Credit Suisse Investment Banking Pitch Book

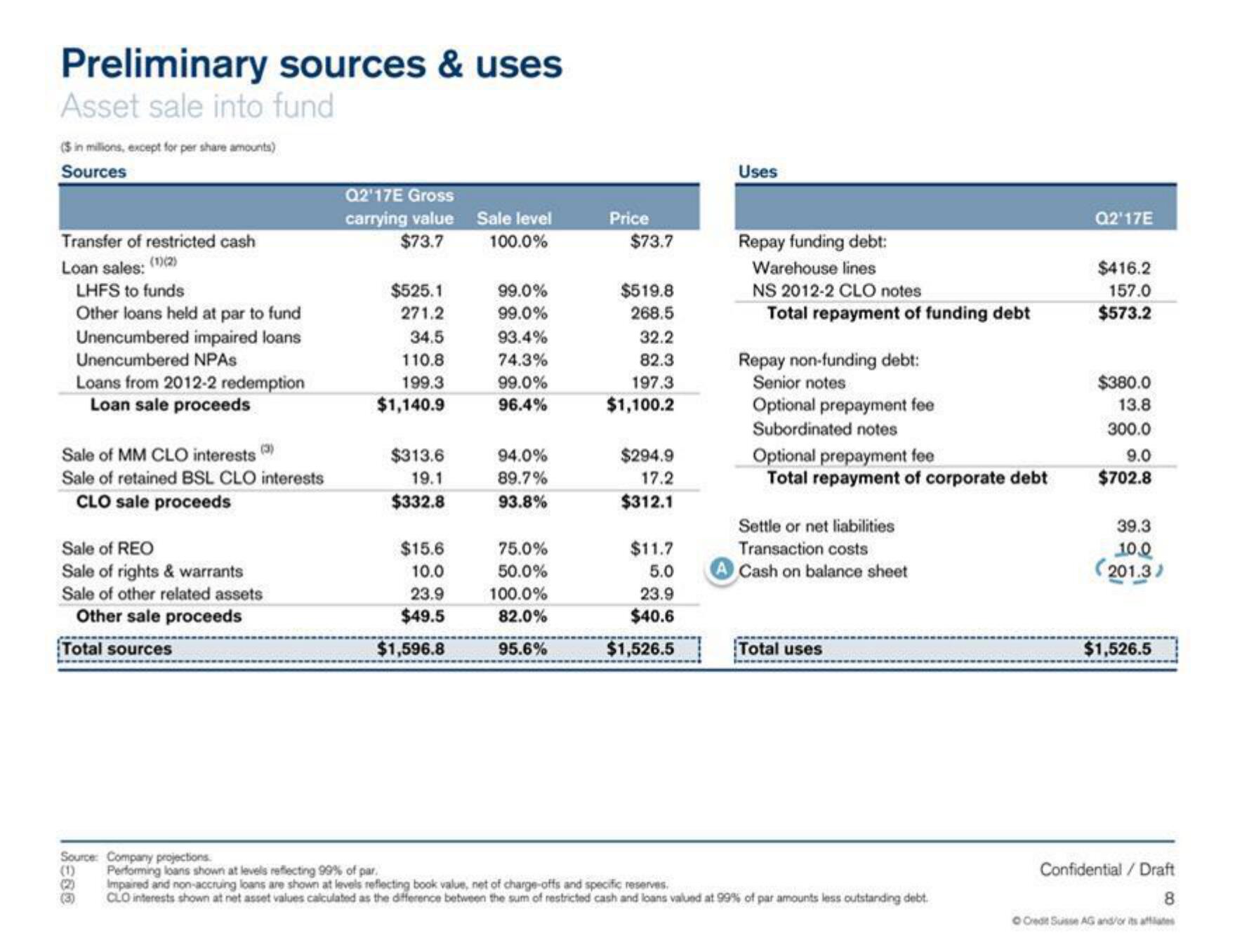

Preliminary sources & uses

Asset sale into fund

($ in millions, except for per share amounts)

Sources

Transfer of restricted cash

(1)(2)

Loan sales:

LHFS to funds

Other loans held at par to fund

Unencumbered impaired loans

Unencumbered NPAs

Loans from 2012-2 redemption

Loan sale proceeds

Sale of MM CLO interests (3)

Sale of retained BSL CLO interests

CLO sale proceeds

Sale of REO

Sale of rights & warrants

Sale of other related assets

Other sale proceeds

Total sources

(1)

(2)

Source: Company projections

Q2'17E Gross

carrying value

$73.7

$525.1

271.2

34.5

110.8

199.3

$1,140.9

$313.6

19.1

$332.8

$15.6

10.0

23.9

$49.5

$1,596.8

Sale level

100.0%

99.0%

99.0%

93.4%

74.3%

99.0%

96.4%

94.0%

89.7%

93.8%

75.0%

50.0%

100.0%

82.0%

95.6%

Price

$73.7

$519.8

268.5

32.2

82.3

197.3

$1,100.2

$294.9

17.2

$312.1

$11.7

5.0

23.9

$40.6

$1,526.5

Uses

Repay funding debt:

Warehouse lines

NS 2012-2 CLO notes

Total repayment of funding debt

Repay non-funding debt:

Senior notes

Optional prepayment fee

Subordinated notes

Optional prepayment fee

Total repayment of corporate debt

Settle or net liabilities

Transaction costs

Cash on balance sheet

Total uses

Performing loans shown at levels reflecting 99% of par.

Impaired and non-accruing loans are shown at levels reflecting book value, net of charge-offs and specific reserves.

CLO interests shown at net asset values calculated as the difference between the sum of restricted cash and loans valued at 99% of par amounts less outstanding debt.

Q2'17E

$416.2

157.0

$573.2

$380.0

13.8

300.0

9.0

$702.8

39.3

10.0

(201.3)

$1,526.5

Confidential / Draft

8

O Credit Suisse AG and/or its affiliatesView entire presentation