HBT Financial Results Presentation Deck

Loan Portfolio Overview: Selected Portfolios

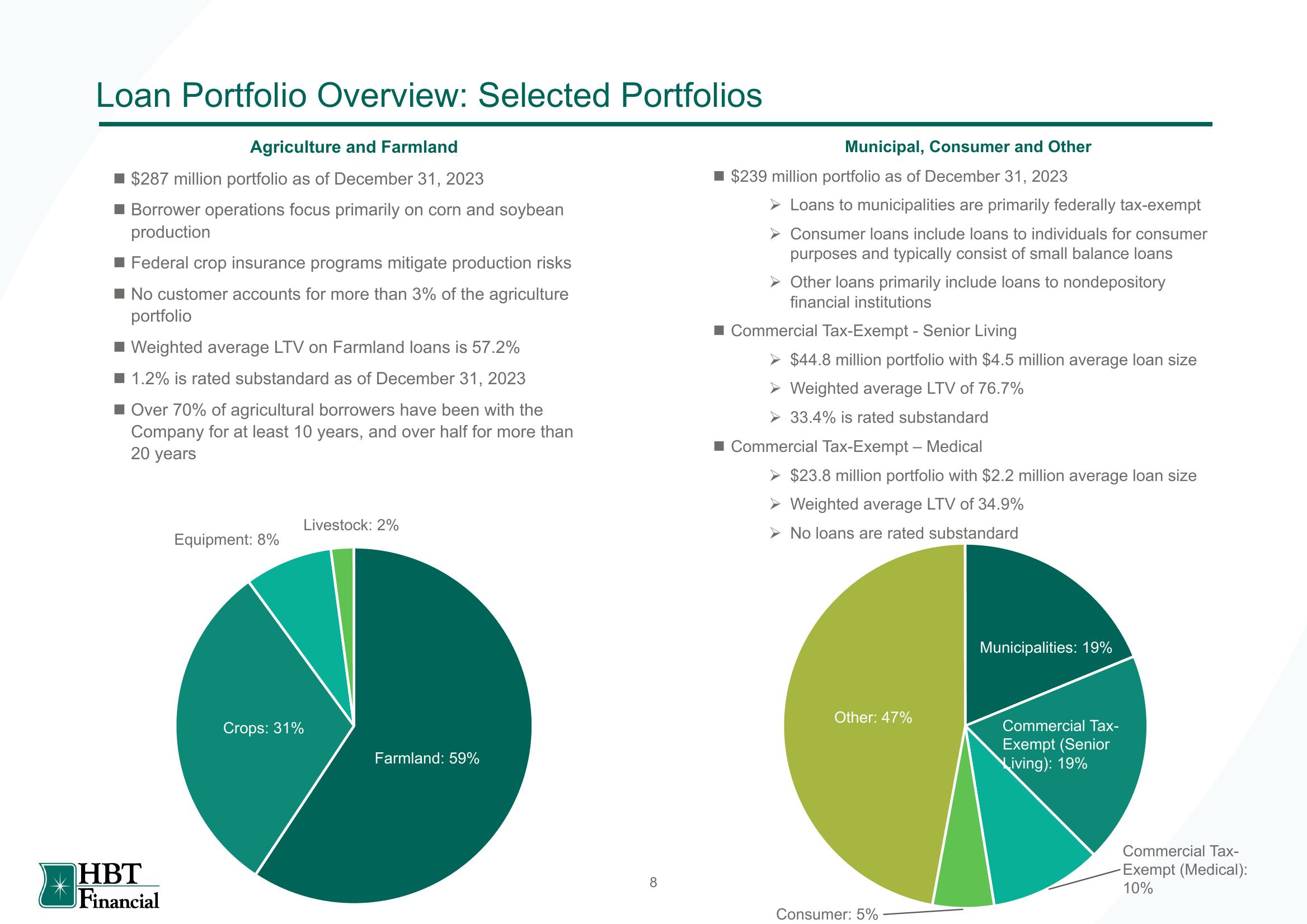

Agriculture and Farmland

$287 million portfolio as of December 31, 2023

■ Borrower operations focus primarily on corn and soybean

production

■ Federal crop insurance programs mitigate production risks

No customer accounts for more than 3% of the agriculture

portfolio

■ Weighted average LTV on Farmland loans is 57.2%

1.2% is rated substandard as of December 31, 2023

Over 70% of agricultural borrowers have been with the

Company for at least 10 years, and over half for more than

20 years

HBT

Financial

Equipment: 8%

Crops: 31%

Livestock: 2%

Farmland: 59%

8

Municipal, Consumer and Other

$239 million portfolio as of December 31, 2023

> Loans to municipalities are primarily federally tax-exempt

Consumer loans include loans to individuals for consumer

purposes and typically consist of small balance loans

Other loans primarily include loans to nondepository

financial institutions

■ Commercial Tax-Exempt - Senior Living

➤ $44.8 million portfolio with $4.5 million average loan size

➤ Weighted average LTV of 76.7%

➤ 33.4% is rated substandard

■ Commercial Tax-Exempt - Medical

► $23.8 million portfolio with $2.2 million average loan size

► Weighted average LTV of 34.9%

➤ No loans are rated substandard

Other: 47%

Consumer: 5%

Municipalities: 19%

Commercial Tax-

Exempt (Senior

Living): 19%

Commercial Tax-

Exempt (Medical):

10%View entire presentation