GlobalFoundries Results Presentation Deck

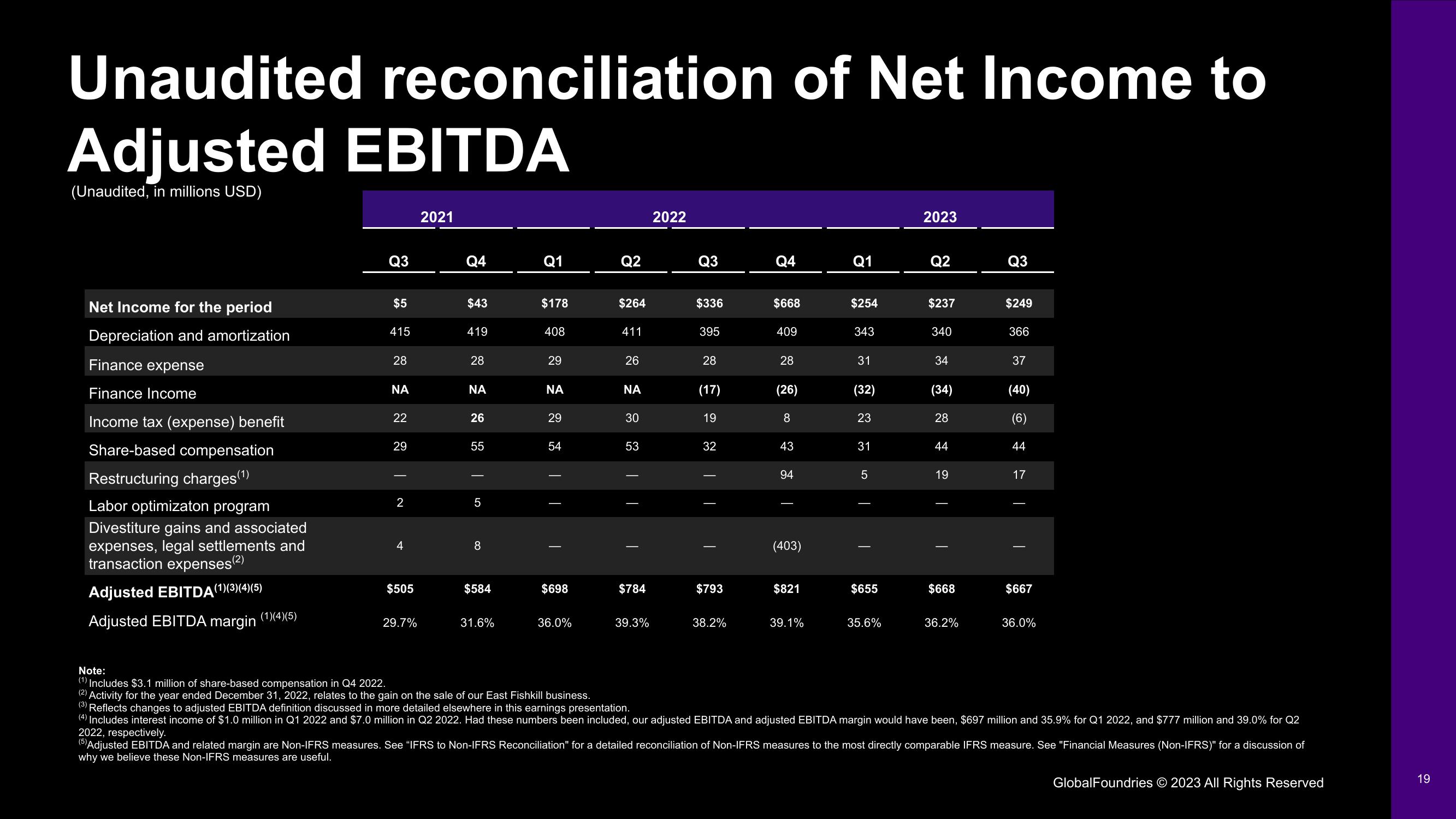

Unaudited reconciliation of Net Income to

Adjusted EBITDA

(Unaudited, in millions USD)

Net Income for the period

Depreciation and amortization

Finance expense

Finance Income

Income tax (expense) benefit

Share-based compensation

Restructuring charges (¹)

Labor optimizaton program

Divestiture gains and associated

expenses, legal settlements and

transaction expenses(²)

Adjusted EBITDA (1)(3)(4) (5)

Adjusted EBITDA margin

(1)(4)(5)

Q3

$5

415

28

ΝΑ

22

29

T

2

4

$505

29.7%

2021

Q4

$43

419

28

ΝΑ

26

55

5

8

$584

31.6%

Q1

$178

408

29

ΝΑ

29

54

$698

36.0%

Note:

(1) Includes $3.1 million of share-based compensation in Q4 2022.

(2) Activity for the year ended December 31, 2022, relates to the gain on the sale of our East Fishkill business.

Q2

$264

411

26

ΝΑ

30

53

I

$784

39.3%

2022

Q3

$336

395

28

(17)

19

32

$793

38.2%

Q4

$668

409

28

(26)

8

43

94

T

(403)

$821

39.1%

Q1

$254

343

31

(32)

23

31

5

$655

35.6%

2023

Q2

$237

340

34

(34)

28

44

19

$668

36.2%

Q3

$249

366

37

(40)

(6)

44

17

$667

36.0%

(3) Reflects changes to adjusted EBITDA definition discussed in more detailed elsewhere in this earnings presentation.

(4) Includes interest income of $1.0 million in Q1 2022 and $7.0 million in Q2 2022. Had these numbers been included, our adjusted EBITDA and adjusted EBITDA margin would have been, $697 million and 35.9% for Q1 2022, and $777 million and 39.0% for Q2

2022, respectively.

(5) Adjusted EBITDA and related margin are Non-IFRS measures. See "IFRS to Non-IFRS Reconciliation" for a detailed reconciliation of Non-IFRS measures to the most directly comparable IFRS measure. See "Financial Measures (Non-IFRS)" for a discussion of

why we believe these Non-IFRS measures are useful.

GlobalFoundries © 2023 All Rights Reserved

19View entire presentation