Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

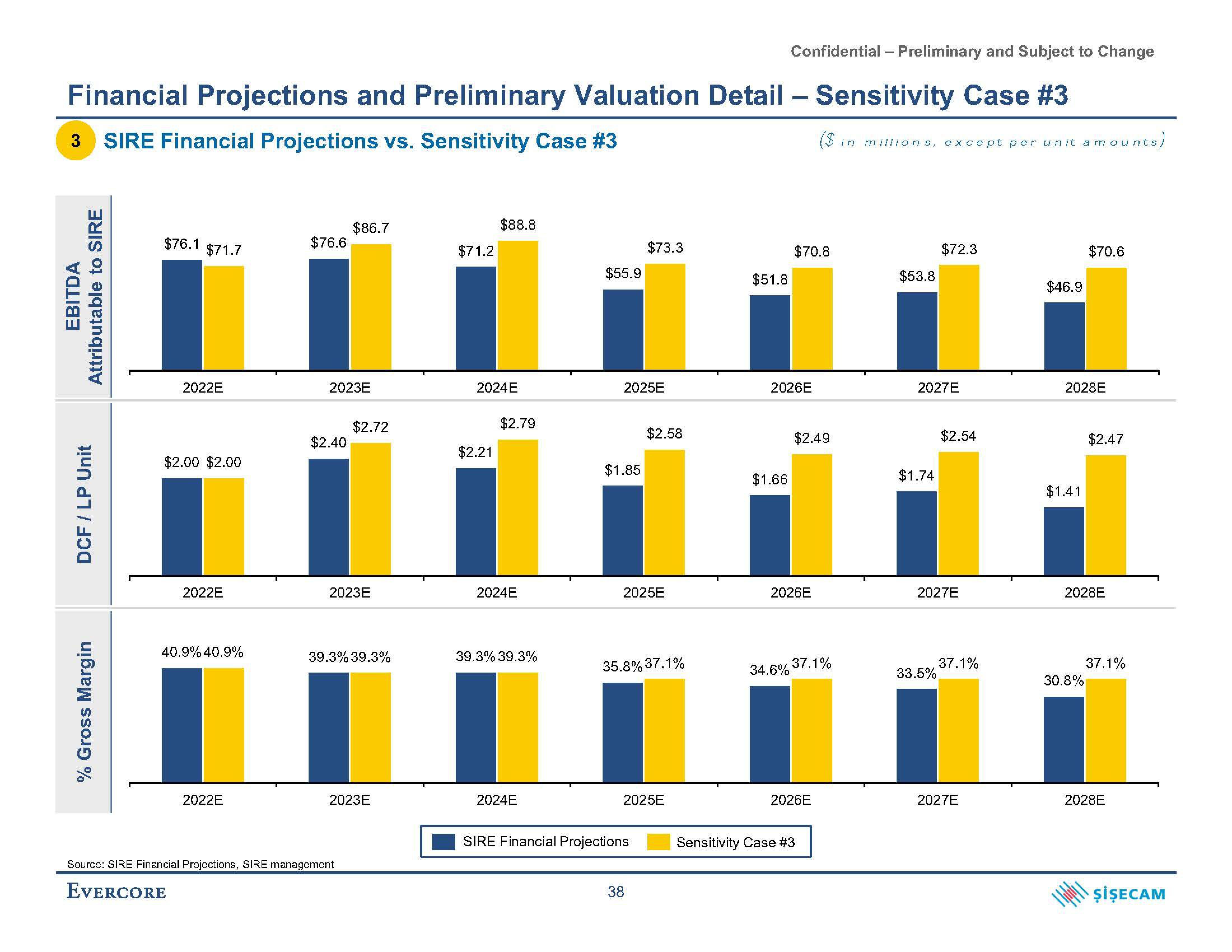

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #3

3 SIRE Financial Projections vs. Sensitivity Case #3

($ in millions, except per unit amounts,

EBITDA

Attributable to SIRE

DCF / LP Unit

% Gross Margin

$76.1 $71.7

2022E

$2.00 $2.00

2022E

40.9% 40.9%

2022E

$76.6

2023E

$2.40

$86.7

$2.72

2023E

39.3% 39.3%

Source: SIRE Financial Projections, SIRE management

EVERCORE

2023E

$71.2

$88.8

2024E

$2.21

$2.79

2024E

39.3% 39.3%

2024E

$55.9

2025E

$1.85

$73.3

2025E

$2.58

35.8% 37.1%

SIRE Financial Projections

2025E

38

$51.8

2026E

$1.66

$70.8

34.6%

$2.49

2026E

37.1%

2026E

Sensitivity Case #3

$53.8

2027E

$1.74

$72.3

33.5%

$2.54

2027E

37.1%

2027E

$46.9

2028E

$1.41

$70.6

30.8%

$2.47

2028E

37.1%

2028E

ŞİŞECAMView entire presentation