Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (cont'd)

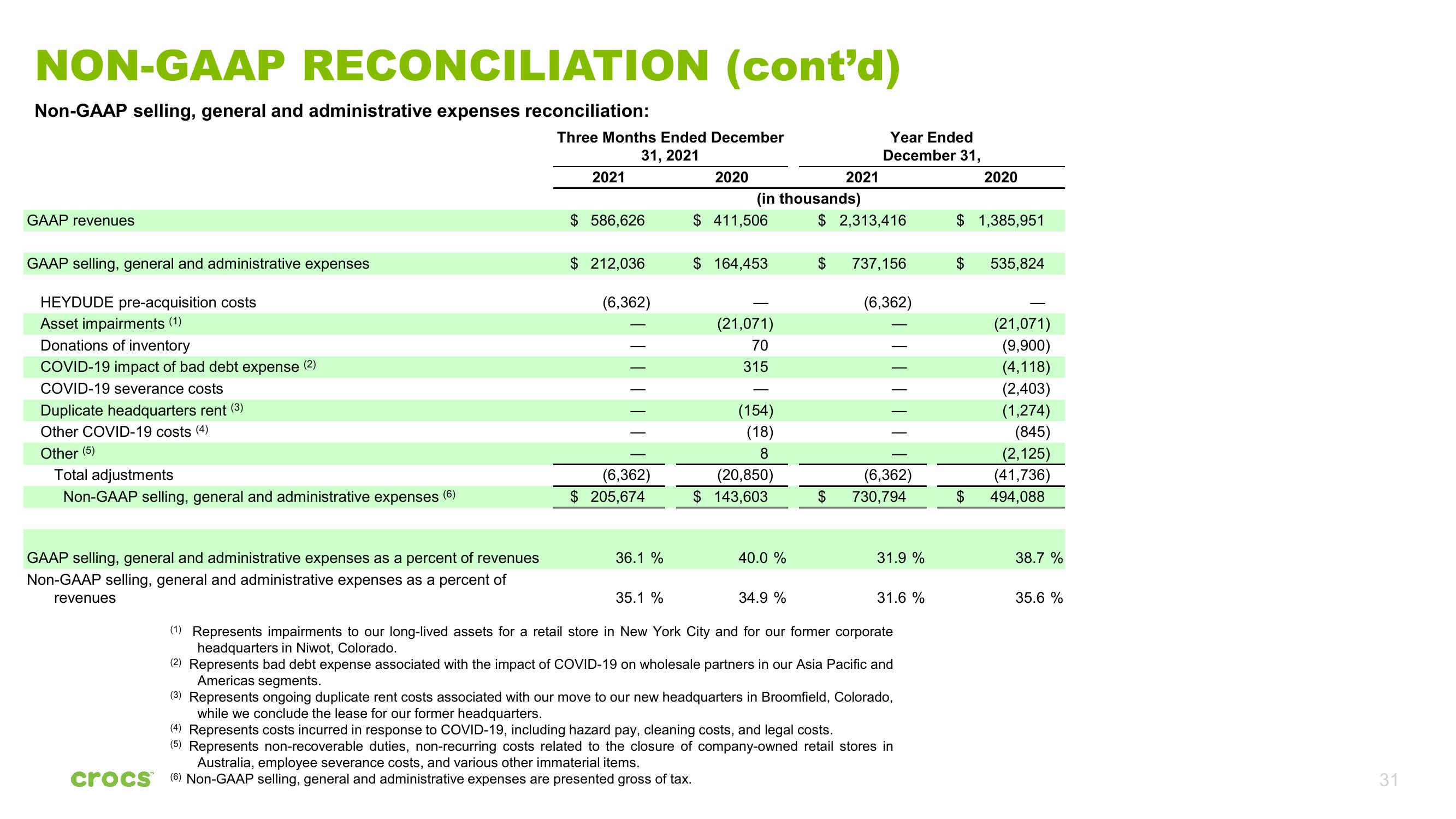

Non-GAAP selling, general and administrative expenses reconciliation:

GAAP revenues

GAAP selling, general and administrative expenses

HEYDUDE pre-acquisition costs

Asset impairments (1)

Donations of inventory

COVID-19 impact of bad debt expense (2)

COVID-19 severance costs

Duplicate headquarters rent (3)

Other COVID-19 costs (4)

Other (5)

Total adjustments

Non-GAAP selling, general and administrative expenses (6)

GAAP selling, general and administrative expenses as a percent of revenues

Non-GAAP selling, general and administrative expenses as a percent of

revenues

Three Months Ended December

31, 2021

2021

$ 586,626

$ 212,036

(6,362)

(6,362)

$ 205,674

36.1 %

35.1 %

2020

crocs (6) Non-GAAP selling, general and administrative expenses are presented gross of tax.

(in thousands)

$ 411,506

$164,453

(21,071)

70

315

(154)

(18)

8

(20,850)

$ 143,603

40.0 %

2021

34.9 %

Year Ended

December 31,

$ 2,313,416

737,156

(6,362)

(6,362)

$ 730,794

31.9 %

31.6 %

(1) Represents impairments to our long-lived assets for a retail store in New York City and for our former corporate

headquarters in Niwot, Colorado.

(2) Represents bad debt expense associated with the impact of COVID-19 on wholesale partners in our Asia Pacific and

Americas segments.

(3) Represents ongoing duplicate rent costs associated with our move to our new headquarters in Broomfield, Colorado,

while we conclude the lease for our former headquarters.

(4) Represents costs incurred in response to COVID-19, including hazard pay, cleaning costs, and legal costs.

(5) Represents non-recoverable duties, non-recurring costs related to the closure of company-owned retail stores in

Australia, employee severance costs, and various other immaterial items.

$ 1,385,951

$

2020

$

535,824

(21,071)

(9,900)

(4,118)

(2,403)

(1,274)

(845)

(2,125)

(41,736)

494,088

38.7 %

35.6 %

31View entire presentation