NioCorp SPAC Presentation Deck

Scandium

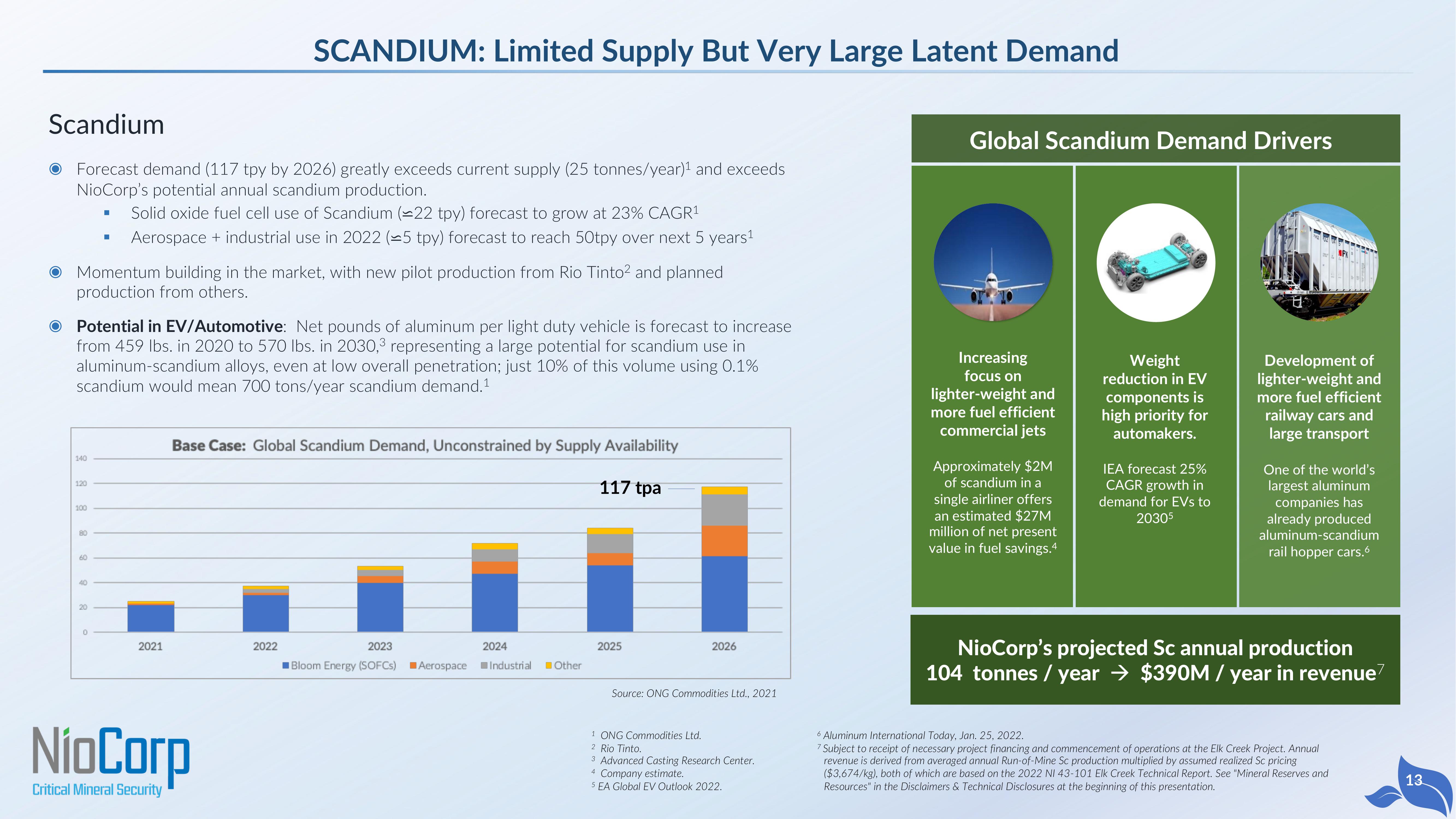

Forecast demand (117 tpy by 2026) greatly exceeds current supply (25 tonnes/year)¹ and exceeds

NioCorp's potential annual scandium production.

■

Solid oxide fuel cell use of Scandium (~22 tpy) forecast to grow at 23% CAGR¹

Aerospace + industrial use in 2022 (-5 tpy) forecast to reach 50tpy over next 5 years¹

Momentum building in the market, with new pilot production from Rio Tinto² and planned

production from others.

140

O Potential in EV/Automotive: Net pounds of aluminum per light duty vehicle is forecast to increase

from 459 lbs. in 2020 to 570 lbs. in 2030,³ representing a large potential for scandium use in

aluminum-scandium alloys, even at low overall penetration; just 10% of this volume using 0.1%

scandium would mean 700 tons/year scandium demand.¹

120

100

80

60

40

I

20

0

SCANDIUM: Limited Supply But Very Large Latent Demand

2021

Base Case: Global Scandium Demand, Unconstrained by Supply Availability

117 tpa

NioCorp

Critical Mineral Security

2022

2023

Bloom Energy (SOFCs) Aerospace Industrial Other

2024

2025

2026

Source: ONG Commodities Ltd., 2021

1 ONG Commodities Ltd.

2 Rio Tinto.

3 Advanced Casting Research Center.

4 Company estimate.

SEA Global EV Outlook 2022.

Global Scandium Demand Drivers

Increasing

focus on

lighter-weight and

more fuel efficient

commercial jets

Approximately $2M

of scandium in a

single airliner offers

an estimated $27M

million of net present

value in fuel savings.4

Weight

reduction in EV

components is

high priority for

automakers.

IEA forecast 25%

CAGR growth in

demand for EVs to

20305

H

Development of

lighter-weight and

more fuel efficient

railway cars and

large transport

One of the world's

largest aluminum

companies has

already produced

aluminum-scandium

rail hopper cars.6

NioCorp's projected Sc annual production

104 tonnes / year → $390M / year in revenue

6 Aluminum International Today, Jan. 25, 2022.

7 Subject to receipt of necessary project financing and commencement of operations at the Elk Creek Project. Annual

revenue is derived from averaged annual Run-of-Mine Sc production multiplied by assumed realized Sc pricing

($3,674/kg), both of which are based on the 2022 NI 43-101 Elk Creek Technical Report. See "Mineral Reserves and

Resources" in the Disclaimers & Technical Disclosures at the beginning of this presentation.

13View entire presentation