Bed Bath & Beyond Results Presentation Deck

FINANCIAL OUTLOOK

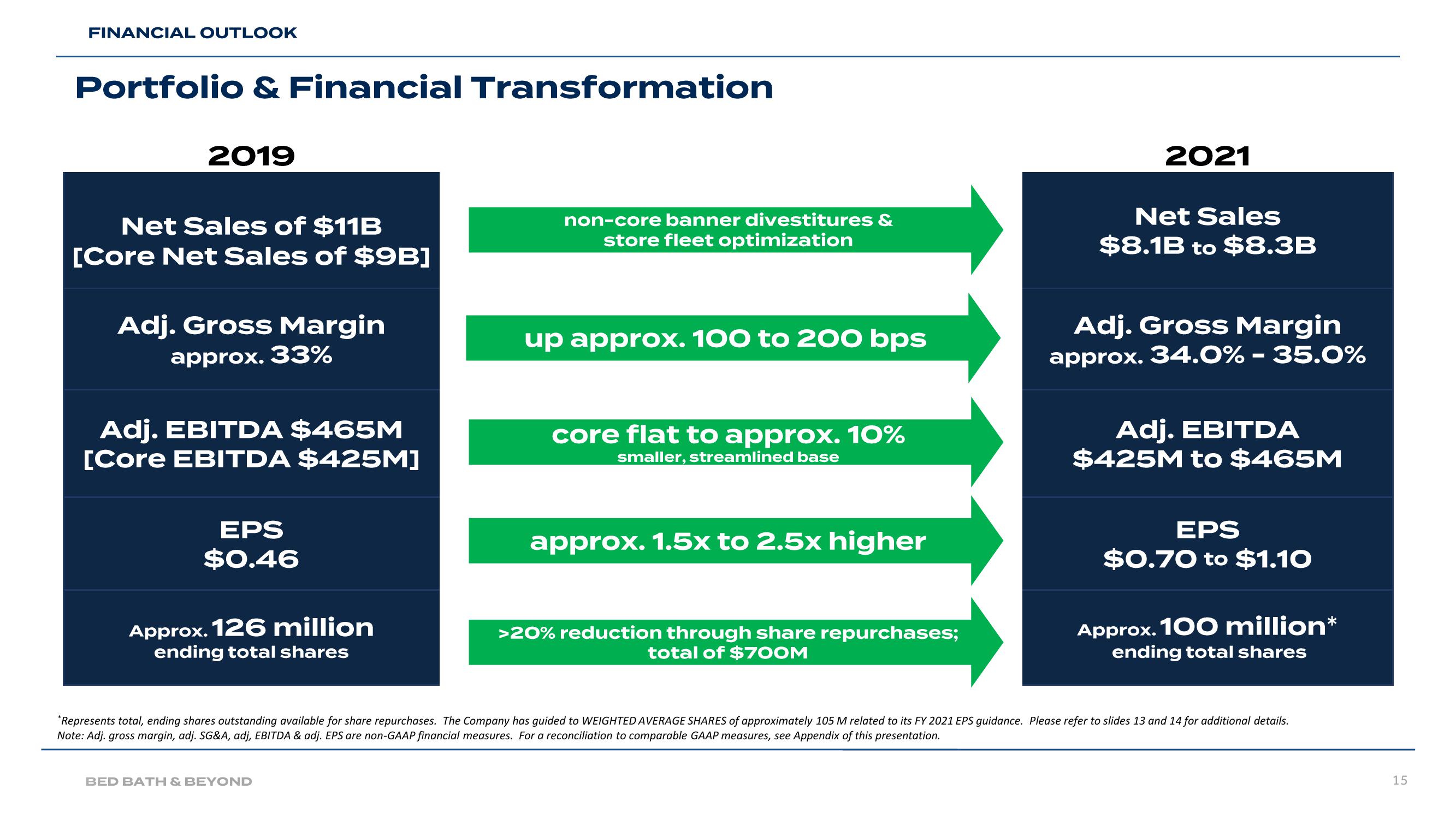

Portfolio & Financial Transformation

2019

Net Sales of $11B

[Core Net Sales of $9B]

Adj. Gross Margin

approx. 33%

Adj. EBITDA $465M

[Core EBITDA $425M]

EPS

$0.46

Approx. 126 million

ending total shares

non-core banner divestitures &

store fleet optimization

BED BATH & BEYOND

up approx. 100 to 200 bps

core flat to approx. 10%

smaller, streamlined base

approx. 1.5x to 2.5x higher

>20% reduction through share repurchases;

total of $700M

2021

Net Sales

$8.1B to $8.3B

Adj. Gross Margin

approx. 34.0% - 35.0%

Adj. EBITDA

$425M to $465M

EPS

$0.70 to $1.10

Approx. 100 million*

ending total shares

*Represents total, ending shares outstanding available for share repurchases. The Company has guided to WEIGHTED AVERAGE SHARES of approximately 105 M related to its FY 2021 EPS guidance. Please refer to slides 13 and 14 for additional details.

Note: Adj. gross margin, adj. SG&A, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

15View entire presentation