Whitebread Annual Update

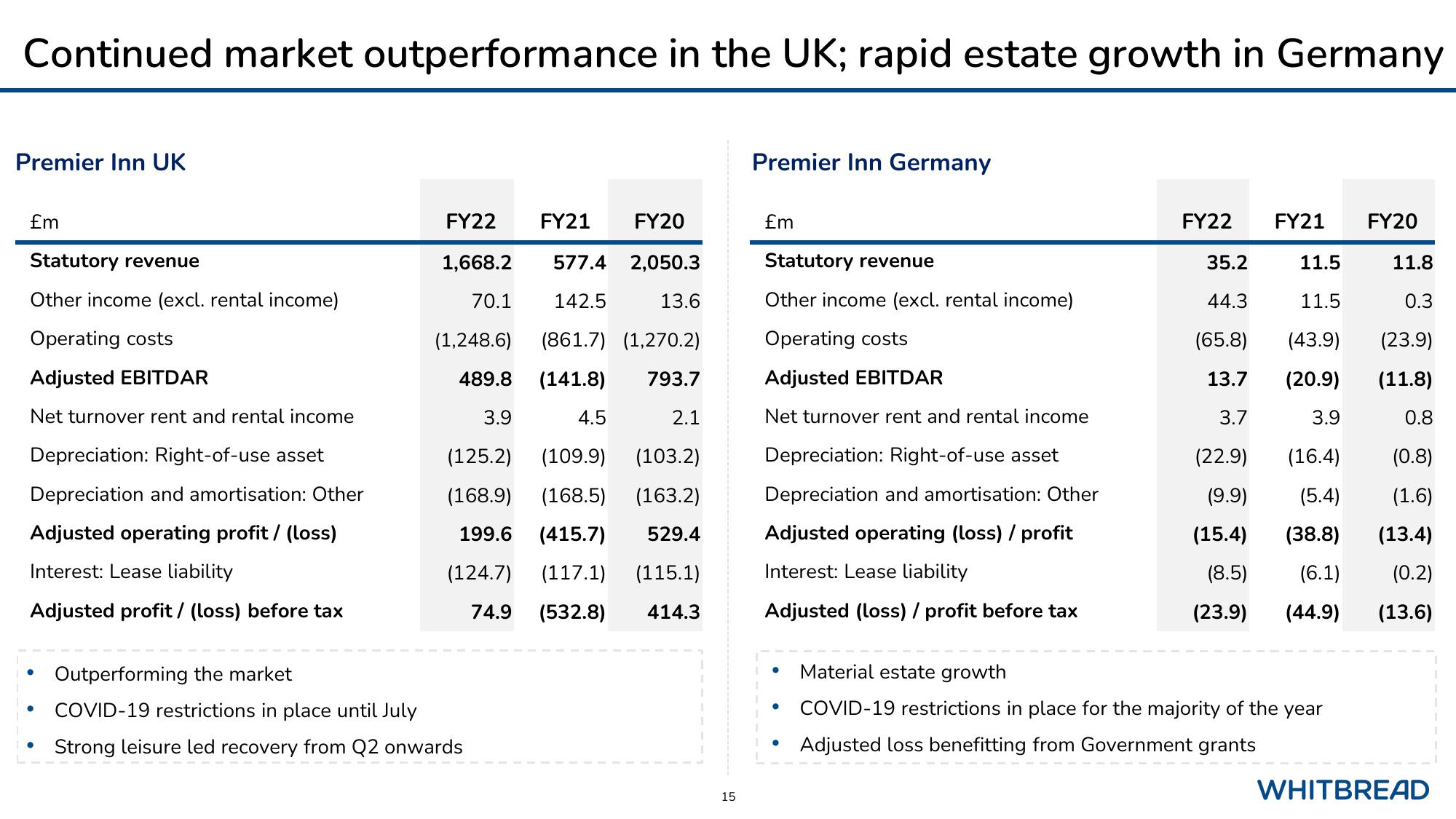

Continued market outperformance in the UK; rapid estate growth in Germany

Premier Inn UK

£m

Statutory revenue

Other income (excl. rental income)

Operating costs

Adjusted EBITDAR

Net turnover rent and rental income

Depreciation: Right-of-use asset

Depreciation and amortisation: Other

Adjusted operating profit / (loss)

Interest: Lease liability

Adjusted profit/ (loss) before tax

●

●

●

FY21 FY20

FY22

1,668.2

70.1

577.4 2,050.3

142.5 13.6

(1,248.6) (861.7) (1,270.2)

489.8 (141.8)

3.9

793.7

2.1

(125.2) (109.9) (103.2)

(168.9) (168.5) (163.2)

199.6 (415.7) 529.4

(117.1) (115.1)

(124.7)

74.9 (532.8)

414.3

Outperforming the market

COVID-19 restrictions in place until July

Strong leisure led recovery from Q2 onwards

4.5

15

Premier Inn Germany

£m

Statutory revenue

Other income (excl. rental income)

Operating costs

Adjusted EBITDAR

Net turnover rent and rental income

Depreciation: Right-of-use asset

Depreciation and amortisation: Other

Adjusted operating (loss) / profit

Interest: Lease liability

Adjusted (loss) / profit before tax

●

FY22 FY21 FY20

35.2

44.3

(65.8)

13.7

3.7

11.5

11.8

11.5

0.3

(43.9) (23.9)

(20.9)

(11.8)

3.9

0.8

(22.9) (16.4)

(0.8)

(9.9)

(5.4)

(1.6)

(15.4)

(38.8)

(13.4)

(8.5)

(6.1)

(0.2)

(23.9)

(44.9) (13.6)

Material estate growth

COVID-19 restrictions in place for the majority of the year

Adjusted loss benefitting from Government grants

WHITBREADView entire presentation