Telia Company Mergers and Acquisitions Presentation Deck

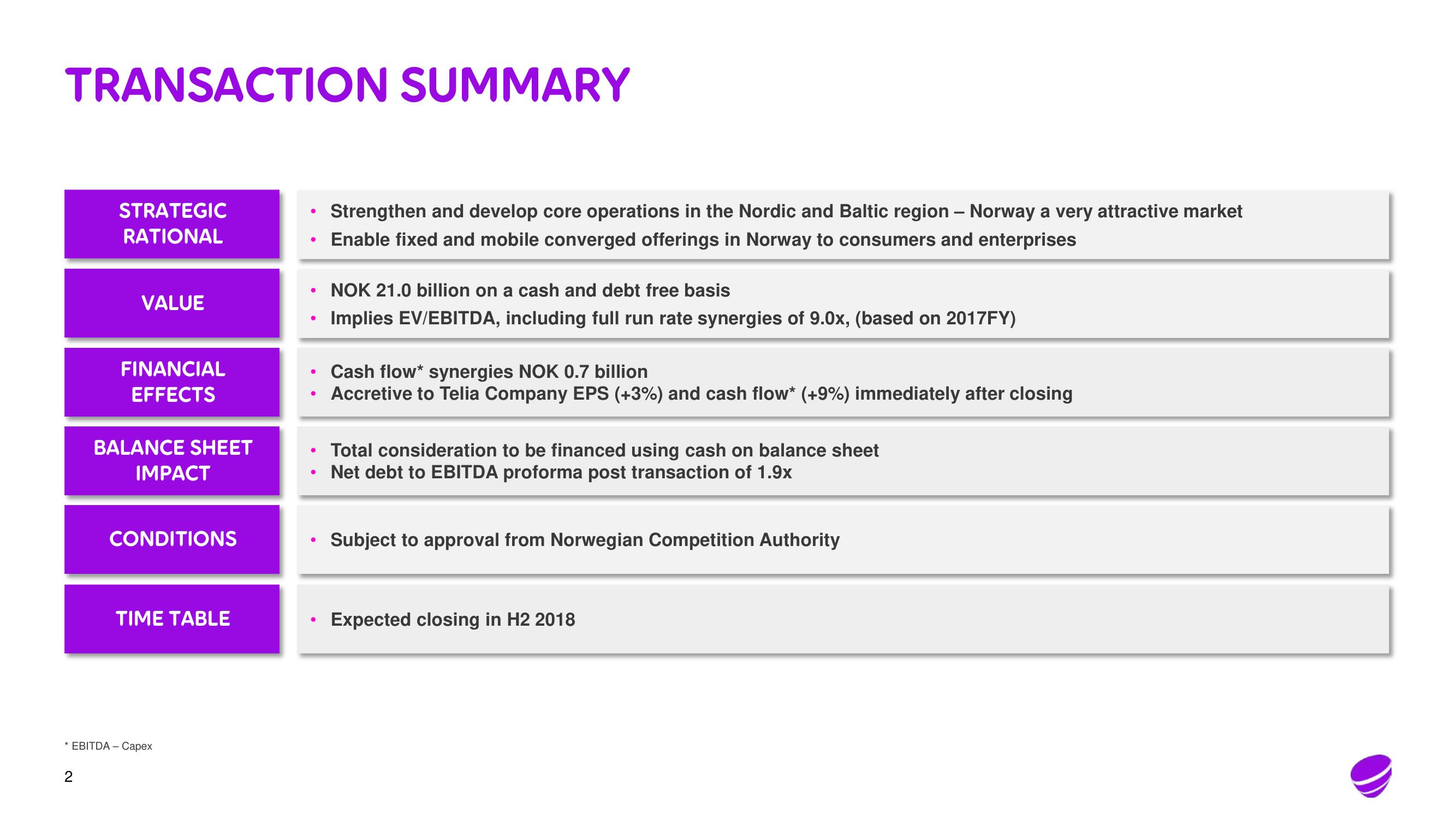

TRANSACTION SUMMARY

STRATEGIC

RATIONAL

2

VALUE

FINANCIAL

EFFECTS

BALANCE SHEET

IMPACT

CONDITIONS

TIME TABLE

* EBITDA - Capex

●

●

●

●

●

●

●

●

●

Strengthen and develop core operations in the Nordic and Baltic region - Norway a very attractive market

Enable fixed and mobile converged offerings in Norway to consumers and enterprises

NOK 21.0 billion on a cash and debt free basis

Implies EV/EBITDA, including full run rate synergies of 9.0x, (based on 2017FY)

Cash flow* synergies NOK 0.7 billion

Accretive to Telia Company EPS (+3%) and cash flow* (+9%) immediately after closing

Total consideration to be financed using cash on balance sheet

Net debt to EBITDA proforma post transaction of 1.9x

Subject to approval from Norwegian Competition Authority

Expected closing in H2 2018View entire presentation