Grove Results Presentation Deck

Non-GAAP Financial Measures

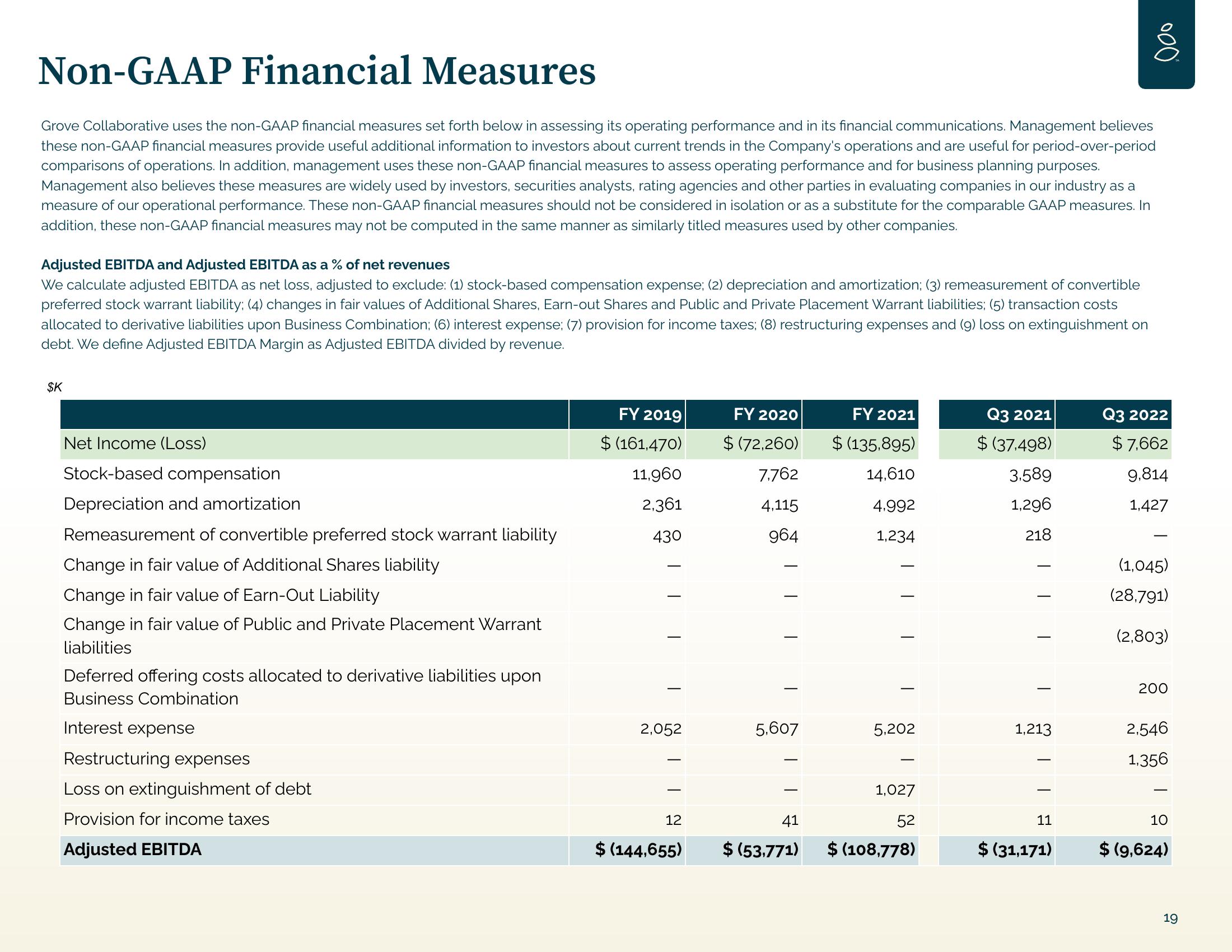

Grove Collaborative uses the non-GAAP financial measures set forth below in assessing its operating performance and in its financial communications. Management believes

these non-GAAP financial measures provide useful additional information to investors about current trends in the Company's operations and are useful for period-over-period

comparisons of operations. In addition, management uses these non-GAAP financial measures to assess operating performance and for business planning purposes.

Management also believes these measures are widely used by investors, securities analysts, rating agencies and other parties in evaluating companies in our industry as a

measure of our operational performance. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures. In

addition, these non-GAAP financial measures may not be computed in the same manner as similarly titled measures used by other companies.

Adjusted EBITDA and Adjusted EBITDA as a % of net revenues

We calculate adjusted EBITDA as net loss, adjusted to exclude: (1) stock-based compensation expense; (2) depreciation and amortization; (3) remeasurement of convertible

preferred stock warrant liability; (4) changes in fair values of Additional Shares, Earn-out Shares and Public and Private Placement Warrant liabilities; (5) transaction costs

allocated to derivative liabilities upon Business Combination; (6) interest expense; (7) provision for income taxes; (8) restructuring expenses and (9) loss on extinguishment on

debt. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue.

$K

Net Income (Loss)

Stock-based compensation

Depreciation and amortization

Remeasurement of convertible preferred stock warrant liability

Change in fair value of Additional Shares liability

Change in fair value of Earn-Out Liability

Change in fair value of Public and Private Placement Warrant

liabilities

Deferred offering costs allocated to derivative liabilities upon

Business Combination

Interest expense

Restructuring expenses

Loss on extinguishment of debt

Provision for income taxes

Adjusted EBITDA

FY 2019

$ (161,470)

11,960

2,361

430

T

T

2,052

12

$ (144,655)

FY 2020

$(72,260)

7,762

4,115

964

T

5,607

41

$ (53,771)

FY 2021

$ (135,895)

14,610

4,992

1,234

T

5,202

1,027

52

$ (108,778)

Q3 2021

$(37,498)

3.589

1,296

218

T

T

1,213

11

000

$ (31,171)

Q3 2022

$7,662

9,814

1,427

(1,045)

(28,791)

(2,803)

200

2,546

1,356

10

$ (9,624)

19View entire presentation