Greystar Equity Partners XI (May-23)

CASE STUDY-AVANA ON BRECKINRIDGE

Garden-style asset located in Duluth submarket, benefitting from local

employment drivers, access to well-rated schools and proximity to central

business district

SOURCING

VALUE-ADD

OPERATIONAL

ENHANCEMENTS

DISPOSITION

•

●

●

Asset was purchased at a discount to replacement cost and was underwritten

for a 5-year hold period

Renovated 179 units at ~60% return on cost during the hold period,

Scope included flooring, countertops, plumbing and lighting fixtures

Common area renovations: landscaping, pool and outdoor space upgrades

Achieved ~40% cumulative rent growth during hold period

Executed opportunities to reduce controllable expenses, including:

More efficient staffing plan

Clearly defined capitalization program

Use of national vendor relationships

Achieved 25% + reduction in controllable expenses during first

●

●

●

year of hold

Conducted comprehensive hold/sell analysis using Greystar's proprietary data

and market analytics

Capitalized on near-peak market pricing to exit the asset early and reduce the

Fund's exposure to the Atlanta market

MARKET

FUND

VINTAGE

UNITS

SQFT/UNIT

ACQUISITION DATE

DISPOSITION DATE

LEVERAGE (LTC)

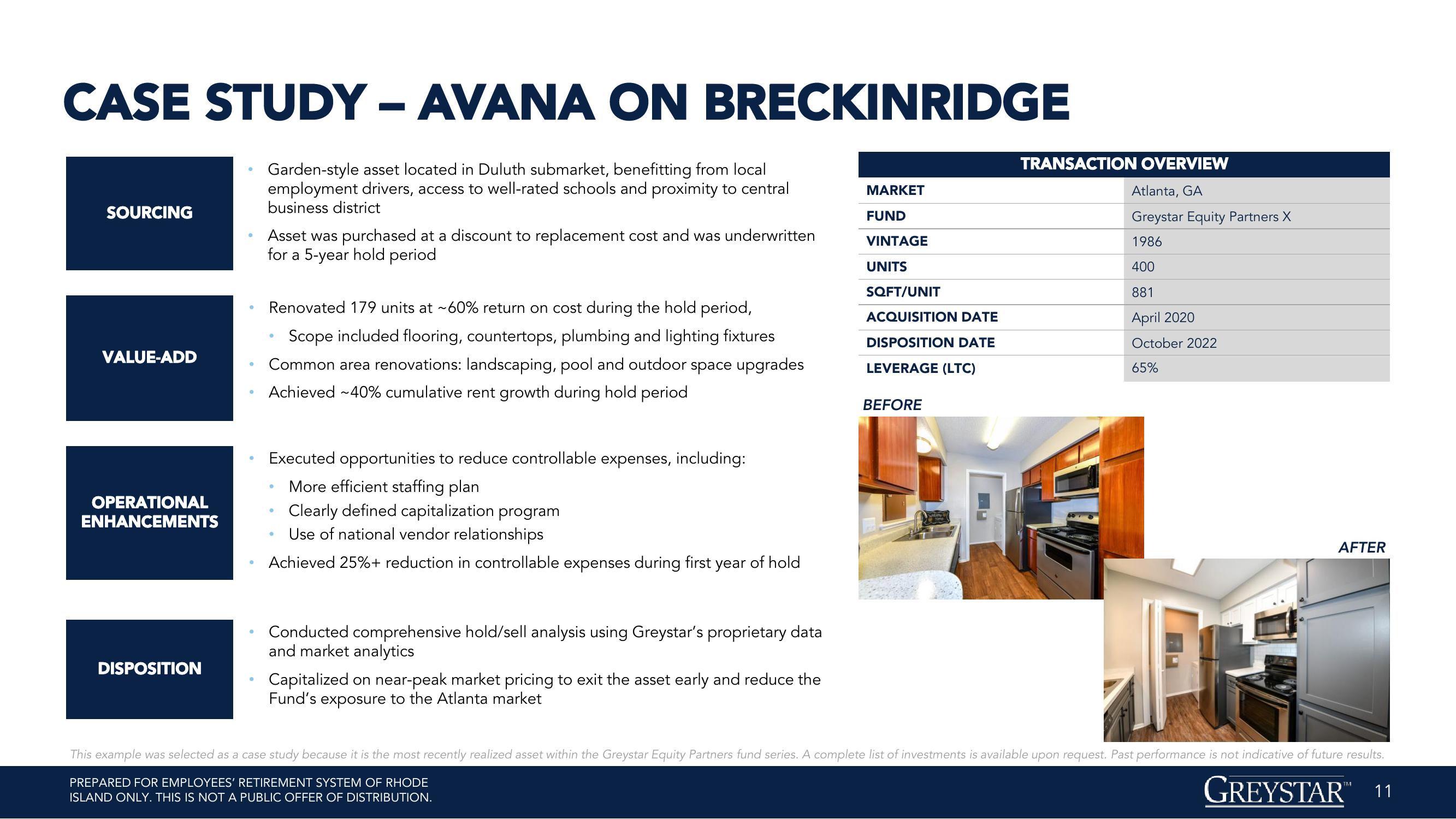

BEFORE

TRANSACTION OVERVIEW

Atlanta, GA

Greystar Equity Partners X

1986

400

881

April 2020

October 2022

65%

AFTER

This example was selected as a case study because it is the most recently realized asset within the Greystar Equity Partners fund series. A complete list of investments is available upon request. Past performance is not indicative of future results.

PREPARED FOR EMPLOYEES' RETIREMENT SYSTEM OF RHODE

GREYSTAR™ 11

ISLAND ONLY. THIS IS NOT A PUBLIC OFFER OF DISTRIBUTION.View entire presentation