jetBlue Results Presentation Deck

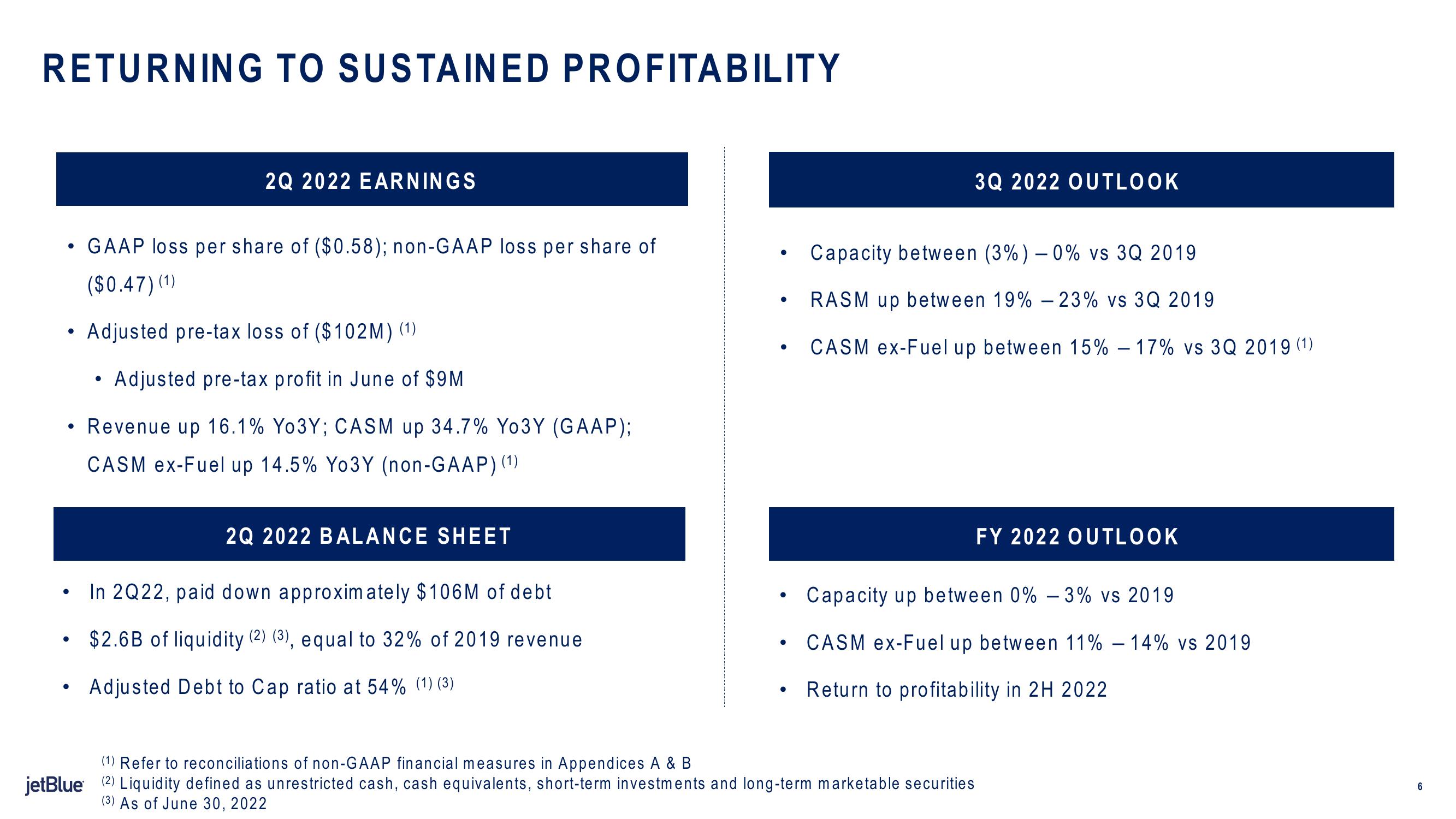

RETURNING TO SUSTAINED PROFITABILITY

●

Adjusted pre-tax loss of ($102M) (1)

Adjusted pre-tax profit in June of $9M

• Revenue up 16.1% Yo3Y; CASM up 34.7% Yo3Y (GAAP);

CASM ex-Fuel up 14.5% Yo3Y (non-GAAP) (¹)

●

●

2Q 2022 EARNINGS

GAAP loss per share of ($0.58); non-GAAP loss per share of

($0.47) (1)

●

2Q 2022 BALANCE SHEET

In 2Q22, paid down approximately $106M of debt

$2.6B of liquidity (2) (3), equal to 32% of 2019 revenue

Adjusted Debt to Cap ratio at 54% (1) (3)

●

●

●

●

●

●

3Q 2022 OUTLOOK

Capacity between (3%) -0% vs 3Q 2019

RASM up between 19% -23% vs 3Q 2019

CASM ex-Fuel up between 15% -17% vs 3Q 2019 (1)

(1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B

jetBlue (2) Liquidity defined as unrestricted cash, cash equivalents, short-term investments and long-term marketable securities

(3) As of June 30, 2022

FY 2022 OUTLOOK

Capacity up between 0% -3% vs 2019.

CASM ex-Fuel up between 11% -14% vs 2019

Return to profitability in 2H 2022

6View entire presentation