Comcast Results Presentation Deck

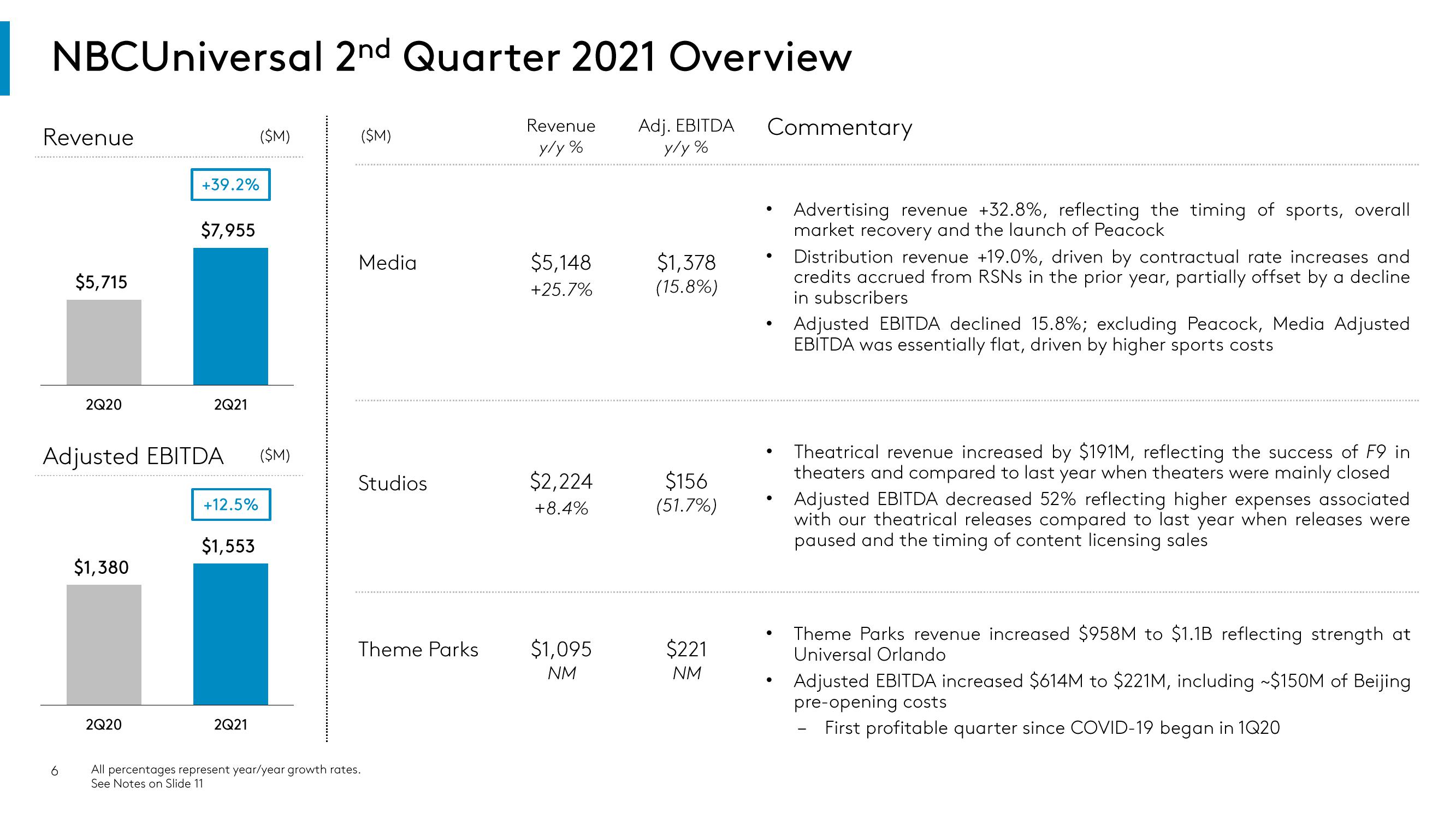

NBCUniversal 2nd Quarter 2021 Overview

Adj. EBITDA

y/y%

Revenue

$5,715

6

2Q20

$1,380

+39.2%

2Q20

$7,955

Adjusted EBITDA ($M)

2Q21

+12.5%

$1,553

($M)

2Q21

($M)

Media

Studios

Theme Parks

All percentages represent year/year growth rates.

See Notes on Slide 11

Revenue

y/y%

$5,148

+25.7%

$2,224

+8.4%

$1,095

NM

$1,378

(15.8%)

$156

(51.7%)

$221

NM

Commentary

●

●

●

●

●

●

Advertising revenue +32.8%, reflecting the timing of sports, overall

market recovery and the launch of Peacock

Distribution revenue +19.0%, driven by contractual rate increases and

credits accrued from RSNs in the prior year, partially offset by a decline

in subscribers

Adjusted EBITDA declined 15.8%; excluding Peacock, Media Adjusted

EBITDA was essentially flat, driven by higher sports costs

Theatrical revenue increased by $191M, reflecting the success of F9 in

theaters and compared to last year when theaters were mainly closed

Adjusted EBITDA decreased 52% reflecting higher expenses associated

with our theatrical releases compared to last year when releases were

paused and the timing of content licensing sales

Theme Parks revenue increased $958M to $1.1B reflecting strength at

Universal Orlando

Adjusted EBITDA increased $614M to $221M, including ~$150M of Beijing

pre-opening costs

First profitable quarter since COVID-19 began in 1Q20

-View entire presentation