Sportradar IPO Presentation Deck

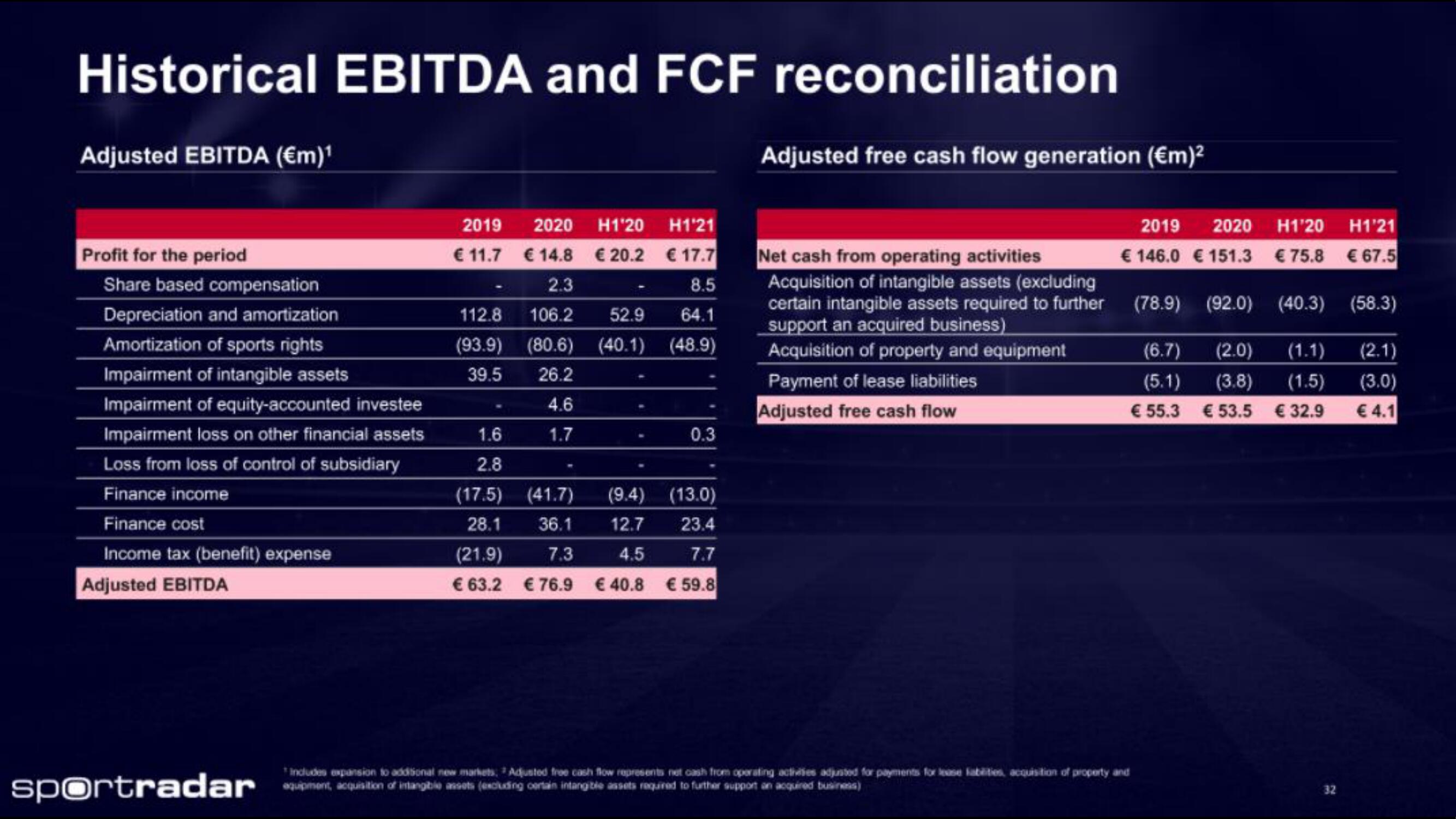

Historical EBITDA and FCF reconciliation

Adjusted EBITDA (€m)¹

Profit for the period

Share based compensation

Depreciation and amortization

Amortization of sports rights

Impairment of intangible assets

Impairment of equity-accounted investee

Impairment loss on other financial assets

Loss from loss of control of subsidiary

Finance income

Finance cost

Income tax (benefit) expense

Adjusted EBITDA

sportradar

2019 2020 H1120 H121

€ 11.7 € 14.8 € 20.2 €17.7

2.3

8.5

112.8 106.2 52.9 64.1

(93.9) (80.6) (40.1) (48.9)

26.2

4.6

39.5

1.7

1.6

2.8

0.3

(9.4) (13.0)

(17.5)

28.1

(21.9)

(41.7)

36.1 12.7 23.4

4.5

7.3

€ 63.2 € 76.9 € 40.8

7.7

€59.8

Adjusted free cash flow generation (€m)²

Net cash from operating activities

Acquisition of intangible assets (excluding

certain intangible assets required to further

support an acquired business)

Acquisition of property and equipment

Payment of lease liabilities

Adjusted free cash flow

2019 2020 H1'20 H121

€ 146.0 €151.3 €75.8 €67.5

Includes expansion to additional new markets: Adjusted free cash flow represents net cash from operating activities adjusted for payments for lease labilities, acquisition of property and

equipment, acquisition of intangible assets (excluding certain intangible assets required to further support an acquired business)

(78.9) (92.0) (40.3) (58.3)

(2.1)

(3.0)

€ 4.1

(6.7) (2.0) (1.1)

(5.1) (3.8) (1.5)

€55.3 € 53.5 € 32.9

32View entire presentation