Deutsche Bank Fixed Income Presentation Deck

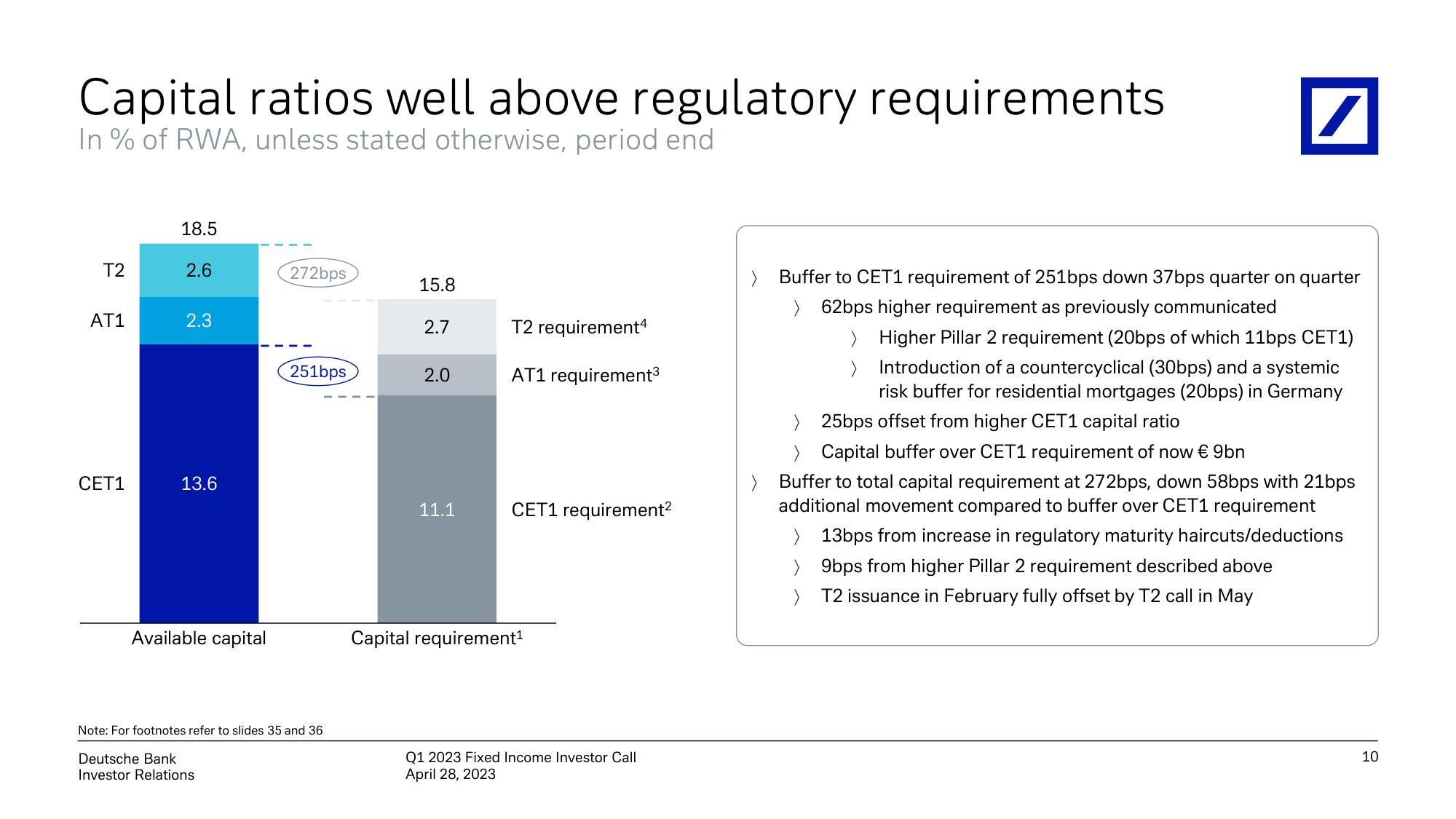

Capital ratios well above regulatory requirements

In % of RWA, unless stated otherwise, period end

T2

AT1

CET1

18.5

2.6

2.3

13.6

Available capital

272bps

251bps

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

15.8

2.7

2.0

11.1

T2 requirement4

AT1 requirement³

CET1 requirement²

Capital requirement¹

Q1 2023 Fixed Income Investor Call

April 28, 2023

>

>

/

Buffer to CET1 requirement of 251bps down 37bps quarter on quarter

> 62bps higher requirement as previously communicated

>

>

Higher Pillar 2 requirement (20bps of which 11bps CET1)

Introduction of a countercyclical (30bps) and a systemic

risk buffer for residential mortgages (20bps) in Germany

> 25bps offset from higher CET1 capital ratio

> Capital buffer over CET1 requirement of now € 9bn

Buffer to total capital requirement at 272bps, down 58bps with 21bps

additional movement compared to buffer over CET1 requirement

> 13bps from increase in regulatory maturity haircuts/deductions

> 9bps from higher Pillar 2 requirement described above

> T2 issuance in February fully offset by T2 call in May

10View entire presentation