Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Income

£0.9bn

Q420: £0.8bn

Cost: income

ratio

72%

Q420: 65%

Loan loss rate

105bps

Q420: 286bps

PERFORMANCE

ROTE

11.7%

Q420: 2.7%

Costs

£0.6bn

Q420: £0.6bn

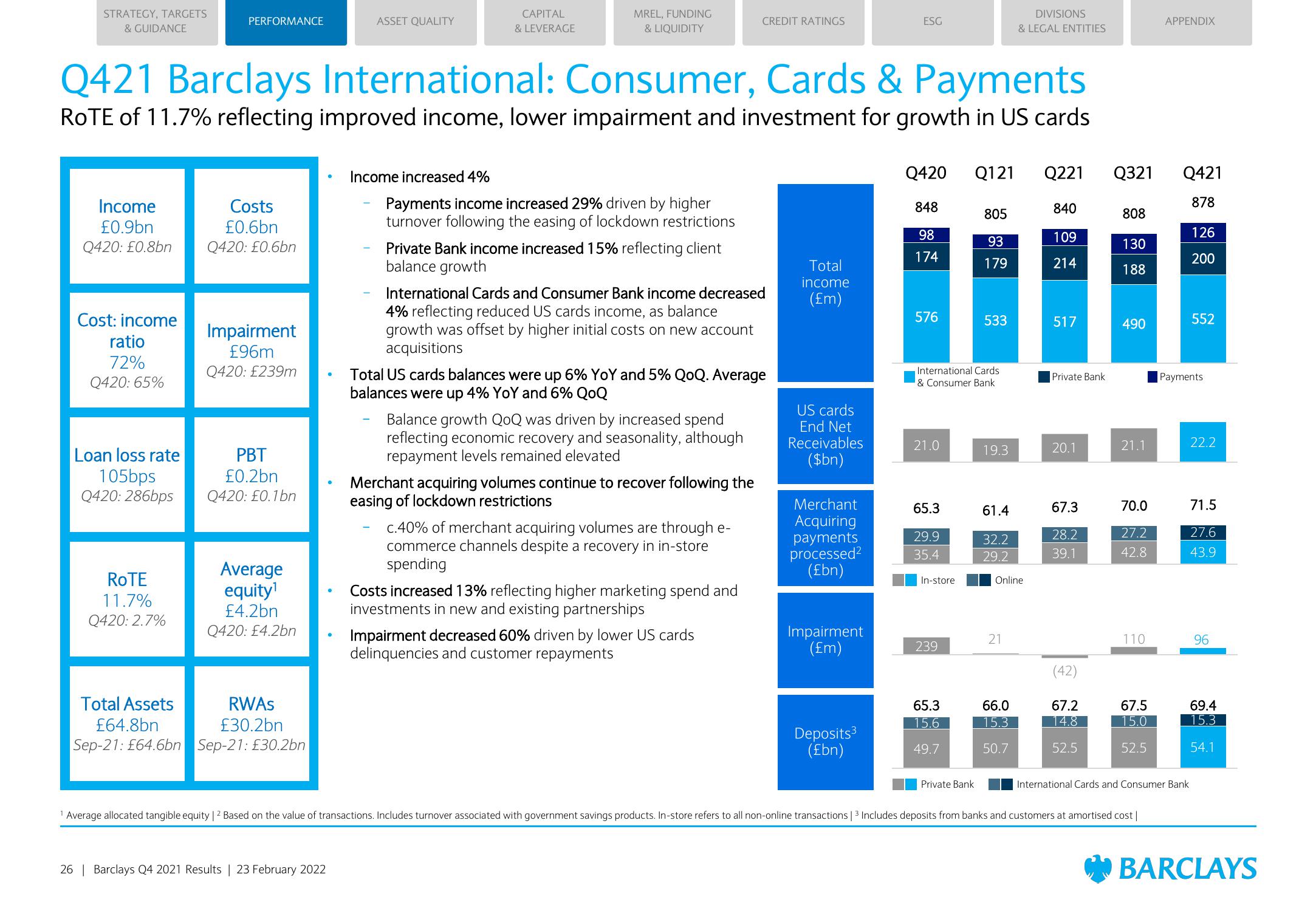

Q421 Barclays International: Consumer, Cards & Payments

ROTE of 11.7% reflecting improved income, lower impairment and investment for growth in US cards

Impairment

£96m

Q420: £239m

PBT

£0.2bn

Q420: £0.1bn

Average

equity¹

£4.2bn

Q420: £4.2bn

Total Assets

RWAS

£30.2bn

£64.8bn

Sep-21: £64.6bn Sep-21: £30.2bn

ASSET QUALITY

●

26 | Barclays Q4 2021 Results | 23 February 2022

CAPITAL

& LEVERAGE

Income increased 4%

MREL, FUNDING

& LIQUIDITY

Payments income increased 29% driven by higher

turnover following the easing of lockdown restrictions

Private Bank income increased 15% reflecting client

balance growth

International Cards and Consumer Bank income decreased

4% reflecting reduced US cards income, as balance

growth was offset by higher initial costs on new account

acquisitions

Total US cards balances were up 6% YoY and 5% QoQ. Average

balances were up 4% YoY and 6% QoQ

Balance growth QoQ was driven by increased spend

reflecting economic recovery and seasonality, although

repayment levels remained elevated

Merchant acquiring volumes continue to recover following the

easing of lockdown restrictions

CREDIT RATINGS

c.40% of merchant acquiring volumes are through e-

commerce channels despite a recovery in in-store

spending

Costs increased 13% reflecting higher marketing spend and

investments in new and existing partnerships

Impairment decreased 60% driven by lower US cards

delinquencies and customer repayments

Total

income

(£m)

US cards

End Net

Receivables

($bn)

Merchant

Acquiring

payments

processed²

(£bn)

Impairment

(£m)

ESG

Deposits ³

(£bn)

Q420

848

98

174

576

21.0

65.3

29.9

35.4

International Cards

& Consumer Bank

In-store

239

65.3

15.6

49.7

Private Bank

Q121 Q221

805

93

179

533

19.3

61.4

32.2

29.2

DIVISIONS

& LEGAL ENTITIES

Online

21

66.0

15.3

50.7

840

109

214

517

Private Bank

20.1

67.3

28.2

39.1

(42)

67.2

14.8

52.5

Q321

808

130

188

490

21.1

70.0

27.2

42.8

110

67.5

15.0

52.5

Average allocated tangible equity | ² Based on the value of transactions. Includes turnover associated with government savings products. In-store refers to all non-online transactions | 3 Includes deposits from banks and customers at amortised cost |

APPENDIX

Q421

878

International Cards and Consumer Bank

126

200

552

Payments

22.2

71.5

27.6

43.9

96

69.4

15.3

54.1

BARCLAYSView entire presentation