J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

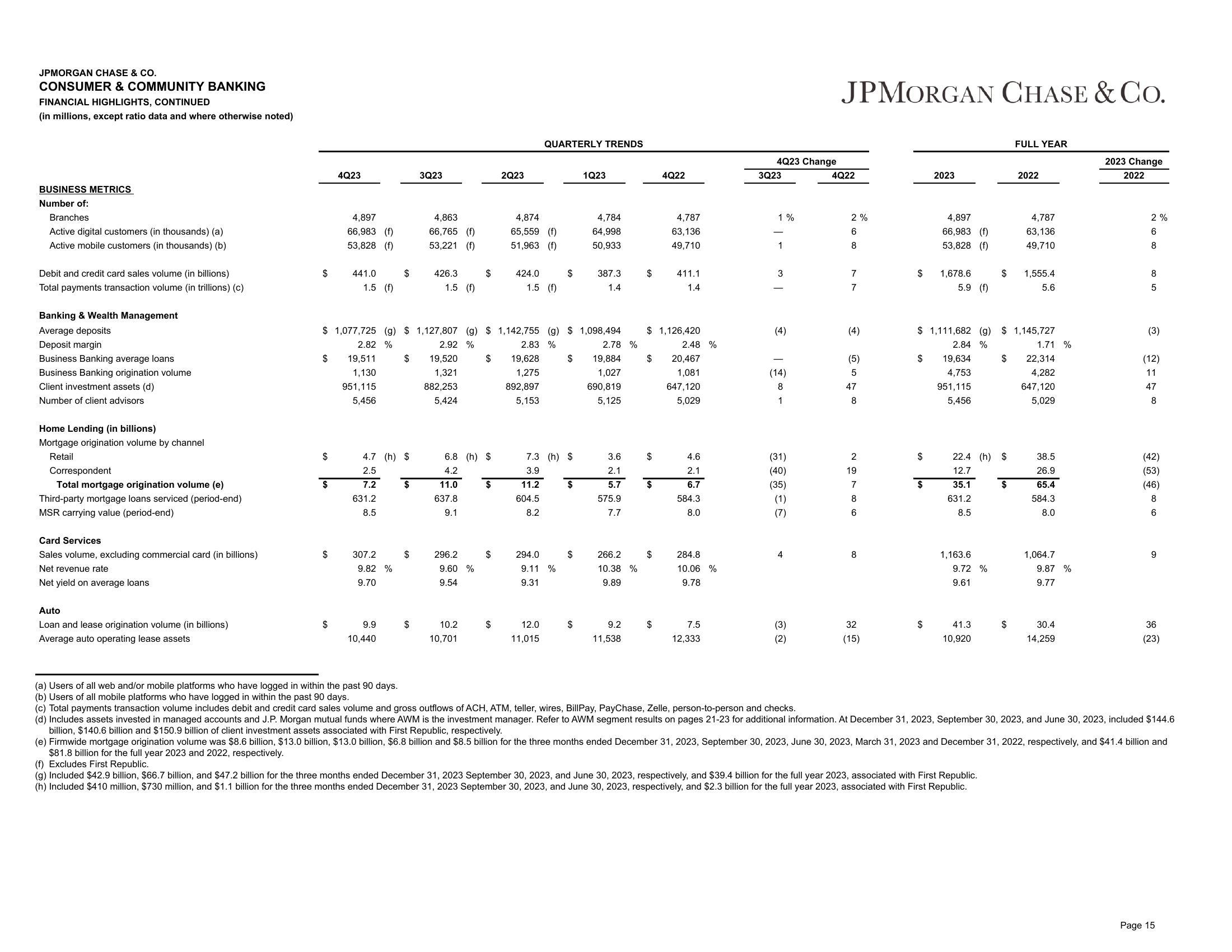

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio data and where otherwise noted)

BUSINESS METRICS

Number of:

Branches

Active digital customers (in thousands) (a)

Active mobile customers (in thousands) (b)

Debit and credit card sales volume (in billions)

Total payments transaction volume (in trillions) (c)

Banking & Wealth Management

Average deposits

Deposit margin

Business Banking average loans

Business Banking origination volume

Client investment assets (d)

Number of client advisors

Home Lending (in billions)

Mortgage origination volume by channel

Retail

Correspondent

Total mortgage origination volume (e)

Third-party mortgage loans serviced (period-end)

MSR carrying value (period-end)

Card Services

Sales volume, excluding commercial card (in billions)

Net revenue rate

Net yield on average loans

Auto

Loan and lease origination volume (in billions)

Average auto operating lease assets

$

$

$

$

4Q23

$

4,897

66,983 (f)

53,828 (f)

441.0

1.5 (f)

19,511

1,130

951,115

5,456

$

307.2

9.82 %

9.70

4.7 (h) $

2.5

7.2

631.2

8.5

9.9

10,440

$

$

$

3Q23

$ 1,077,725 (g) $ 1,127,807 (g) $ 1,142,755 (g) $ 1,098,494

2.82 %

2.83 %

2.92 %

19,520

1,321

882,253

5,424

$

4,863

66,765 (f)

53,221 (f)

426.3

1.5 (f)

296.2

$

6.8 (h) $

4.2

11.0

637.8

9.1

9.60 %

9.54

10.2

10,701

$

2Q23

$ 19,628

1,275

892,897

5,153

$

$

4,874

65,559 (f)

51,963 (f)

424.0

1.5 (f)

QUARTERLY TRENDS

294.0

$

7.3 (h) $

3.9

11.2

604.5

8.2

9.11 %

9.31

12.0

11,015

$

$

1Q23

$

4,784

64,998

50,933

387.3

1.4

2.78 %

19,884

1,027

690,819

5,125

3.6

2.1

5.7

575.9

7.7

266.2

10.38 %

9.89

9.2

11,538

$

$

$

$ 1,126,420

$

$

4Q22

$

4,787

63,136

49,710

411.1

1.4

2.48 %

20,467

1,081

647,120

5,029

4.6

2.1

6.7

584.3

8.0

284.8

10.06 %

9.78

7.5

12,333

4Q23 Change

3Q23

1%

1

3

(4)

(14)

8

1

(31)

(40)

(35)

(1)

(7)

4

(3)

(2)

JPMORGAN CHASE & Co.

4Q22

2%

6

8

7

7

(4)

(5)

5

47

8

2

19

7

8

6

8

32

(15)

$ 1,678.6

2023

$

4,897

66,983 (f)

53,828 (f)

$

$ 19,634

4,753

$

5.9 (f)

$1,111,682 (g) $ 1,145,727

2.84 %

951,115

5,456

$

1,163.6

9.72 %

9.61

22.4 (h) $

12.7

35.1

631.2

8.5

41.3

10,920

FULL YEAR

2022

$

4,787

63,136

49,710

1,555.4

5.6

1.71 %

$ 22,314

4,282

647,120

5,029

38.5

26.9

65.4

584.3

8.0

1,064.7

9.87 %

9.77

30.4

14,259

2023 Change

2022

2%

6

8

COLO

8

5

(3)

(12)

11

47

8

(42)

(53)

(46)

8

6

9

36

(23)

(a) Users of all web and/or mobile platforms who have logged in within the past 90 days.

(b) Users of all mobile platforms who have logged in within the past 90 days.

(c) Total payments transaction volume includes debit and credit card sales volume and gross outflows of ACH, ATM, teller, wires, BillPay, PayChase, Zelle, person-to-person and checks.

(d) Includes assets invested in managed accounts and J.P. Morgan mutual funds where AWM is the investment manager. Refer to AWM

billion, $140.6 billion and $150.9 billion of client investment assets associated with First Republic, respectively.

(e) Firmwide mortgage origination volume was $8.6 billion, $13.0 billion, $13.0 billion, $6.8 billion and $8.5 billion for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $41.4 billion and

$81.8 billion for the full year 2023 and 2022, respectively.

(f) Excludes First Republic.

(g) Included $42.9 billion, $66.7 billion, and $47.2 billion for the three months ended December 31, 2023 September 30, 2023, and June 30, 2023, respectively, and $39.4 billion for the full year 2023, associated with First Republic.

(h) Included $410 million, $730 million, and $1.1 billion for the three months ended December 31, 2023 September 30, 2023, and June 30, 2023, respectively, and $2.3 billion for the full year 2023, associated with First Republic.

results on pages 21-23 for additional information. At December 31, 2023, September 30, 2023, and June 30, 2023, included $144.6

Page 15View entire presentation