Nexters SPAC Presentation Deck

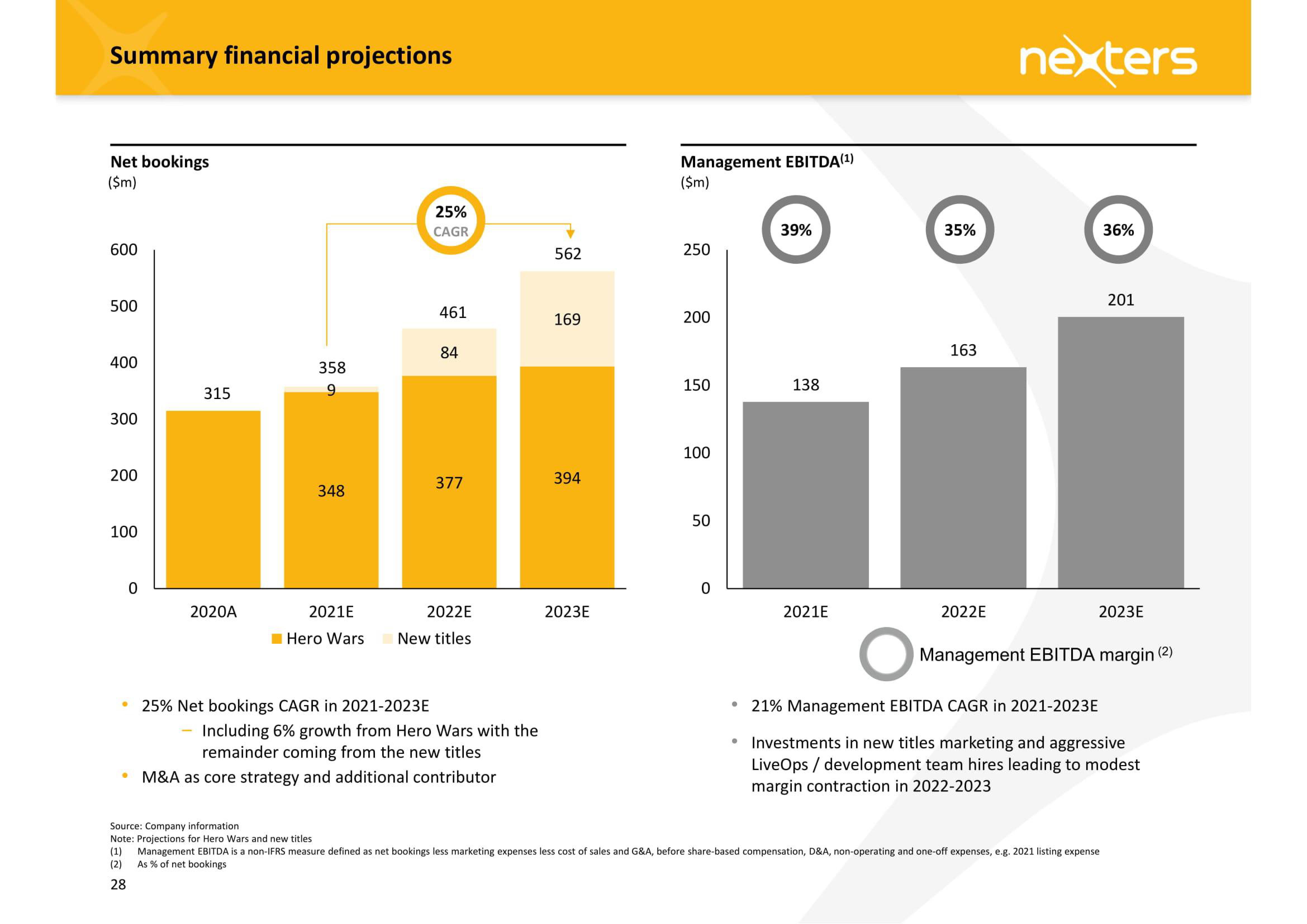

Summary financial projections

Net bookings

($m)

600

500

400

300

200

100

0

·

315

2020A

358

9

348

2021E

Hero Wars

25%

CAGR

25% Net bookings CAGR in 2021-2023E

461

84

377

2022E

New titles

Including 6% growth from Hero Wars with the

remainder coming from the new titles

M&A as core strategy and additional contributor

562

169

394

2023E

Management EBITDA (¹)

($m)

250

200

150

100

50

●

●

39%

138

2021E

35%

163

2022E

nexters

36%

201

2023E

O

21% Management EBITDA CAGR in 2021-2023E

Investments in new titles marketing and aggressive

LiveOps / development team hires leading to modest

margin contraction in 2022-2023

Source: Company information

Note: Projections for Hero Wars and new titles

(1) Management EBITDA is a non-IFRS measure defined as net bookings less marketing expenses less cost of sales and G&A, before share-based compensation, D&A, non-operating and one-off expenses, e.g. 2021 listing expense

(2) As % of net bookings

28

Management EBITDA margin (2)View entire presentation