BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

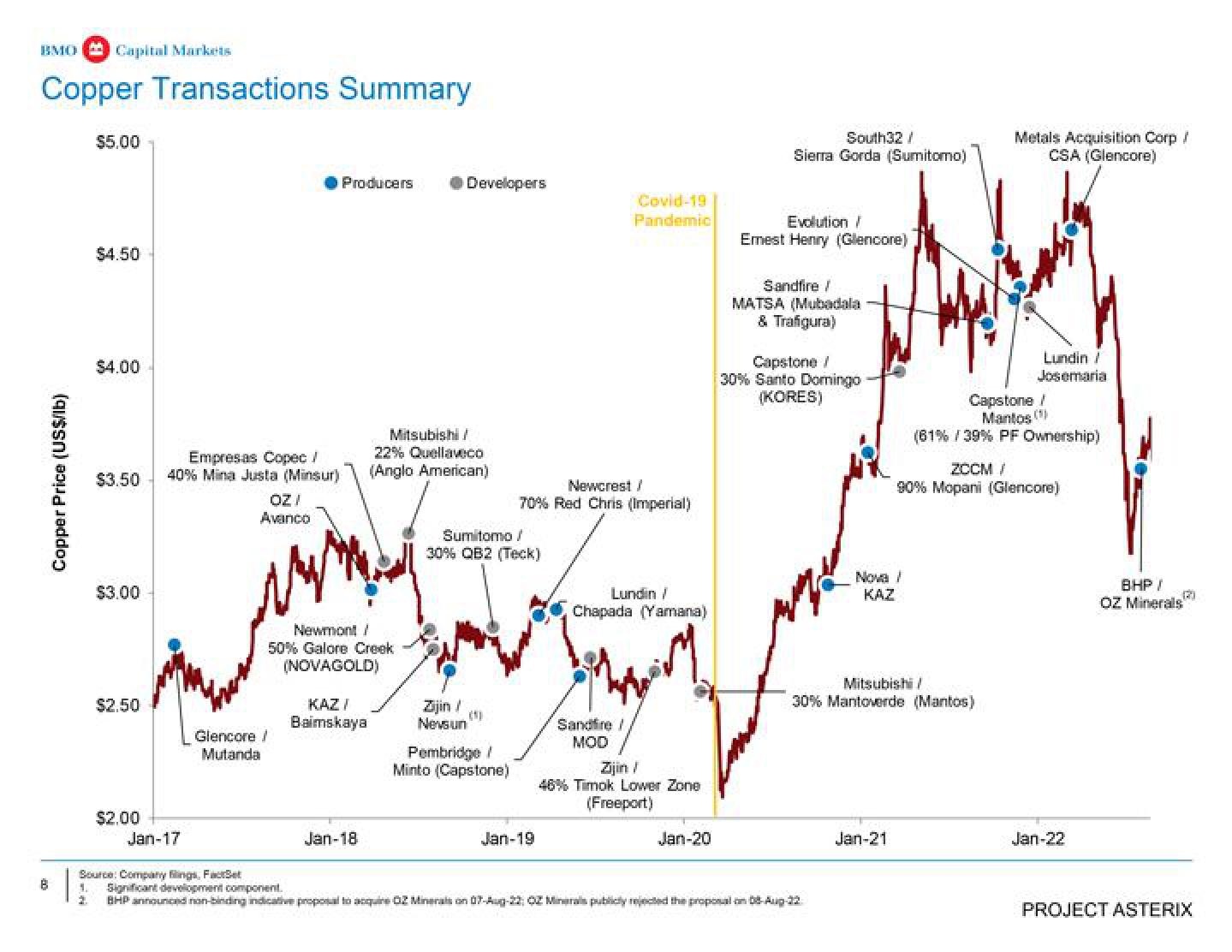

Copper Transactions Summary

8

Copper Price (US$/lb)

$5,00

$4.50

$4.00

$3.50

$3.00

$2.50

$2.00

Empresas Copec /

40% Mina Justa (Minsur)

Jan-17

OZI

Avanco

Glencore /

Mutanda

Producers

Newmont /

50% Galore Creek

(NOVAGOLD)

KAZ/

Baimskaya

Jan-18

Mitsubishi/

22% Quellaveco

(Anglo American)

Developers

Zijin /

Nevsun

Sumitomo /

30% QB2 (Teck)

Pembridge /

Minto (Capstone)

Newcrest /

70% Red Chris (Imperial)

Jan-19

Covid-19

Pandemic

Lundin /

Chapada (Yamana)

Sandfire /

MOD

Zijin /

46% Timok Lower Zone

(Freeport)

Jan-20

South32/

Sierra Gorda (Sumitomo)

Evolution /

Emest Henry (Glencore)

Sandfire /

MATSA (Mubadala

& Trafigura)

Capstone /

30% Santo Domingo

(KORES)

Source: Companyings, FactSet

1. Significant development component.

2.

BHP announced non-binding indicative proposal to acquire 02 Minerals on 07-Aug-22; 02 Minerals publicly rejected the proposal on 08-Aug-32

Nova /

KAZ

Mitsubishi/

30% Mantoverde (Mantos)

Jan-21

Metals Acquisition Corp /

CSA (Glencore)

Lundin /

Josemaria

Capstone /

Mantos (1)

(61% / 39% PF Ownership)

ZCCM /

90% Mopani (Glencore)

Jan-22

BHP /

OZ Minerals

PROJECT ASTERIXView entire presentation