Volta SPAC Presentation Deck

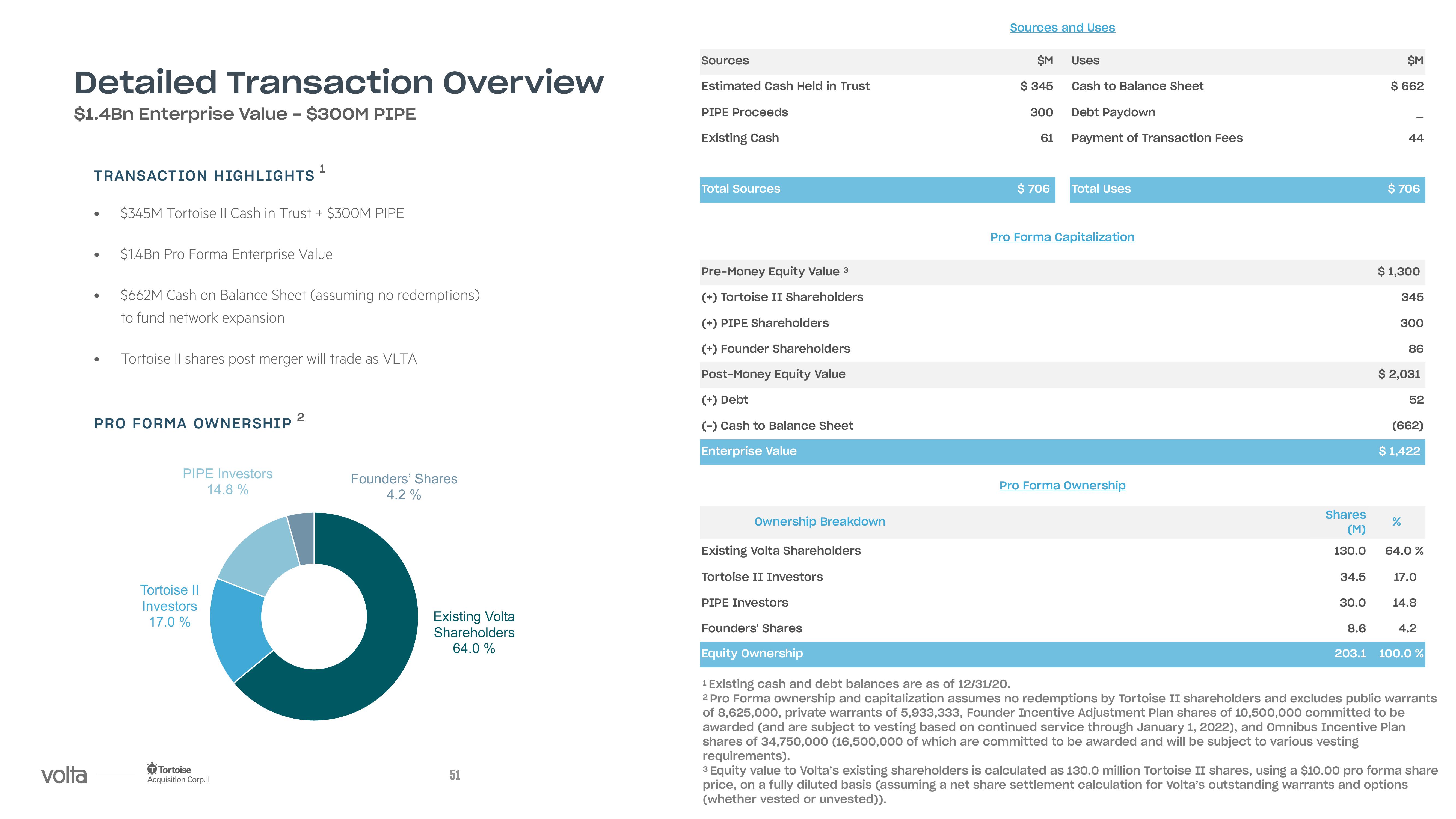

Detailed Transaction Overview

$1.4Bn Enterprise Value - $300M PIPE

volta

TRANSACTION HIGHLIGHTS

●

●

●

$345M Tortoise II Cash in Trust + $300M PIPE

$1.4Bn Pro Forma Enterprise Value

$662M Cash on Balance Sheet (assuming no redemptions)

to fund network expansion

Tortoise II shares post merger will trade as VLTA

PRO FORMA OWNERSHIP 2

1

PIPE Investors

14.8%

Tortoise II

Investors

17.0%

Tortoise

Acquisition Corp.Il

Founders' Shares

4.2 %

Existing Volta

Shareholders

64.0 %

51

Sources

Estimated Cash Held in Trust

PIPE Proceeds

Existing Cash

Total Sources

Pre-Money Equity Value 3

(+) Tortoise II Shareholders

(+) PIPE Shareholders

(+) Founder Shareholders

Post-Money Equity Value

(+) Debt

(-) Cash to Balance Sheet

Enterprise Value

Ownership Breakdown

Existing Volta Shareholders

Tortoise II Investors

PIPE Investors

Founders' Shares

Equity Ownership

Sources and Uses

$M

$ 345

300

61

$ 706

Uses

Cash to Balance Sheet

Debt Paydown

Payment of Transaction Fees

Total Uses

Pro Forma Capitalization

Pro Forma Ownership

Shares

(M)

130.0

34.5

30.0

8.6

$M

$ 662

44

$ 706

$ 1,300

345

300

86

$ 2,031

%

52

(662)

$ 1,422

64.0 %

17.0

14.8

4.2

203.1 100.0 %

¹ Existing cash and debt balances are as of 12/31/20.

2 Pro Forma ownership and capitalization assumes no redemptions by Tortoise II shareholders and excludes public warrants

of 8,625,000, private warrants of 5,933,333, Founder Incentive Adjustment Plan shares of 10,500,000 committed to be

awarded (and are subject to vesting based on continued service through January 1, 2022), and Omnibus Incentive Plan

shares of 34,750,000 (16,500,000 of which are committed to be awarded and will be subject to various vesting

requirements).

3 Equity value to Volta's existing shareholders is calculated as 130.0 million Tortoise II shares, using a $10.00 pro forma share

price, on a fully diluted basis (assuming a net share settlement calculation for Volta's outstanding warrants and options

(whether vested or unvested)).View entire presentation