Trian Partners Activist Presentation Deck

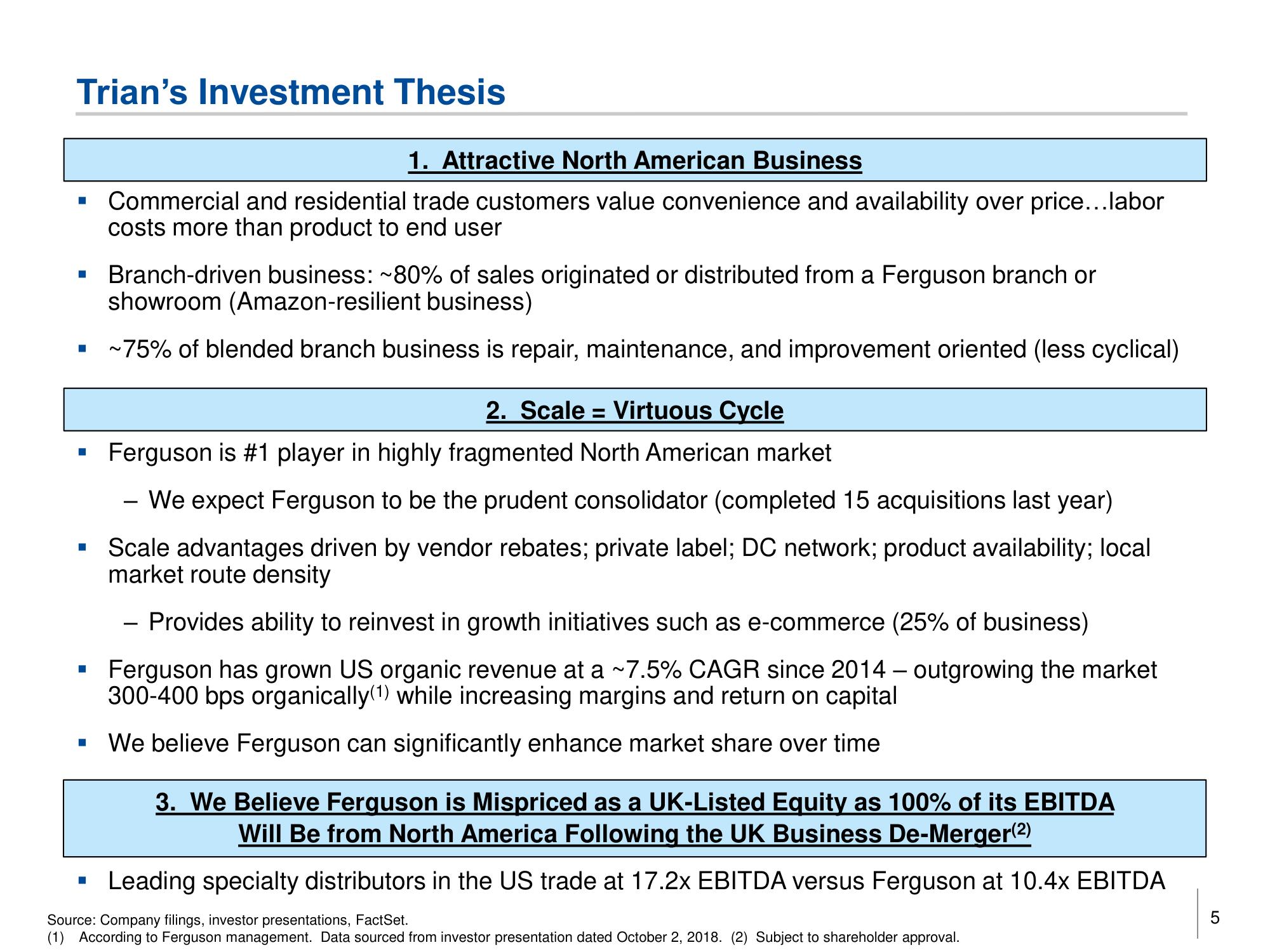

Trian's Investment Thesis

■

■

■

2. Scale = Virtuous Cycle

Ferguson is #1 player in highly fragmented North American market

We expect Ferguson to be the prudent consolidator (completed 15 acquisitions last year)

Scale advantages driven by vendor rebates; private label; DC network; product availability; local

market route density

- Provides ability to reinvest in growth initiatives such as e-commerce (25% of business)

Ferguson has grown US organic revenue at a ~7.5% CAGR since 2014 - outgrowing the market

300-400 bps organically (1) while increasing margins and return on capital

▪ We believe Ferguson can significantly enhance market share over time

■

■

1. Attractive North American Business

Commercial and residential trade customers value convenience and availability over price...labor

costs more than product to end user

Branch-driven business: ~80% of sales originated or distributed from a Ferguson branch or

showroom (Amazon-resilient business)

~75% of blended branch business is repair, maintenance, and improvement oriented (less cyclical)

■

-

3. We Believe Ferguson is Mispriced as a UK-Listed Equity as 100% of its EBITDA

Will Be from North America Following the UK Business De-Merger(²)

Leading specialty distributors in the US trade at 17.2x EBITDA versus Ferguson at 10.4x EBITDA

Source: Company filings, investor presentations, FactSet.

(1) According to Ferguson management. Data sourced from investor presentation dated October 2, 2018. (2) Subject to shareholder approval.

LOView entire presentation