Lumen Results Presentation Deck

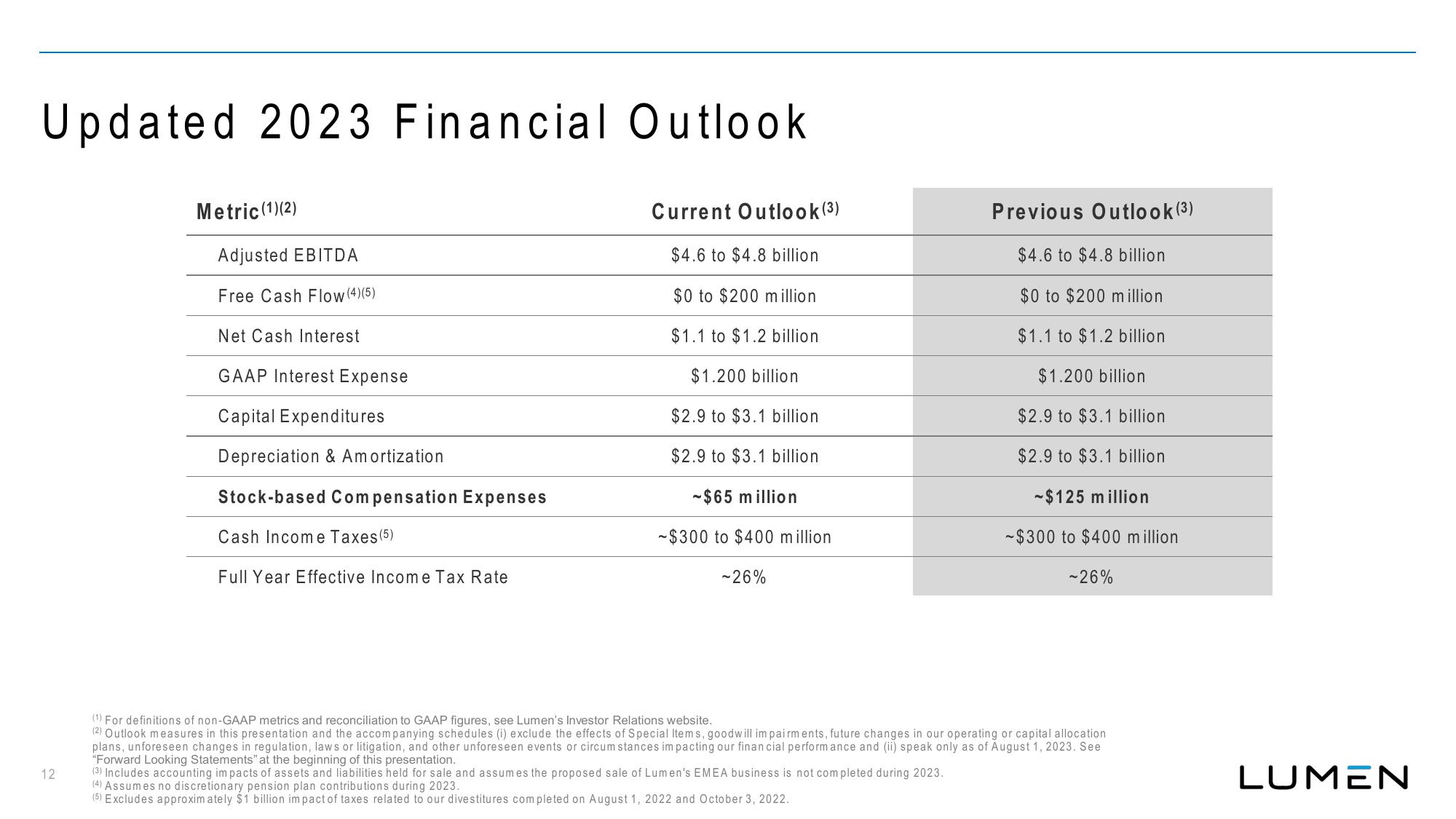

Updated 2023 Financial Outlook

12

Metric (1)(2)

Adjusted EBITDA

Free Cash Flow (4)(5)

Net Cash Interest

GAAP Interest Expense

Capital Expenditures

Depreciation & Amortization

Stock-based Compensation Expenses

Cash Income Taxes (5)

Full Year Effective Income Tax Rate

Current Outlook (3)

$4.6 to $4.8 billion.

$0 to $200 million

$1.1 to $1.2 billion

$1.200 billion

$2.9 to $3.1 billion.

$2.9 to $3.1 billion.

-$65 million

-$300 to $400 million

-26%

Previous Outlook (³)

$4.6 to $4.8 billion

$0 to $200 million

$1.1 to $1.2 billion

$1.200 billion

$2.9 to $3.1 billion

$2.9 to $3.1 billion

-$125 million

-$300 to $400 million

(3) Includes accounting impacts of assets and liabilities held for sale and assumes the proposed sale of Lumen's EMEA business is not completed during 2023.

(4) Assumes no discretionary pension plan contributions during 2023.

(5) Excludes approximately $1 billion impact of taxes related to our divestitures completed on August 1, 2022 and October 3, 2022.

-26%

(1) For definitions of non-GAAP metrics and reconciliation to GAAP figures, see Lumen's Investor Relations website.

(2) Outlook measures in this presentation and the accompanying schedules (i) exclude the effects of Special Items, goodwill impairments, future changes in our operating or capital allocation

plans, unforeseen changes in regulation, laws or litigation, and other unforeseen events or circumstances im pacting our financial performance and (ii) speak only as of August 1, 2023. See

"Forward Looking Statements" at the beginning of this presentation.

LUMENView entire presentation