BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

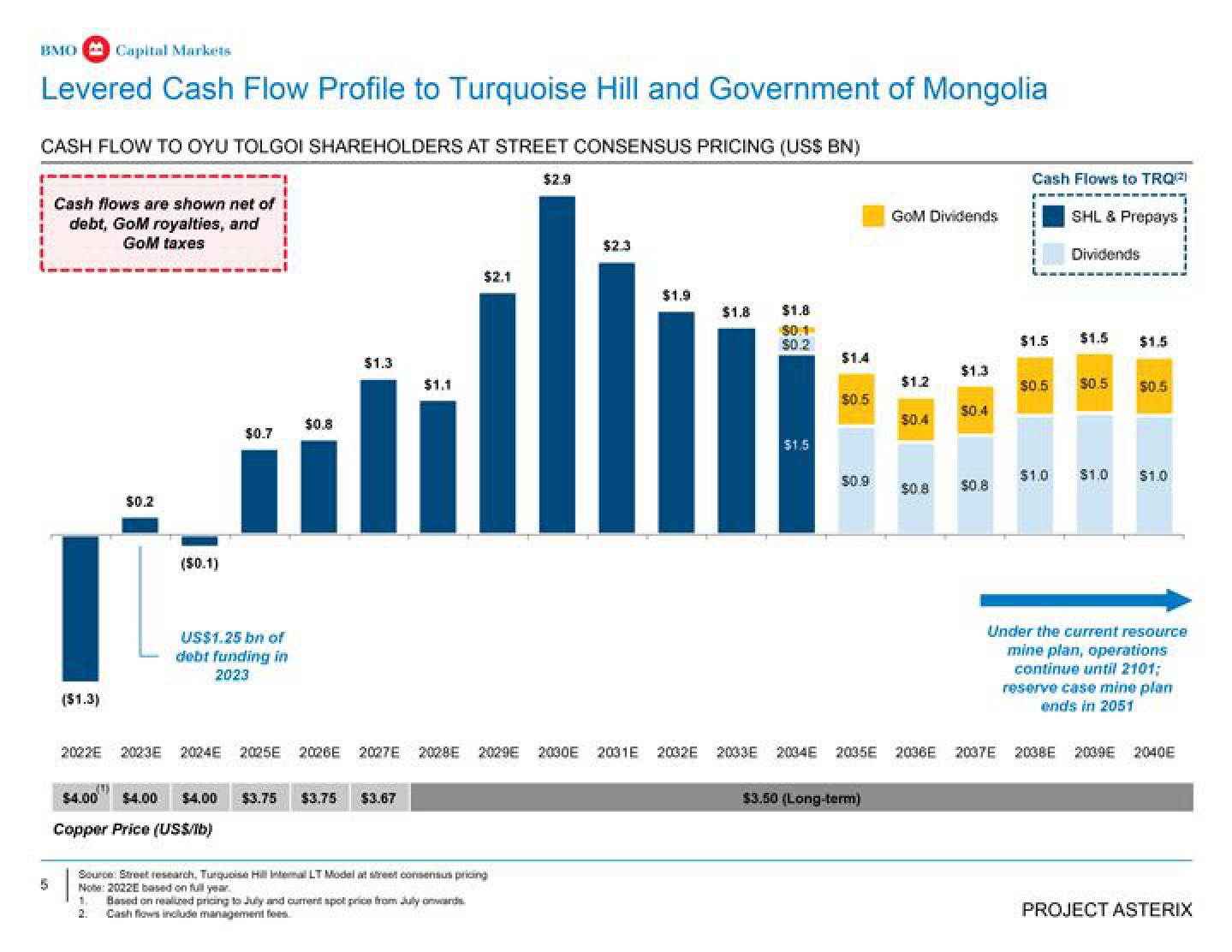

Levered Cash Flow Profile to Turquoise Hill and Government of Mongolia

CASH FLOW TO OYU TOLGOI SHAREHOLDERS AT STREET CONSENSUS PRICING (US$ BN)

Cash flows are shown net of

debt, GoM royalties, and

GoM taxes

($1.3)

($0.1)

$0.7

US$1.25 bn of

debt funding in

2023

$0.8

$1.3

$1.1

$4.00 $4.00 $4.00 $3.75 $3.75 $3.67

Copper Price (US$/lb)

$2.1

2022 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2000E

Source: Street research, Turquoise Hill Iemal LT Model at street consensus pricing

Note: 2022E based on full year.

1.

Based on realed pricing to July and current spot price from July onwards.

Cash flows include management fees

$2.9

$2.3

$1.9

2001E 2002E

$1.8 $1.8

$0.1

$0.2

$1.5

$1.4

$0.5

50.9

GoM Dividends

$3.50 (Long-term)

$1.2

$0.8

2033E 2004E 2035E 2036E

$1.3

50.4

$0.8

Cash Flows to TROPI

2037E

$1.5

$0.5

SHL & Prepays

Dividends

$1.5

$0.5

$1.0 $1.0

$1.5

$0.5

$1.0

Under the current resource

mine plan, operations

continue until 2101;

reserve case mine plan

ends in 2051

2038E 2009E 2040E

PROJECT ASTERIXView entire presentation