Tradeweb Results Presentation Deck

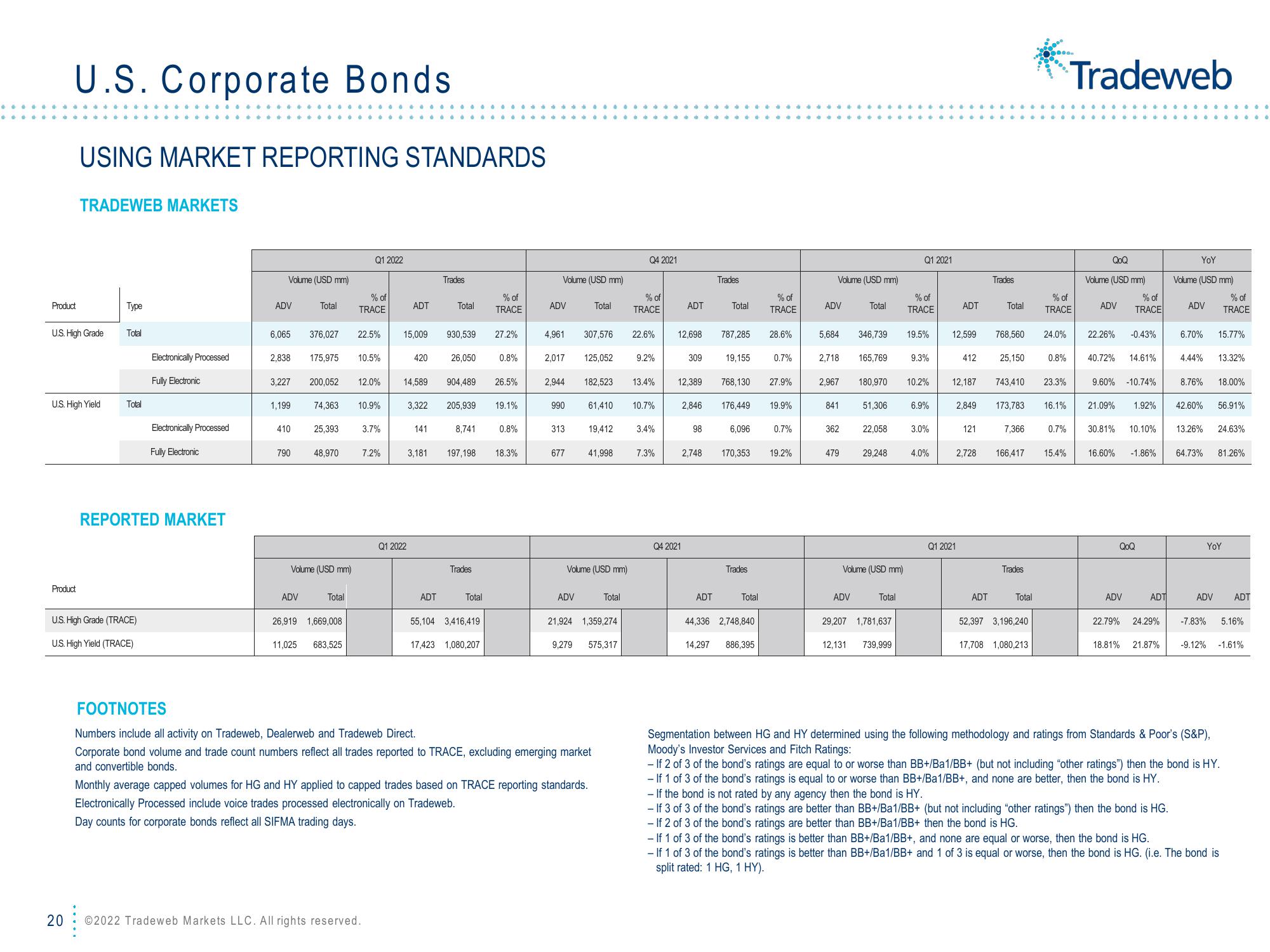

U.S. Corporate Bonds

Product

USING MARKET REPORTING STANDARDS

U.S. High Grade

Product

TRADEWEB MARKETS

U.S. High Yield

20

Type

Total

Total

U.S. High Grade (TRACE)

U.S. High Yield (TRACE)

Electronically Processed

Fully Electronic

Electronically Processed

Fully Electronic

REPORTED MARKET

Volume (USD mm)

ADV

1,199

410

790

Total

ADV

6,065 376,027 22.5% 15,009 930,539 27.2%

2,838 175,975 10.5%

3,227 200,052 12.0%

25,393

74,363 10.9%

48,970

Volume (USD mm)

Total

Q1 2022

% of

TRACE

26,919 1,669,008

11,025 683,525

3.7%

©2022 Tradeweb Markets LLC. All rights reserved.

7.2%

ADT

Q1 2022

420

14,589

Trades

141

Total

ADT

26,050 0.8%

3,322 205,939 19.1%

904,489 26.5%

% of

TRACE

8,741

3,181 197,198 18.3%

Trades

Total

55,104 3,416,419

17,423 1,080,207

0.8%

Volume (USD mm)

ADV

4,961

2,017

2,944

990

313

677

ADV

Total

125,052

307,576 22.6%

182,523

61,410

19,412

41,998

Volume (USD mm)

FOOTNOTES

Numbers include all activity on Tradeweb, Dealerweb and Tradeweb Direct.

Corporate bond volume and trade count numbers reflect all trades reported to TRACE, excluding emerging market

and convertible bonds.

21,924 1,359,274

Monthly average capped volumes for HG and HY applied to capped trades based on TRACE reporting standards.

Electronically Processed include voice trades processed electronically on Tradeweb.

Day counts for corporate bonds reflect all SIFMA trading days.

Total

9,279 575,317

Q4 2021

% of

TRACE

9.2%

10.7%

3.4%

13.4% 12,389

7.3%

ADT

Q4 2021

12,698 787,285

309

Trades

98

Total

ADT

19,155

768,130

6.096

2,846 176,449 19.9%

Trades

Total

% of

TRACE

44,336 2,748,840

28.6%

2,748 170,353 19.2%

14,297 886,395

0.7%

27.9%

0.7%

Volume (USD mm)

ADV

Total

5,684 346,739 19.5%

2,967 180,970

841

2,718 165,769 9.3%

362

51,306

ADV

22,058

479 29,248

Volume (USD mm)

Q1 2021

Total

% of

TRACE

29,207 1,781,637

12,131 739,999

10.2%

6.9%

3.0%

4.0%

ADT

412

Q1 2021

12,599 768,560 24.0%

Trades

Total

121

25,150

12,187 743,410 23.3%

ADT

2,849 173,783 16.1%

7,366

Trades

% of

TRACE

2,728 166,417 15.4%

Total

0.8%

52,397 3,196,240

17,708 1,080,213

0.7%

Tradeweb

QOQ

Volume (USD mm)

ADV

22.26% -0.43%

% of

TRACE

40.72% 14.61%

9.60% -10.74%

QoQ

ADV

ADT

YoY

Volume (USD mm)

21.09% 1.92% 42.60% 56.91%

22.79% 24.29%

% of

ADV TRACE

30.81% 10.10% 13.26% 24.63%

16.60% -1.86% 64.73% 81.26%

6.70% 15.77%

4.44% 13.32%

-If the bond is not rated by any agency then the bond is HY.

- If 3 of 3 of the bond's ratings are better than BB+/Ba1/BB+ (but not including "other ratings") then the bond is HG.

- If 2 of 3 of the bond's ratings are better than BB+/Ba1/BB+ then the bond is HG.

8.76% 18.00%

YOY

ADV ADT

-7.83% 5.16%

18.81% 21.87% -9.12%

-1.61%

Segmentation between HG and HY determined using the following methodology and ratings from Standards & Poor's (S&P),

Moody's Investor Services and Fitch Ratings:

- If 2 of 3 of the bond's ratings are equal to or worse than BB+/Ba1/BB+ (but not including "other ratings") then the bond is HY.

- If 1 of 3 of the bond's ratings is equal to or worse than BB+/Ba1/BB+, and none are better, then the bond is HY.

- If 1 of 3 of the bond's ratings is better than BB+/Ba1/BB+, and none are equal or worse, then the bond is HG.

- If 1 of 3 of the bond's ratings is better than BB+/Ba1/BB+ and 1 of 3 is equal or worse, then the bond is HG. (i.e. The bond is

split rated: 1 HG, 1 HY).View entire presentation