Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

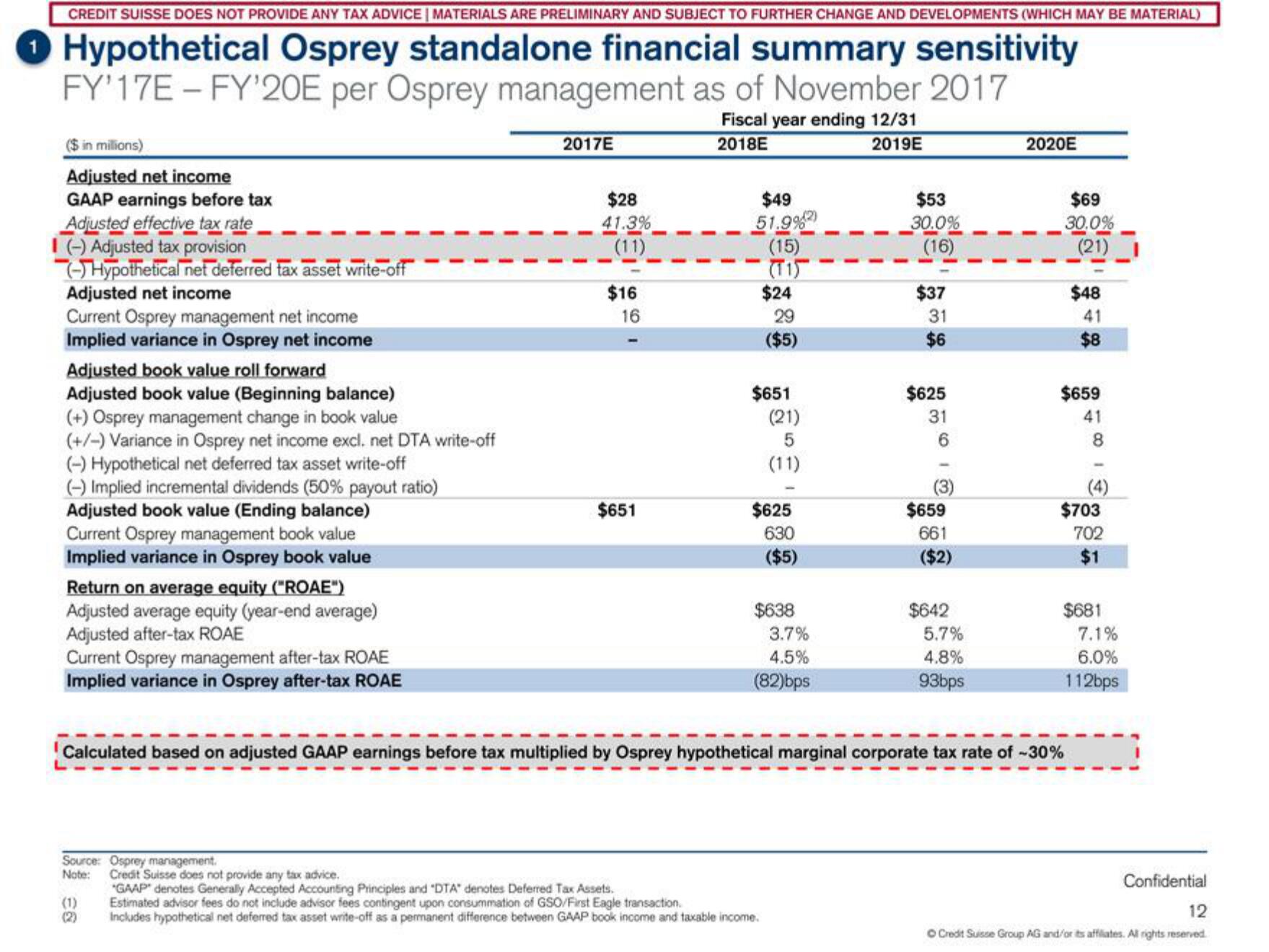

Hypothetical Osprey standalone financial summary sensitivity

FY'17E-FY'20E per Osprey management as of November 2017

Fiscal year ending 12/31

2017E

2018E

2019E

($ in millions)

Adjusted net income

GAAP earnings before tax

Adjusted effective tax rate

I(-) Adjusted tax provision

(-) Hypothetical net deferred tax asset write-off

Adjusted net income

Current Osprey management net income

Implied variance in Osprey net income

Adjusted book value roll forward

Adjusted book value (Beginning balance)

(+) Osprey management change in book value

(+/-) Variance in Osprey net income excl. net DTA write-off

(-) Hypothetical net deferred tax asset write-off

(-) Implied incremental dividends (50% payout ratio)

Adjusted book value (Ending balance)

Current Osprey management book value

Implied variance in Osprey book value

Return on average equity ("ROAE")

Adjusted average equity (year-end average)

Adjusted after-tax ROAE

Current Osprey management after-tax ROAE

Implied variance in Osprey after-tax ROAE

$28

41.3%

(11)

Source: Osprey management.

Note: Credit Suisse does not provide any tax advice.

(1)

$16

16

$651

$49

51.9%)

(15)

(11)

$24

29

($5)

$651

(21)

5

(11)

$625

630

($5)

$638

3.7%

4.5%

(82)bps

"GAAP denotes Generally Accepted Accounting Principles and "DTA" denotes Deferred Tax Assets.

Estimated advisor fees do not include advisor fees contingent upon consummation of GSO/First Eagle transaction.

Includes hypothetical net deferred tax asset write-off as a permanent difference between GAAP book income and taxable income.

$53

30.0%

(16)

$37

31

$6

$625

31

6

$659

661

($2)

$642

5.7%

4.8%

93bps

2020E

$69

30.0%

(21)

Calculated based on adjusted GAAP earnings before tax multiplied by Osprey hypothetical marginal corporate tax rate of -30%

$48

41

$8

$659

41

8

$703

702

$1

$681

7.1%

6.0%

112bps

Confidential

12

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation