PropertyGuru SPAC Presentation Deck

Pro Forma Revenue(¹) Bridge

I

33

■

US$m

10%

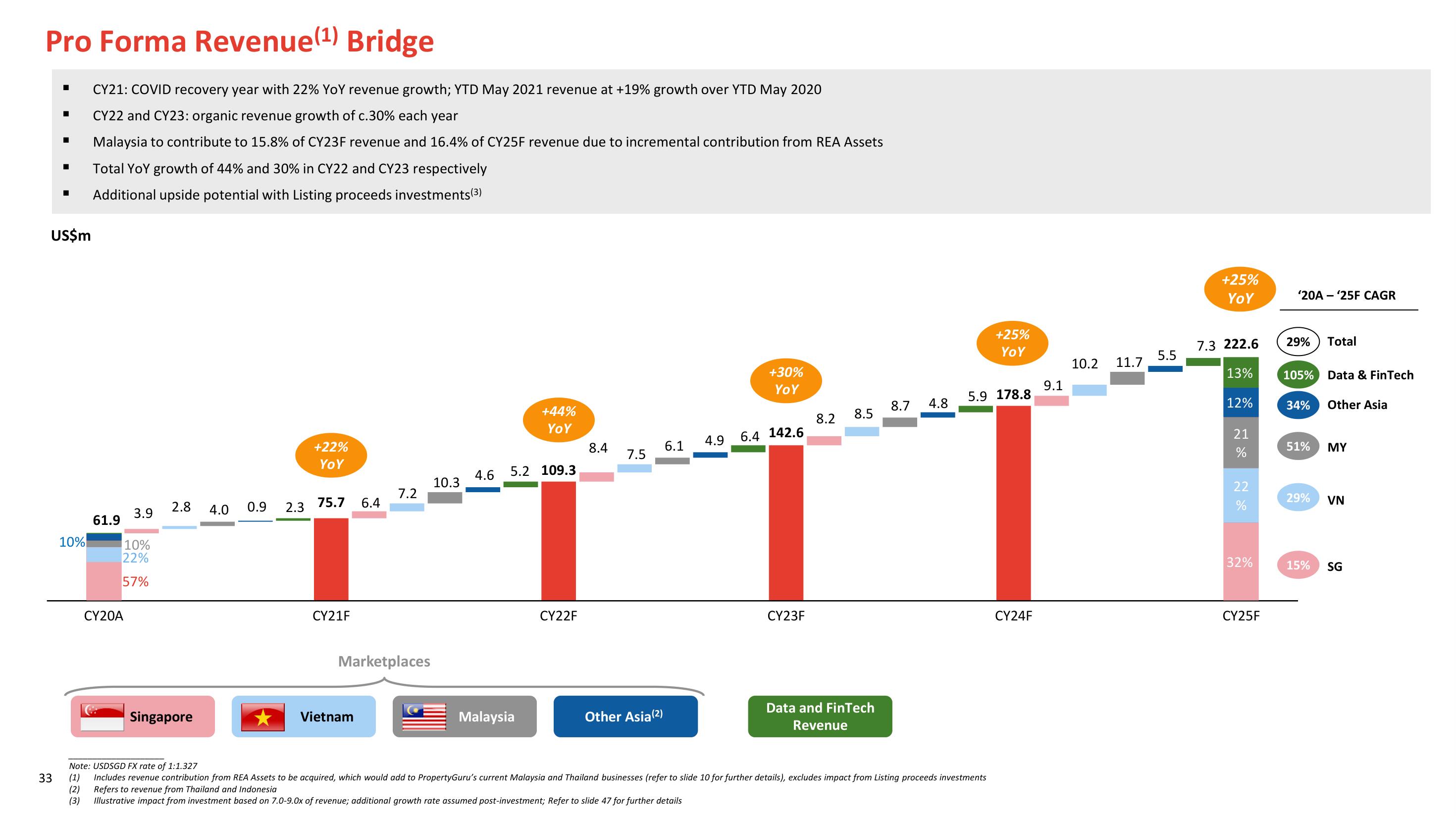

CY21: COVID recovery year with 22% YoY revenue growth; YTD May 2021 revenue at +19% growth over YTD May 2020

CY22 and CY23: organic revenue growth of c.30% each year

Malaysia to contribute to 15.8% of CY23F revenue and 16.4% of CY25F revenue due to incremental contribution from REA Assets

Total YoY growth of 44% and 30% in CY22 and CY23 respectively

Additional upside potential with Listing proceeds investments (3)

61.9

3.9

10%

22%

57%

CY20A

2.8

Singapore

4.0

0.9

2.3

+22%

YOY

75.7

CY21F

6.4

Vietnam

7.2

Marketplaces

10.3

+44%

YOY

4.6 5.2 109.3

Malaysia

CY22F

8.4

7.5

Other Asia (²)

6.1

4.9

+30%

YoY

6.4 142.6

CY23F

8.2 8.5

Data and FinTech

Revenue

8.7

4.8

+25%

YoY

5.9 178.8

Note: USDSGD FX rate of 1:1.327

(1) Includes revenue contribution from REA Assets to be acquired, which would add to PropertyGuru's current Malaysia and Thailand businesses (refer to slide 10 for further details), excludes impact from Listing proceeds investments

(2) Refers to revenue from Thailand and Indonesia

(3)

Illustrative impact from investment based on 7.0-9.0x of revenue; additional growth rate assumed post-investment; Refer to slide 47 for further details

CY24F

9.1

10.2 11.7

5.5

+25%

YOY

7.3 222.6

13%

12%

21

%

22

%

32%

CY25F

'20A - '25F CAGR

29%

105% Data & FinTech

34% Other Asia

51%

Total

29%

15%

MY

VN

SGView entire presentation