Wallbox SPAC Presentation Deck

WALLBOX¹

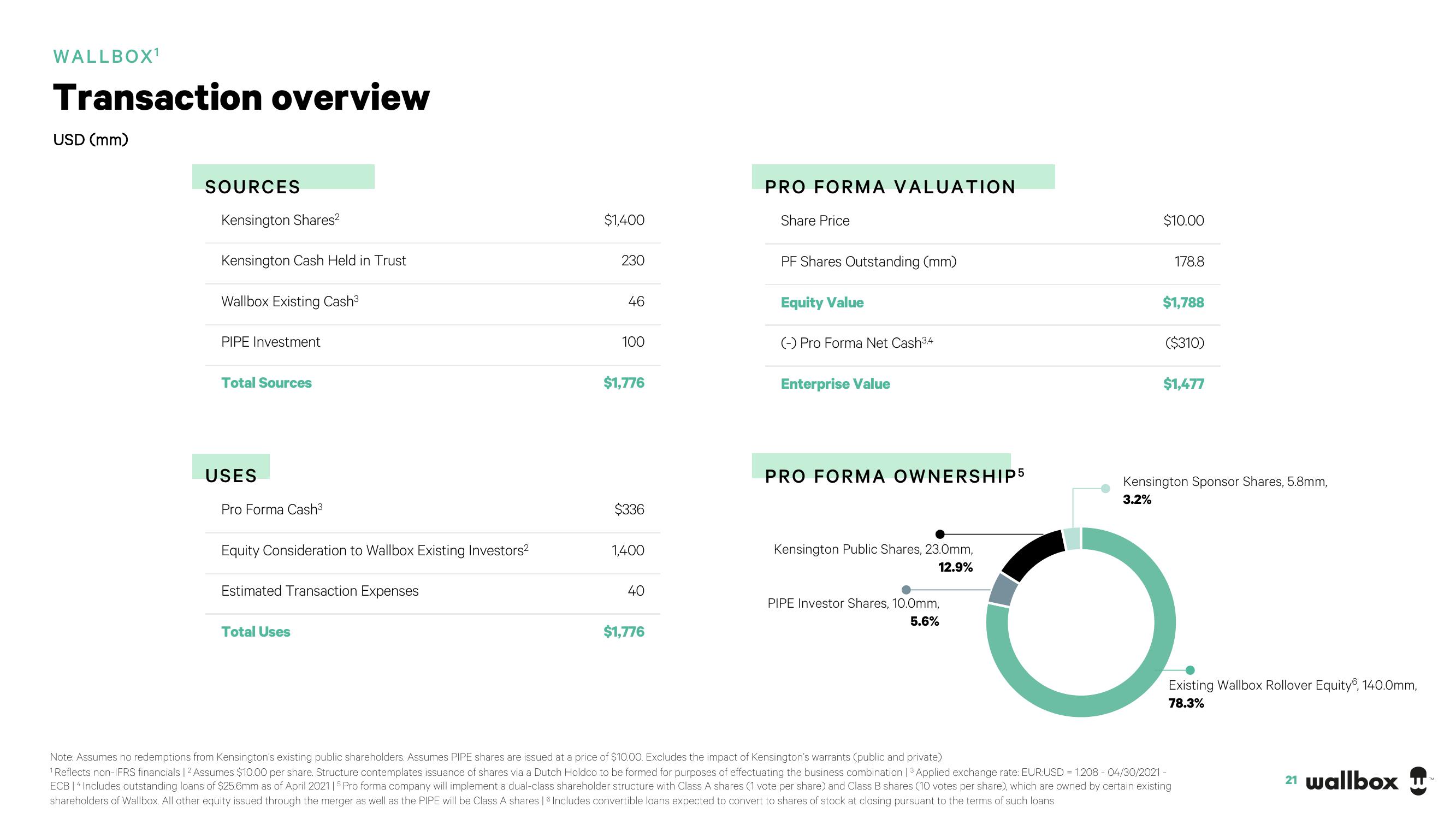

Transaction overview

USD (mm)

SOURCES

Kensington Shares²

Kensington Cash Held in Trust

Wallbox Existing Cash³

PIPE Investment

Total Sources

USES

Pro Forma Cash³

Equity Consideration to Wallbox Existing Investors²

Estimated Transaction Expenses

Total Uses

$1,400

230

46

100

$1,776

$336

1,400

40

$1,776

PRO FORMA VALUATION

Share Price

PF Shares Outstanding (mm)

Equity Value

(-) Pro Forma Net Cash³,4

Enterprise Value

PRO FORMA OWNERSHIP5

Kensington Public Shares, 23.0mm,

12.9%

PIPE Investor Shares, 10.0mm,

5.6%

$10.00

$1,788

178.8

($310)

$1,477

O

Kensington Sponsor Shares, 5.8mm,

3.2%

Existing Wallbox Rollover Equity, 140.0mm,

78.3%

Note: Assumes no redemptions from Kensington's existing public shareholders. Assumes PIPE shares are issued at a price of $10.00. Excludes the impact of Kensington's warrants (public and private)

¹ Reflects non-IFRS financials | 2 Assumes $10.00 per share. Structure contemplates issuance of shares via a Dutch Holdco to be formed for purposes of effectuating the business combination | 3 Applied exchange rate: EUR:USD = 1.208 - 04/30/2021 -

ECB 14 Includes outstanding loans of $25.6mm as of April 2021 | 5 Pro forma company will implement a dual-class shareholder structure with Class A shares (1 vote per share) and Class B shares (10 votes per share), which are owned by certain existing

shareholders of Wallbox. All other equity issued through the merger as well as the PIPE will be Class A shares | Includes convertible loans expected to convert to shares of stock at closing pursuant to the terms of such loans

21 wallbox

TMView entire presentation