Hexagon Purus Results Presentation Deck

15

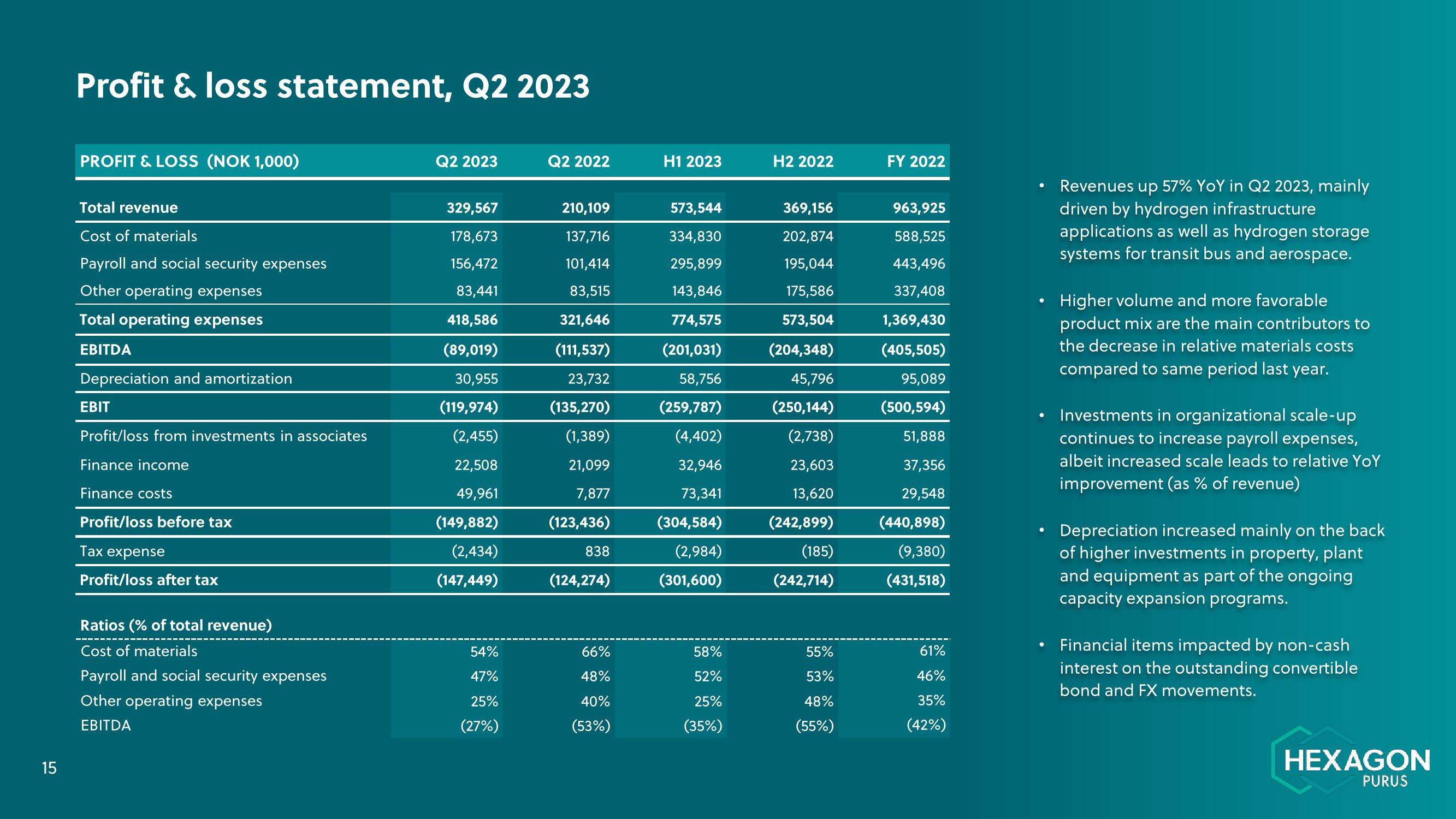

Profit & loss statement, Q2 2023

PROFIT & LOSS (NOK 1,000)

Total revenue

Cost of materials

Payroll and social security expenses

Other operating expenses

Total operating expenses

EBITDA

Depreciation and amortization

EBIT

Profit/loss from investments in associates

Finance income

Finance costs

Profit/loss before tax

Tax expense

Profit/loss after tax

Ratios (% of total revenue)

Cost of materials

Payroll and social security expenses

Other operating expenses

EBITDA

Q2 2023

329,567

178,673

156,472

83,441

418,586

(89,019)

30,955

(119,974)

(2,455)

22,508

49,961

(149,882)

(2,434)

(147,449)

54%

47%

25%

(27%)

Q2 2022

210,109

137,716

101,414

83,515

321,646

(111,537)

23,732

(135,270)

(1,389)

21,099

7,877

(123,436)

838

(124,274)

66%

48%

40%

(53%)

H1 2023

573,544

334,830

295,899

143,846

774,575

(201,031)

58,756

(259,787)

(4,402)

32,946

73,341

(304,584)

(2,984)

(301,600)

58%

52%

25%

(35%)

H2 2022

369,156

202,874

195,044

175,586

573,504

(204,348)

45,796

(250,144)

(2,738)

23,603

13,620

(242,899)

(185)

(242,714)

55%

53%

48%

(55%)

FY 2022

963,925

588,525

443,496

337,408

1,369,430

(405,505)

95,089

(500,594)

51,888

37,356

29,548

(440,898)

(9,380)

(431,518)

61%

46%

35%

(42%)

●

●

●

Revenues up 57% YoY in Q2 2023, mainly

driven by hydrogen infrastructure

applications as well as hydrogen storage

systems for transit bus and aerospace.

Higher volume and more favorable

product mix are the main contributors to

the decrease in relative materials costs

compared to same period last year.

Investments in organizational scale-up

continues to increase payroll expenses,

albeit increased scale leads to relative YoY

improvement (as % of revenue)

Depreciation increased mainly on the back

of higher investments in property, plant

and equipment as part of the ongoing

capacity expansion programs.

Financial items impacted by non-cash

interest on the outstanding convertible

bond and FX movements.

HEXAGON

PURUSView entire presentation