive entry point for investors relative to what

Cohn Robbins believes are Allwyn's core lottery peers

Single Market lottery operator FDJ trades at 10.9x 2023E Adj. EBITDA', and The Lottery Corporation is valued at 17.2x 2023E Adj. EBITDA¹

• Cohn Robbins' investment thesis is based on Allwyn's scalable lottery platform with significant barriers to entry, the resiliency of the business model with high margins and free cash

flow conversion and the potential future top line growth borne out of the digital transformation of lottery

Cohn Robbins' view of value for Allwyn does not incorporate potential upside from ongoing UK tender process or further international expansion

Illustrative Price per Share at Different Multiples

●

Growth Implied Multiple

Firm Value

Pro Forma Equity Value

Pro Forma Fully Diluted Shares Outstanding

Illustrative Share Price

Illustrative ROI @ various multiples

5

1)

2)

Discounted²

35 €)

10.3x

0.6x

$8,986

$7,415

800.8

$9.26

0.0%

At Deal³

10.9x

0.6x

$9,579

$8,008

800.8

$10.00

8.0%

FV/2023E EBITDA

13.0x

0.7x

$11,393

$9,821

824.1

$11.92

28.7%

14.0x

0.8x

$12,269

$10,698

827.1

$12.93

39.7%

15.0x

0.8x

$13,145

$11.574

847.3

$13.66

47.5%

Source: Company information, Press Releases,

Note: Assumes no redemptions from Cohn Robbins SPAC Trust and assumes $353mm common PIPE proceeds; EUR:USD spot rate of 1.07 applied, sourced from CapIQ, as of 27-May-22; Adj. net debt as of Dec-21A, includes €322mm of convertible notes expected to be outstanding at transaction close, pro

forma for OPAP stake increase and acquisition of Betano in Q2-22. Excludes impact of expected free cash flow and a €170 mm one time dividend prior to closing. Forecast financials for Allwyn are presented on a pro rata basis and sourced from management estimates (subject to material change). Cohn

Robbins cash in trust as of 31-March-22

This table is for illustrative purposes only and is not a prediction of future performance or a guarantee of future results. Actual results may differ materially, as they involve known and unknown risks and

uncertainties because they relate to events and depend on circumstances that may or may not occur in the future and are based on potentially inaccurate assumptions. Accordingly, you should not place

undue reliance on this table, which speaks only as of the date of this Presentation. Neither Cohn Robbins nor Allwyn undertakes any obligation to publicly revise this table to reflect circumstances or events

after the date hereof or to reflect the occurrence of unanticipated events. You should, however, review the disclaimer on slides 2 and 3 of this Presentation.

Capital IQ as of 27-May-22

Based on pro rata Allwyn financials sourced from management estimates (subject to material change); includes the impact of expected bonus shares

Based on pro rata Allwyn financials sourced from management estimates (subject to material change); does not include the impact of expected bonus shares. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares underlying CRHC warrants

expected to be adjusted by the same ratio.

Based on 18.2% 2019-2023E EBITDA CAGR

16.0x

0.9x

Reflects expected impact of shares underlying 42.2mm total Sponsor and SPAC public warrants net exercised into shares using TSM. Reflects expected impact from 30.0mm earnout shares to existing Allwyn shareholders and 26.5% Founder Share earnout vesting at $12.00 / $14.00. Reflects

expected 16% Founder Share forfeiture

$14,022

$12,451

849.5

$14.66

58.3%

allwynView entire presentation