J.P.Morgan Investment Banking Pitch Book

SITUATION OVERVIEW

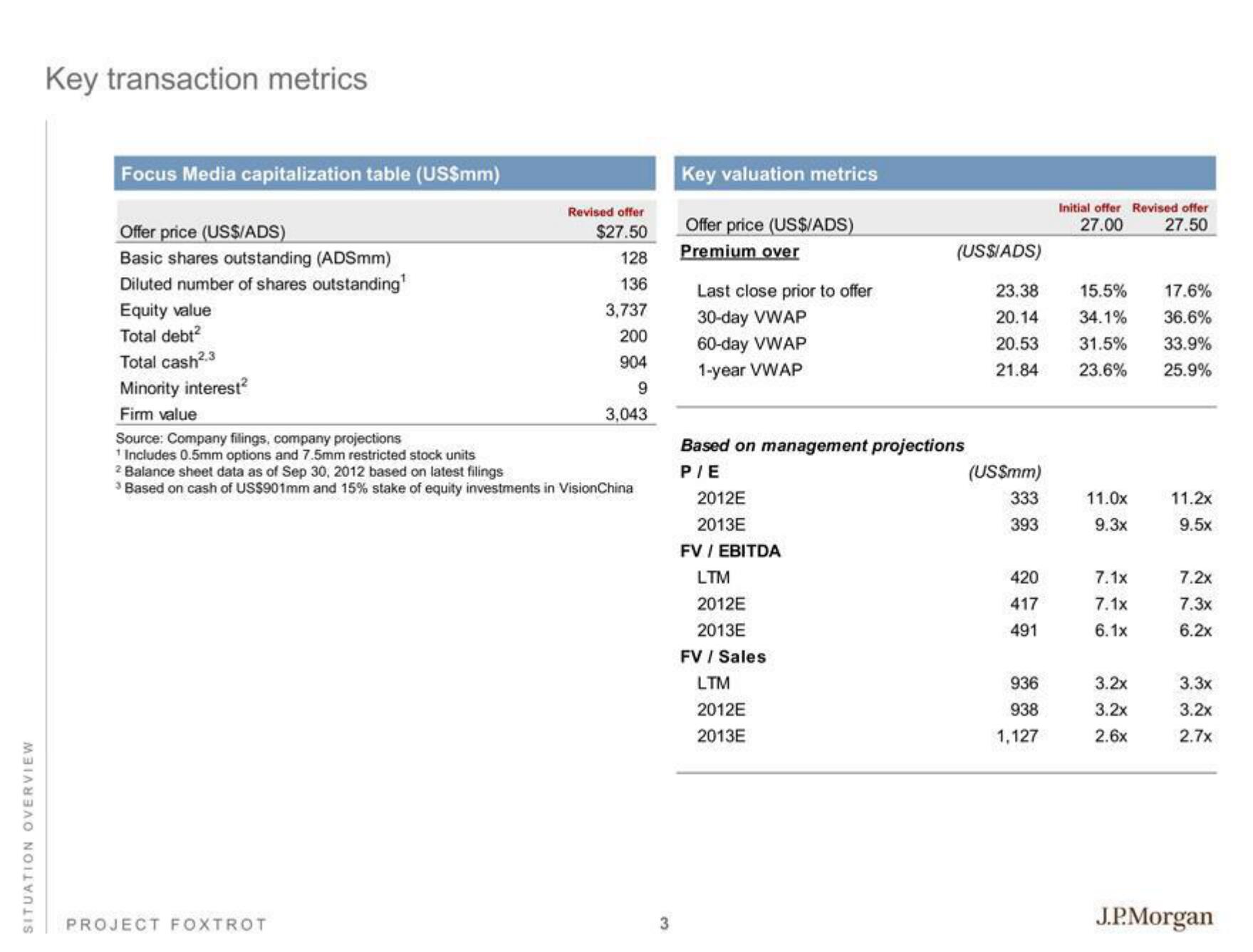

Key transaction metrics

Focus Media capitalization table (US$mm)

Revised offer

$27.50

128

136

3,737

200

904

9

3,043

Offer price (US$/ADS)

Basic shares outstanding (ADSmm)

Diluted number of shares outstanding¹

Equity value

Total debt²

Total cash².3

Minority interest

Firm value

Source: Company filings, company projections

1 Includes 0.5mm options and 7.5mm restricted stock units

2 Balance sheet data as of Sep 30, 2012 based on latest filings

³ Based on cash of US$901mm and 15% stake of equity investments in VisionChina

PROJECT FOXTROT

3

Key valuation metrics

Offer price (US$/ADS)

Premium over

Last close prior to offer

30-day VWAP

60-day VWAP

1-year VWAP

Based on management projections

P/E

2012E

2013E

FV / EBITDA

LTM

(US$/ADS)

2012E

2013E

FV / Sales

LTM

2012E

2013E

23.38

20.14

20.53

21.84

(US$mm)

333

393

420

417

491

936

938

1,127

Initial offer Revised offer

27.00 27.50

15.5%

34.1%

31.5%

23.6%

11.0x

9.3x

7.1x

7.1x

6.1x

3.2x

3.2x

2.6x

17.6%

36.6%

33.9%

25.9%

11.2x

9.5x

7.2x

7.3x

6.2x

3.3x

3.2x

2.7x

J.P.MorganView entire presentation