SoftBank Results Presentation Deck

SVF1

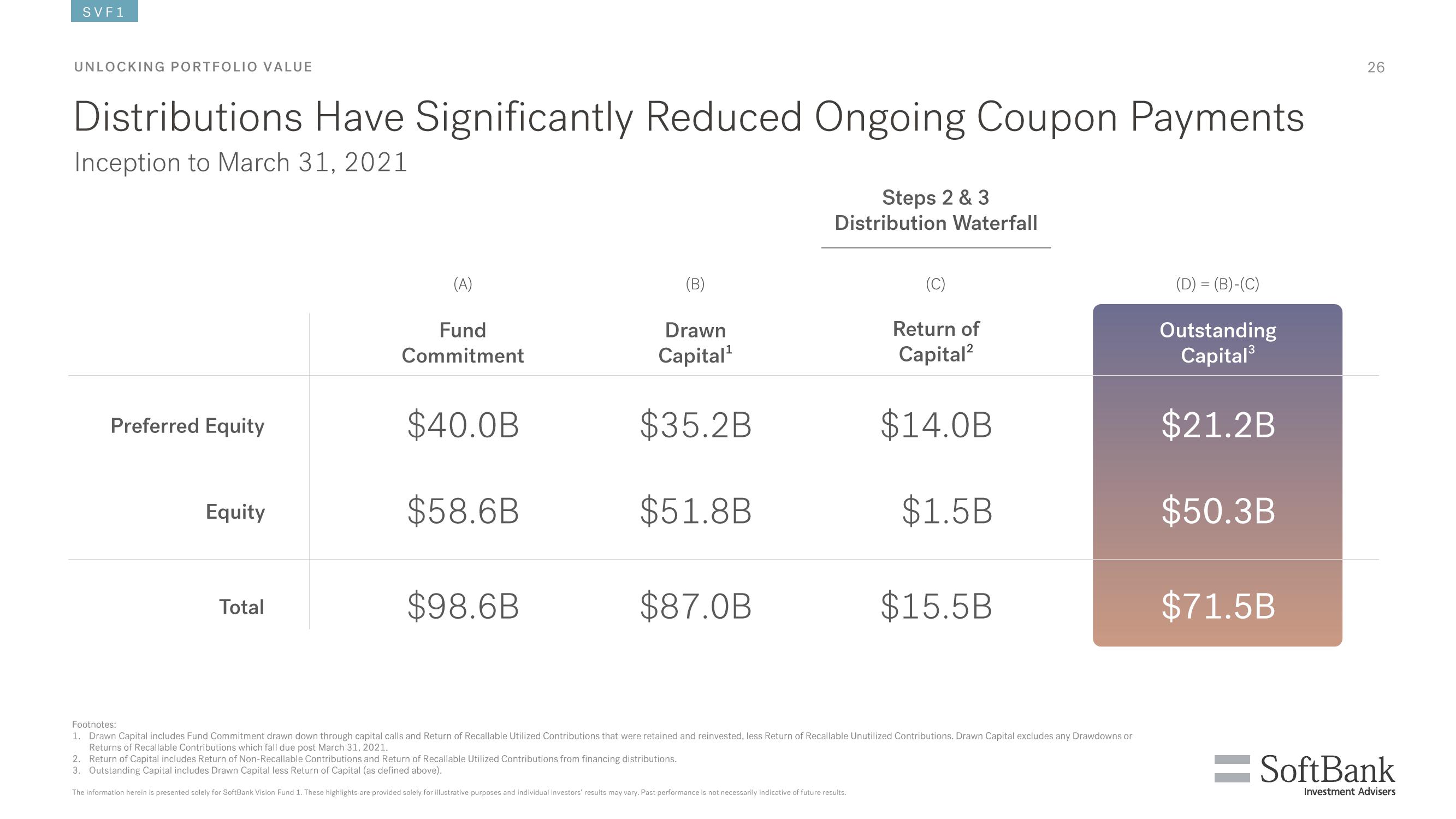

UNLOCKING PORTFOLIO VALUE

Distributions Have Significantly Reduced Ongoing Coupon Payments

Inception to March 31, 2021

Preferred Equity

Equity

Total

(A)

Fund

Commitment

$40.0B

$58.6B

$98.6B

Drawn

Capital¹

$35.2B

$51.8B

$87.0B

Steps 2 & 3

Distribution Waterfall

Return of

Capital²

2. Return of Capital includes Return of Non-Recallable Contributions and Return of Recallable Utilized Contributions from financing distributions.

3. Outstanding Capital includes Drawn Capital less Return of Capital (as defined above).

The information herein is presented solely for SoftBank Vision Fund 1. These highlights are provided solely for illustrative purposes and individual investors' results may vary. Past performance is not necessarily indicative of future results.

$14.0B

$1.5B

$15.5B

Footnotes:

1. Drawn Capital includes Fund Commitment drawn down through capital calls and Return of Recallable Utilized Contributions that were retained and reinvested, less Return of Recallable Unutilized Contributions. Drawn Capital excludes any Drawdowns or

Returns of Recallable Contributions which fall due post March 31, 2021.

(D) = (B)-(C)

Outstanding

Capital³

$21.2B

$50.3B

$71.5B

26

=SoftBank

Investment AdvisersView entire presentation