Forbes SPAC Presentation Deck

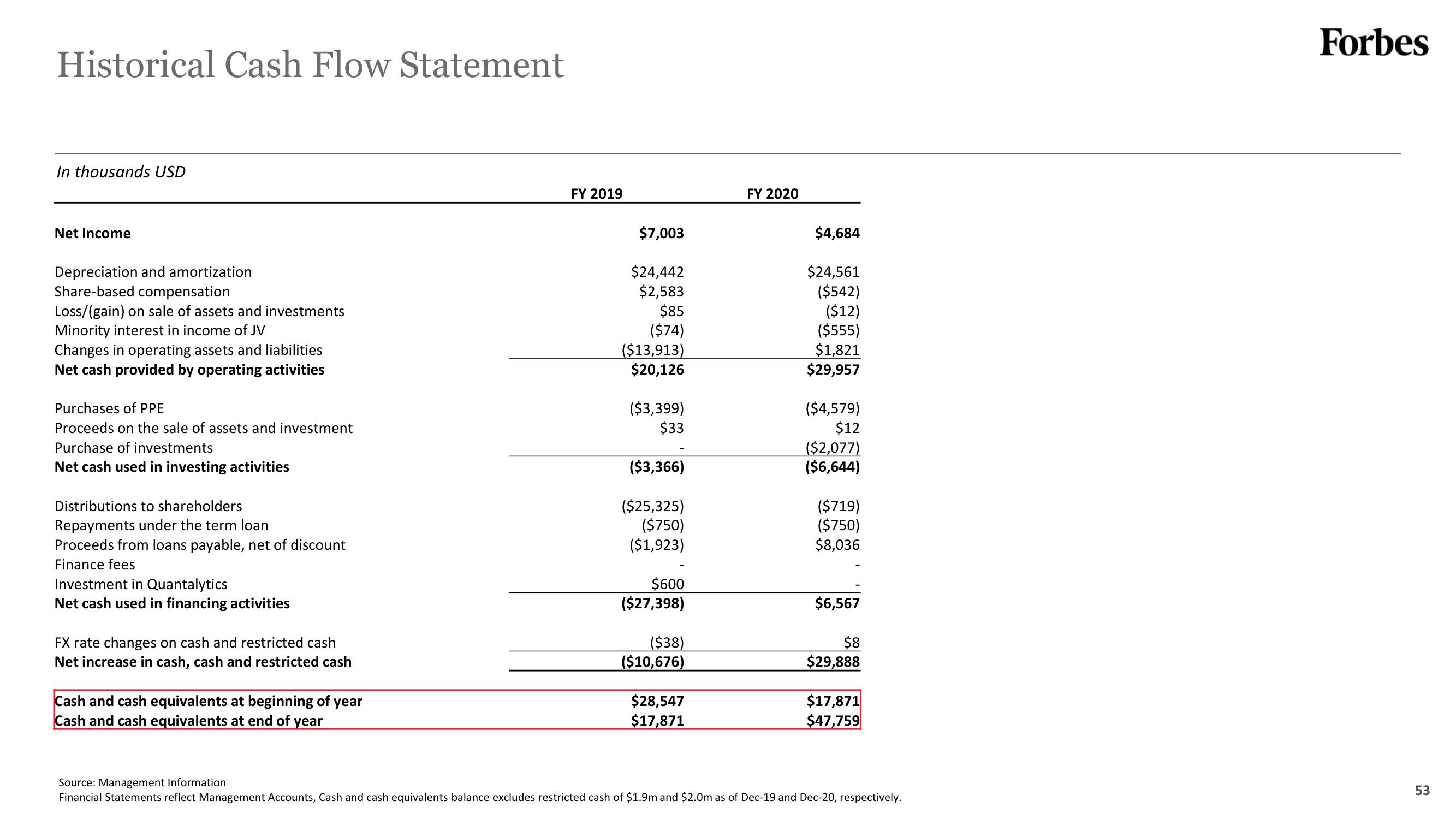

Historical Cash Flow Statement

In thousands USD

Net Income

Depreciation and amortization

Share-based compensation

Loss/(gain) on sale of assets and investments

Minority interest in income of JV

Changes in operating assets and liabilities

Net cash provided by operating activities

Purchases of PPE

Proceeds on the sale of assets and investment

Purchase of investments

Net cash used in investing activities

Distributions to shareholders

Repayments under the term loan

Proceeds from loans payable, net of discount

Finance fees

Investment in Quantalytics

Net cash used in financing activities

FX rate changes on cash and restricted cash

Net increase in cash, cash and restricted cash

Cash and cash equivalents at beginning of year

Cash and cash equivalents at end of year

FY 2019

$7,003

$24,442

$2,583

$85

($74)

($13,913)

$20,126

($3,399)

$33

($3,366)

($25,325)

($750)

($1,923)

$600

($27,398)

($38)

($10,676)

$28,547

$17,871

FY 2020

$4,684

$24,561

($542)

($12)

($555)

$1,821

$29,957

($4,579)

$12

($2,077)

($6,644)

($719)

($750)

$8,036

$6,567

$8

$29,888

$17,871

$47,759

Source: Management Information

Financial Statements reflect Management Accounts, Cash and cash equivalents balance excludes restricted cash of $1.9m and $2.0m as of Dec-19 and Dec-20, respectively.

Forbes

53View entire presentation