Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

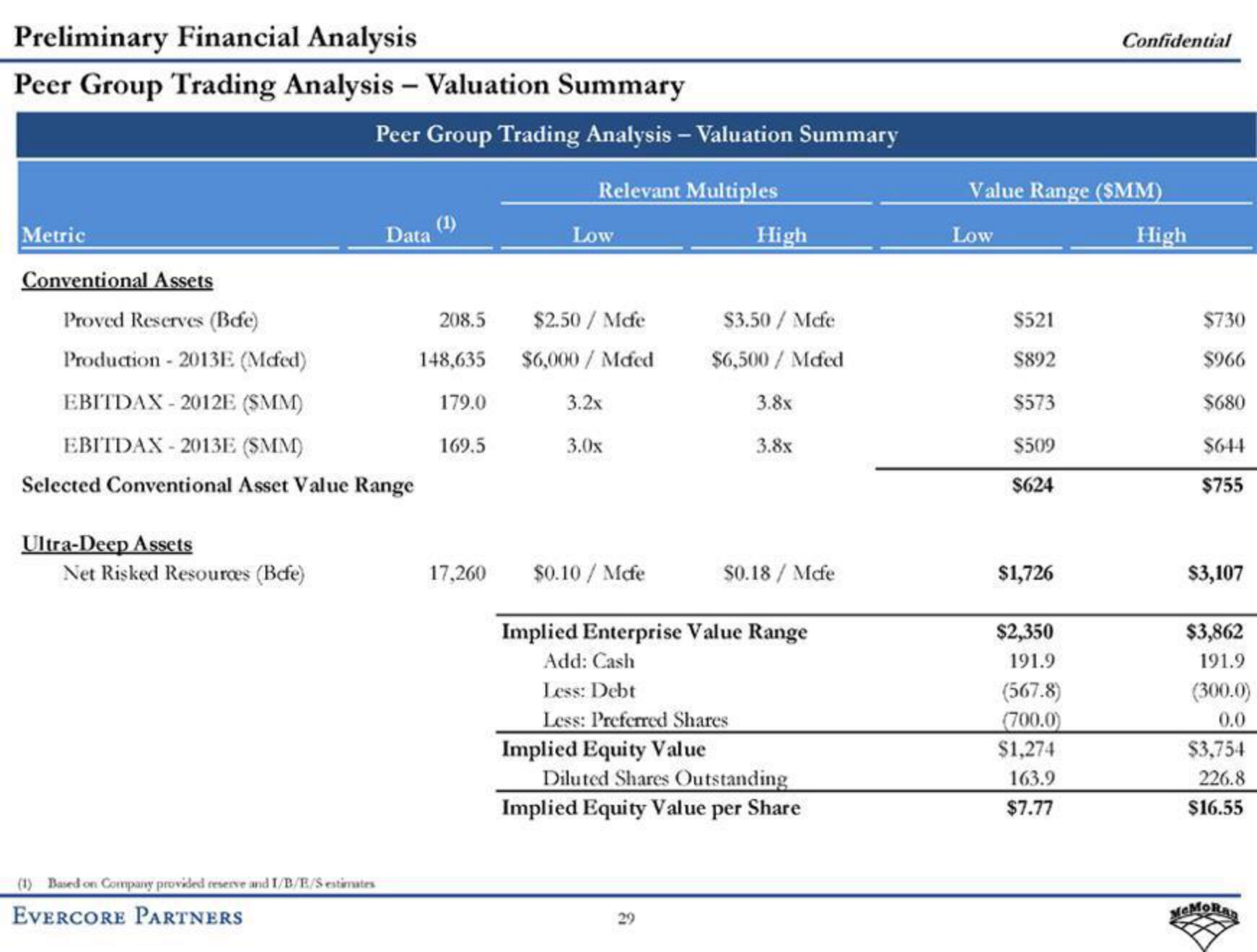

Peer Group Trading Analysis - Valuation Summary

Metric

Conventional Assets

Proved Reserves (Befe)

Production - 2013E (Mcfed)

EBITDAX - 2012E (SMM)

Ultra-Deep Assets

Peer Group Trading Analysis - Valuation Summary

Relevant Multiples

EBITDAX 2013E (SMM)

Selected Conventional Asset Value Range

Net Risked Resources (Bcfe)

Data

(1) Based on Company provided reserve and I/B/E/S estimates

EVERCORE PARTNERS

208.5

148,635

179.0

169.5

17,260

Low

$2.50 / Mcfe

$6,000/Mcfed

3.2x

3.0x

$0.10/Mcfe

Implied Equity Value

High

$3.50/Mcfe

$6,500/Mcfed

3.8x

3.8x

Implied Enterprise Value Range

Add: Cash

Less: Debt

Less: Preferred Shares

29

$0.18/Mcfe

Diluted Shares Outstanding

Implied Equity Value per Share

Value Range (SMM)

Low

$521

$892

$573

$509

$624

$1,726

$2,350

191.9

Confidential

(567.8)

(700.0)

$1,274

163.9

$7.77

High

$730

$966

$680

$644

$755

$3,107

$3,862

191.9

(300.0)

0.0

$3,754

226.8

$16.55

MCMORADView entire presentation