Cboe Results Presentation Deck

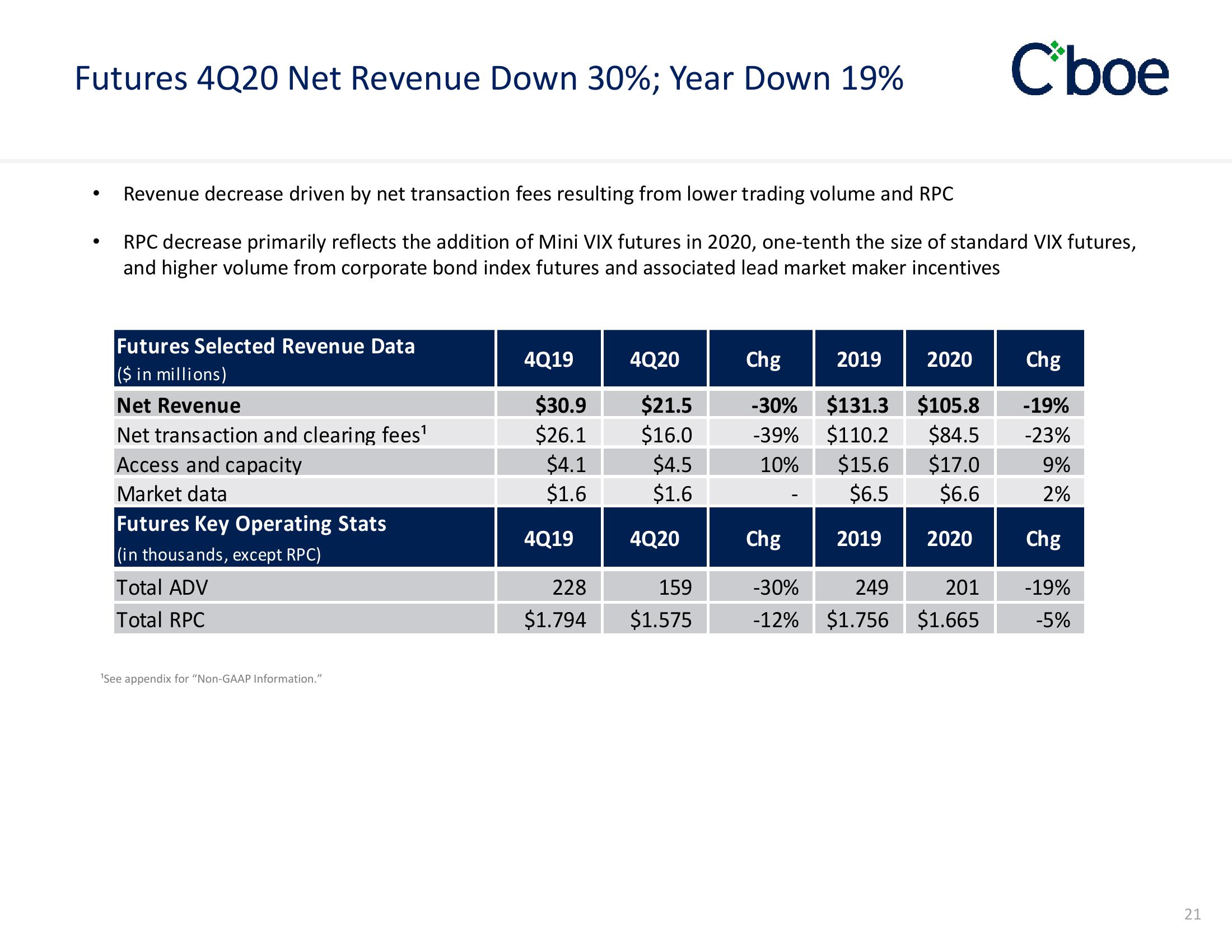

Futures 4Q20 Net Revenue Down 30%; Year Down 19%

●

●

Revenue decrease driven by net transaction fees resulting from lower trading volume and RPC

RPC decrease primarily reflects the addition of Mini VIX futures in 2020, one-tenth the size of standard VIX futures,

and higher volume from corporate bond index futures and associated lead market maker incentives

Futures Selected Revenue Data

($ in millions)

Net Revenue

Net transaction and clearing fees¹

Access and capacity

Market data

Futures Key Operating Stats

(in thousands, except RPC)

Total ADV

Total RPC

¹See appendix for "Non-GAAP Information."

4Q19

$30.9

$26.1

$4.1

$1.6

4Q19

228

$1.794

4Q20

$21.5

$16.0

$4.5

$1.6

4Q20

159

$1.575

Chg 2019

-30% $131.3

-39% $110.2

10%

$15.6

$6.5

Chg

2019

C'boe

2020 Chg

$105.8

$84.5

$17.0

$6.6

2020

-19%

-23%

9%

2%

Chg

-30%

249

201

-19%

-12% $1.756 $1.665 -5%

21View entire presentation